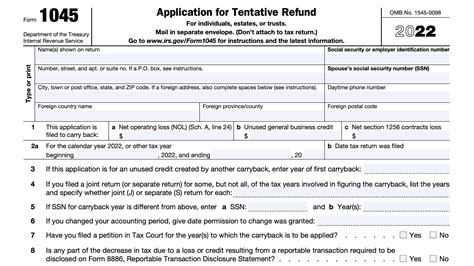

As the tax season approaches, individuals and businesses alike are looking for ways to minimize their tax liability and maximize their refunds. One often-overlooked opportunity for taxpayers who have overpaid their taxes is to file Schedule Form 1045, Application for Tentative Refund. In this article, we will delve into the world of Schedule Form 1045, exploring its purpose, benefits, and the step-by-step process of filing.

What is Schedule Form 1045?

Schedule Form 1045 is an application for a tentative refund, which allows taxpayers to claim a refund for overpaid taxes. This form is typically used when a taxpayer has overpaid their taxes due to an error or a change in their tax situation. By filing Schedule Form 1045, taxpayers can request a refund of their overpaid taxes, rather than waiting for the IRS to process their return and issue a refund.

Benefits of Filing Schedule Form 1045

Filing Schedule Form 1045 can provide several benefits to taxpayers, including:

- Reduced tax liability: By claiming a refund for overpaid taxes, taxpayers can reduce their tax liability and minimize their financial burden.

- Faster refund: Filing Schedule Form 1045 can result in a faster refund, as the IRS will process the application separately from the taxpayer's regular return.

- Reduced interest: By claiming a refund, taxpayers can reduce the amount of interest they owe on their tax debt.

Who Can File Schedule Form 1045?

Any taxpayer who has overpaid their taxes can file Schedule Form 1045. This includes individuals, businesses, and estates. However, there are certain requirements and limitations that taxpayers must meet before filing.

- Taxpayers must have filed their tax return and paid their tax bill in full.

- Taxpayers must have overpaid their taxes due to an error or a change in their tax situation.

- Taxpayers must file Schedule Form 1045 within one year from the original due date of their tax return.

Step-by-Step Process of Filing Schedule Form 1045

Filing Schedule Form 1045 is a straightforward process that requires taxpayers to gather certain information and complete the form. Here's a step-by-step guide:

- Gather necessary information: Taxpayers will need to gather their tax return, W-2 forms, and any other relevant documents to support their claim.

- Complete Schedule Form 1045: Taxpayers will need to complete Schedule Form 1045, which includes providing their name, address, and taxpayer identification number.

- Calculate overpaid taxes: Taxpayers will need to calculate the amount of taxes they have overpaid, using Form 1040 or Form 1120.

- Attach supporting documents: Taxpayers will need to attach supporting documents, such as W-2 forms and tax returns, to support their claim.

- Submit the application: Taxpayers will need to submit their application to the IRS, either by mail or electronically.

Tips and Reminders

When filing Schedule Form 1045, taxpayers should keep the following tips and reminders in mind:

- Make sure to file Schedule Form 1045 separately from your regular tax return.

- Use the correct form and follow the instructions carefully.

- Attach all supporting documents to support your claim.

- Submit your application to the IRS as soon as possible to avoid delays.

Common Mistakes to Avoid

When filing Schedule Form 1045, taxpayers should avoid the following common mistakes:

- Filing Schedule Form 1045 with your regular tax return.

- Failing to attach supporting documents.

- Miscalculating the amount of overpaid taxes.

- Submitting the application too late.

Conclusion

In conclusion, Schedule Form 1045 is an important tool for taxpayers who have overpaid their taxes. By filing this form, taxpayers can claim a refund and reduce their tax liability. However, it's essential to follow the instructions carefully and avoid common mistakes to ensure a successful application. We encourage taxpayers to take advantage of this opportunity and claim their rightful refund.

Now, it's your turn! Have you ever filed Schedule Form 1045? Share your experience in the comments below. Don't forget to share this article with your friends and family who may be eligible for a tentative refund.

What is the purpose of Schedule Form 1045?

+Schedule Form 1045 is an application for a tentative refund, which allows taxpayers to claim a refund for overpaid taxes.

Who can file Schedule Form 1045?

+Any taxpayer who has overpaid their taxes can file Schedule Form 1045, including individuals, businesses, and estates.

How do I calculate the amount of overpaid taxes?

+Taxpayers can calculate the amount of overpaid taxes using Form 1040 or Form 1120.