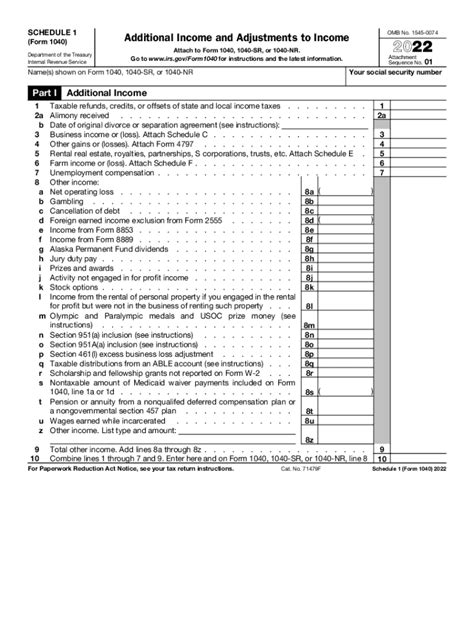

Filing taxes can be a daunting task, especially for those who are new to the process or have complex tax situations. One crucial aspect of tax filing is completing Schedule 1, which is a supplemental form used to report additional income and adjustments to income. In this article, we will delve into the world of Schedule 1, Form 1040, and provide you with 5 valuable tips to ensure you file accurately and efficiently.

As a taxpayer, it is essential to understand the purpose of Schedule 1 and how it affects your overall tax liability. Schedule 1 is used to report income and adjustments that are not reported on the main Form 1040. This includes income from self-employment, capital gains, and alimony, among others. The form is also used to claim certain deductions and credits, such as the student loan interest deduction and the earned income tax credit.

Given the complexity of tax laws and regulations, it is easy to make mistakes when filing Schedule 1. However, these mistakes can lead to delays, penalties, and even audits. By following these 5 tips, you can ensure that you file Schedule 1 accurately and avoid any potential issues.

Tip 1: Understand the Purpose of Schedule 1

Before you start filling out Schedule 1, it is crucial to understand its purpose and how it affects your overall tax liability. Schedule 1 is used to report additional income and adjustments to income that are not reported on the main Form 1040. This includes income from self-employment, capital gains, and alimony, among others. The form is also used to claim certain deductions and credits, such as the student loan interest deduction and the earned income tax credit.

To determine if you need to file Schedule 1, review the instructions for Form 1040 and the specific instructions for Schedule 1. If you have any of the income or adjustments listed, you will need to complete Schedule 1.

Tip 2: Gather All Necessary Documents

To accurately complete Schedule 1, you will need to gather all necessary documents, including:

- Form 1099-MISC for self-employment income

- Form 1099-INT for interest income

- Form 1099-DIV for dividend income

- Form 1099-B for capital gains and losses

- Form 1098 for mortgage interest and property taxes

- Form 1098-T for education expenses

Make sure to review each document carefully and ensure that you have all the necessary information to complete Schedule 1.

Tip 3: Report Self-Employment Income Accurately

Self-employment income is a common type of income reported on Schedule 1. To report self-employment income accurately, you will need to complete Part I of Schedule 1. This includes reporting your business income and expenses, as well as calculating your self-employment tax.

Make sure to keep accurate records of your business income and expenses throughout the year. This will help you to accurately complete Schedule 1 and avoid any potential issues.

Tip 4: Claim Deductions and Credits Accurately

Schedule 1 is also used to claim certain deductions and credits, such as the student loan interest deduction and the earned income tax credit. To claim these deductions and credits, you will need to complete the relevant sections of Schedule 1.

Make sure to review the instructions for each deduction and credit carefully and ensure that you meet the necessary requirements. This will help you to accurately claim the deductions and credits you are eligible for.

Tip 5: Review and Double-Check Your Work

Finally, it is essential to review and double-check your work before submitting Schedule 1. This includes reviewing your math calculations and ensuring that you have accurately completed all necessary sections.

By taking the time to review and double-check your work, you can avoid any potential issues and ensure that you file Schedule 1 accurately.

By following these 5 tips, you can ensure that you file Schedule 1 accurately and efficiently. Remember to understand the purpose of Schedule 1, gather all necessary documents, report self-employment income accurately, claim deductions and credits accurately, and review and double-check your work.

We hope this article has provided you with valuable insights and tips for filing Schedule 1, Form 1040. If you have any questions or concerns, please do not hesitate to comment below.

What is Schedule 1, Form 1040?

+Schedule 1, Form 1040 is a supplemental form used to report additional income and adjustments to income that are not reported on the main Form 1040.

What type of income is reported on Schedule 1?

+Schedule 1 is used to report income from self-employment, capital gains, and alimony, among others.

How do I claim deductions and credits on Schedule 1?

+To claim deductions and credits on Schedule 1, you will need to complete the relevant sections of the form and ensure that you meet the necessary requirements.