Completing the SBA Form 8821, also known as the Tax Information Authorization, is a crucial step in various business processes, including loan applications and tax-related matters. This form authorizes the Small Business Administration (SBA) or other parties to access and review your tax information, ensuring compliance with federal regulations. In this article, we'll guide you through the process of completing the SBA Form 8821 correctly, highlighting key considerations and providing practical tips.

Understanding the Purpose of SBA Form 8821

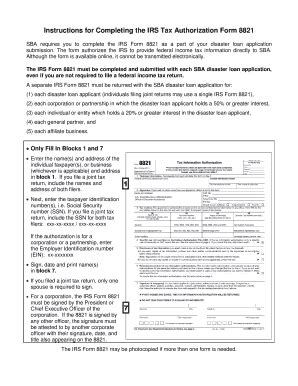

The SBA Form 8821 is a tax information authorization form that allows the SBA or other authorized parties to access your tax information on file with the Internal Revenue Service (IRS). This form is typically required when applying for an SBA loan or participating in other SBA programs. By completing this form, you're granting permission for the SBA or other parties to review your tax information, ensuring compliance with federal regulations and verifying the accuracy of your tax returns.

Why Accuracy Matters

Completing the SBA Form 8821 accurately is crucial to avoid delays or rejection of your loan application or other business processes. Inaccurate or incomplete information can lead to additional requests for documentation, resulting in prolonged processing times. Moreover, incorrect information may raise concerns about your business's creditworthiness or compliance with tax laws, potentially impacting your ability to secure funding or participate in SBA programs.

Tips for Completing SBA Form 8821 Correctly

To ensure accurate completion of the SBA Form 8821, follow these five tips:

Tip 1: Review the Form Carefully

Before starting to fill out the form, review it carefully to understand the required information and ensure you have all necessary documentation. Pay attention to the specific tax years and tax returns being requested, as this information may impact the completion of the form.

Tip 2: Ensure Accuracy in Taxpayer Information

Accurately provide your taxpayer information, including your name, Social Security number or Employer Identification Number (EIN), and address. Verify this information against your tax returns and other official documents to ensure consistency.

Tip 3: Specify the Correct Tax Years and Returns

Carefully review the tax years and returns being requested, as this information may impact the completion of the form. Ensure you provide the correct tax years and returns, as specified in the form instructions.

Tip 4: Authorize the Correct Parties

Clearly specify the parties being authorized to access your tax information. Ensure you include all necessary parties, such as the SBA, lenders, or other authorized representatives.

Tip 5: Sign and Date the Form Correctly

Sign and date the form in the presence of a notary public, if required. Ensure your signature is consistent with your taxpayer information and other official documents.

Common Mistakes to Avoid

When completing the SBA Form 8821, avoid common mistakes, such as:

- Inaccurate or incomplete taxpayer information

- Incorrect tax years or returns

- Failure to authorize the correct parties

- Inconsistent or missing signatures

- Failure to notarize the form, if required

Conclusion

Completing the SBA Form 8821 correctly is crucial to ensure smooth processing of your loan application or other business processes. By following the tips outlined in this article, you'll be able to accurately complete the form, avoiding common mistakes and potential delays. Remember to review the form carefully, ensure accuracy in taxpayer information, specify the correct tax years and returns, authorize the correct parties, and sign and date the form correctly.

What is the purpose of the SBA Form 8821?

+The SBA Form 8821 is a tax information authorization form that allows the SBA or other authorized parties to access your tax information on file with the IRS.

What are the common mistakes to avoid when completing the SBA Form 8821?

+

Why is it important to complete the SBA Form 8821 accurately?

+Completing the SBA Form 8821 accurately is crucial to avoid delays or rejection of your loan application or other business processes. Inaccurate or incomplete information can lead to additional requests for documentation, resulting in prolonged processing times.