As a U.S. citizen or resident, you're required to report and pay taxes on your worldwide income, regardless of where it's earned. However, this can lead to double taxation, where you're taxed on the same income by both the United States and the foreign country where the income was earned. To mitigate this, the U.S. government offers a foreign tax credit, which allows you to claim a credit against your U.S. tax liability for taxes paid to a foreign government. In this article, we'll delve into the world of Form 1116, the form used to claim the foreign tax credit, and provide you with a comprehensive guide on how to navigate this complex process.

One of the most significant benefits of claiming the foreign tax credit is that it can substantially reduce your U.S. tax liability. By claiming a credit for taxes paid to a foreign government, you can avoid paying taxes twice on the same income. However, the process of claiming the foreign tax credit can be complex and time-consuming, requiring careful attention to detail and a thorough understanding of the relevant tax laws and regulations.

Understanding the Foreign Tax Credit

The foreign tax credit is a non-refundable credit that can be claimed against your U.S. tax liability for taxes paid to a foreign government. The credit is calculated based on the amount of foreign taxes paid, and it can be claimed on Form 1116. To qualify for the foreign tax credit, the foreign taxes paid must meet certain requirements, including:

- The taxes must be imposed by a foreign government

- The taxes must be based on income

- The taxes must be paid or accrued during the tax year

- The taxes must not be eligible for a refund or credit from the foreign government

Types of Foreign Taxes That Qualify for the Credit

Not all foreign taxes qualify for the foreign tax credit. The following types of taxes do qualify:

- Income taxes

- Wage taxes

- Wealth taxes

- Net worth taxes

The following types of taxes do not qualify:

- Sales taxes

- Value-added taxes (VATs)

- Customs duties

- Taxes on real property

How to Claim the Foreign Tax Credit

To claim the foreign tax credit, you'll need to complete Form 1116 and attach it to your tax return (Form 1040). The following steps will guide you through the process:

- Determine the amount of foreign taxes paid: You'll need to calculate the amount of foreign taxes paid or accrued during the tax year.

- Complete Form 1116: You'll need to provide information about the foreign taxes paid, including the name of the foreign government, the type of tax, and the amount of tax paid.

- Calculate the foreign tax credit: You'll need to calculate the foreign tax credit based on the amount of foreign taxes paid.

- Claim the foreign tax credit: You'll need to claim the foreign tax credit on Form 1040.

Form 1116: A Line-by-Line Guide

Form 1116 is a complex form that requires careful attention to detail. The following is a line-by-line guide to help you navigate the form:

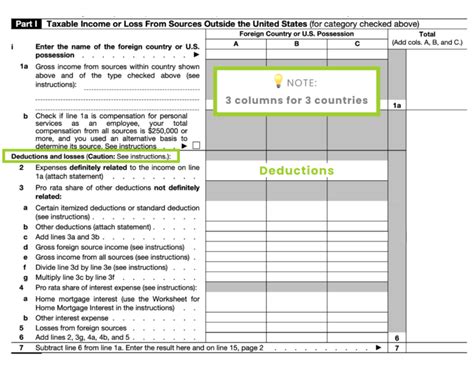

- Part I: Income from Sources Outside the United States

- Line 1: Enter the amount of foreign gross income

- Line 2: Enter the amount of foreign taxes paid

- Part II: Foreign Taxes Paid or Accrued

- Line 3: Enter the amount of foreign taxes paid or accrued

- Line 4: Enter the amount of foreign taxes that qualify for the credit

- Part III: Calculation of the Foreign Tax Credit

- Line 5: Enter the amount of the foreign tax credit

- Line 6: Enter the amount of the foreign tax credit that can be claimed

Common Mistakes to Avoid

When claiming the foreign tax credit, it's essential to avoid common mistakes that can delay or disallow your credit. The following are some common mistakes to avoid:

- Failing to complete Form 1116 correctly

- Failing to attach Form 1116 to your tax return

- Failing to provide supporting documentation for foreign taxes paid

- Claiming a credit for taxes that do not qualify

Penalties for Non-Compliance

If you fail to comply with the foreign tax credit rules, you may be subject to penalties and interest. The following are some penalties that may apply:

- Failure to file Form 1116: $100 penalty

- Failure to pay the correct amount of tax: interest and penalties on the unpaid amount

- Willful failure to comply: 75% penalty on the unpaid amount

Conclusion

Claiming the foreign tax credit can be a complex and time-consuming process, but it can also provide significant tax savings. By understanding the rules and requirements for claiming the credit, you can avoid common mistakes and ensure that you receive the credit you're eligible for. Remember to complete Form 1116 accurately, attach it to your tax return, and provide supporting documentation for foreign taxes paid. If you're unsure about any aspect of the process, consider consulting a tax professional.

We hope this article has provided you with a comprehensive guide to claiming the foreign tax credit. If you have any questions or comments, please don't hesitate to reach out. Share this article with others who may benefit from this information, and take the first step towards reducing your U.S. tax liability.

What is the foreign tax credit?

+The foreign tax credit is a non-refundable credit that can be claimed against your U.S. tax liability for taxes paid to a foreign government.

What types of foreign taxes qualify for the credit?

+The following types of taxes qualify for the credit: income taxes, wage taxes, wealth taxes, and net worth taxes.

How do I claim the foreign tax credit?

+To claim the foreign tax credit, you'll need to complete Form 1116 and attach it to your tax return (Form 1040).