Filing taxes as a fiduciary or trustee can be a complex and daunting task. The Schedule B Form 1041, also known as the "Interest, Dividends, and Capital Gains Distribution" form, is a crucial part of the tax filing process for estates and trusts. In this article, we will delve into the world of Schedule B Form 1041, providing a comprehensive guide on how to file, what to expect, and tips to make the process smoother.

Understanding Schedule B Form 1041

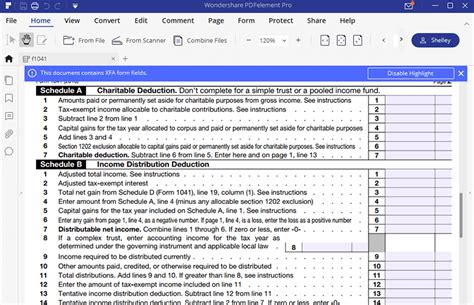

Schedule B Form 1041 is used to report the income, gains, losses, and deductions of an estate or trust. This form is typically filed along with the Form 1041, which is the main tax return form for estates and trusts. The Schedule B Form 1041 is divided into several parts, each focusing on a specific type of income or gain.

Who Needs to File Schedule B Form 1041?

Not all estates and trusts are required to file Schedule B Form 1041. The following entities need to file this form:

- Estates: If the estate has income, gains, losses, or deductions that need to be reported.

- Trusts: If the trust has income, gains, losses, or deductions that need to be reported, and the trust is not a grantor trust.

- Beneficiaries: If the beneficiary receives income, gains, losses, or deductions from the estate or trust.

How to File Schedule B Form 1041

Filing Schedule B Form 1041 requires careful attention to detail and a thorough understanding of the tax laws. Here are the steps to follow:

- Gather necessary documents: Collect all relevant documents, including the estate or trust's financial statements, tax returns, and any other supporting documents.

- Determine the type of income: Identify the type of income, gains, losses, and deductions that need to be reported on the Schedule B Form 1041.

- Complete the form: Fill out the Schedule B Form 1041, making sure to report all required information accurately.

- Attach supporting documents: Attach any supporting documents, such as financial statements and tax returns, to the Schedule B Form 1041.

- File the form: File the Schedule B Form 1041 along with the Form 1041, making sure to meet the filing deadline.

Tips for Filing Schedule B Form 1041

Filing Schedule B Form 1041 can be a complex process, but with the following tips, you can make it smoother:

- Consult a tax professional: If you are unsure about how to file Schedule B Form 1041, consult a tax professional who has experience with estate and trust taxes.

- Use tax software: Consider using tax software that supports Schedule B Form 1041 to help with the filing process.

- Keep accurate records: Keep accurate and detailed records of the estate or trust's financial transactions to ensure accurate reporting on the Schedule B Form 1041.

Common Mistakes to Avoid

When filing Schedule B Form 1041, it is essential to avoid common mistakes that can lead to delays or penalties. Here are some common mistakes to avoid:

- Inaccurate reporting: Make sure to report all required information accurately, including income, gains, losses, and deductions.

- Missing supporting documents: Ensure that all supporting documents, such as financial statements and tax returns, are attached to the Schedule B Form 1041.

- Late filing: File the Schedule B Form 1041 on time to avoid late filing penalties.

Conclusion: A Smooth Filing Process

Filing Schedule B Form 1041 requires attention to detail and a thorough understanding of the tax laws. By following the steps outlined in this article and avoiding common mistakes, you can ensure a smooth filing process. Remember to consult a tax professional if you are unsure about how to file Schedule B Form 1041, and keep accurate records to ensure accurate reporting.

Final Thoughts

We hope this comprehensive guide has provided you with a better understanding of Schedule B Form 1041 and how to file it accurately. If you have any questions or concerns, please leave a comment below. Share this article with others who may benefit from this information, and don't hesitate to reach out if you need further assistance.

FAQ Section

What is Schedule B Form 1041?

+Schedule B Form 1041 is a tax form used to report the income, gains, losses, and deductions of an estate or trust.

Who needs to file Schedule B Form 1041?

+Estates and trusts that have income, gains, losses, or deductions that need to be reported need to file Schedule B Form 1041.

How do I file Schedule B Form 1041?

+File Schedule B Form 1041 along with Form 1041, making sure to report all required information accurately and attaching supporting documents.