When it comes to applying for financial assistance through the Small Business Administration (SBA), one of the crucial forms you'll need to complete is the SBA Form 413. This form is specifically designed for personal financial statements, and it plays a significant role in the SBA's loan application process. In this article, we'll delve into the world of SBA Form 413, explaining its importance, providing instructions on how to fill it out, and discussing where to download a fillable version.

What is SBA Form 413?

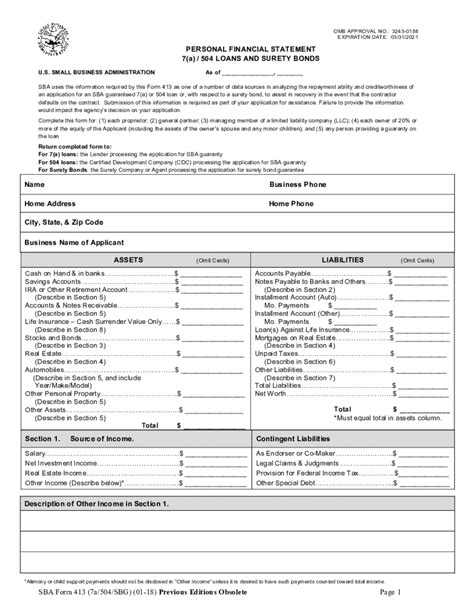

The SBA Form 413, also known as the Personal Financial Statement, is a critical document required by the SBA for loan applicants. This form provides a comprehensive overview of an individual's financial situation, including their assets, liabilities, and income. The information provided in this form helps the SBA assess the creditworthiness of the applicant and determine their ability to repay the loan.

Why is SBA Form 413 Important?

The SBA Form 413 is essential for several reasons:

- It helps the SBA evaluate the applicant's financial stability and creditworthiness.

- It provides a detailed picture of the applicant's financial situation, enabling the SBA to make informed decisions about loan approval.

- It ensures that the applicant is transparent about their financial situation, reducing the risk of default.

How to Fill Out SBA Form 413

Filling out SBA Form 413 requires careful attention to detail and accuracy. Here's a step-by-step guide to help you complete the form:

- Section 1: Personal Information

- Provide your name, address, and social security number or Individual Taxpayer Identification Number (ITIN).

- Section 2: Assets

- List all your assets, including cash, savings, investments, real estate, and personal property.

- Provide the current value of each asset.

- Section 3: Liabilities

- List all your liabilities, including debts, loans, and credit card balances.

- Provide the current balance of each liability.

- Section 4: Income

- Report your income from all sources, including employment, self-employment, and investments.

- Section 5: Expenses

- List your monthly expenses, including housing, transportation, and living expenses.

Tips for Completing SBA Form 413

- Ensure accuracy and completeness when filling out the form.

- Use the most current information available.

- Be transparent about your financial situation.

- Review the form carefully before submitting it.

Where to Download SBA Form 413 Fillable

You can download a fillable version of SBA Form 413 from the official SBA website or other reputable sources. Here are a few options:

- SBA Website: Visit the SBA website at and search for Form 413.

- SBA.gov/forms: You can also download the form directly from the SBA's forms page.

- Other reputable sources: You can also find fillable versions of SBA Form 413 on other websites, such as the IRS website or online form providers.

Conclusion

SBA Form 413 is a critical document required for SBA loan applications. By understanding the importance of this form and following the instructions provided, you can ensure that your application is complete and accurate. Remember to download a fillable version of the form from a reputable source and take the time to review it carefully before submitting it.

We hope this article has provided you with valuable insights into SBA Form 413. If you have any further questions or concerns, please don't hesitate to comment below.

What is the purpose of SBA Form 413?

+SBA Form 413 is a personal financial statement required by the SBA for loan applicants. It provides a comprehensive overview of an individual's financial situation, including their assets, liabilities, and income.

Where can I download a fillable version of SBA Form 413?

+You can download a fillable version of SBA Form 413 from the official SBA website or other reputable sources, such as the IRS website or online form providers.

What information do I need to provide on SBA Form 413?

+You will need to provide personal and financial information, including your name, address, social security number, assets, liabilities, income, and expenses.