In the world of business, particularly in the state of New York, there are various forms and documents that companies need to file to stay compliant with the law. One such form is the Form NYS-1, also known as the Certificate of Incorporation, which is used to form a corporation in New York. However, there is another crucial form that limited liability companies (LLCs) need to file, known as Form NYC-202. In this comprehensive guide, we will delve into the world of Form NYC-202, its importance, and provide step-by-step instructions on how to file it.

What is Form NYC-202?

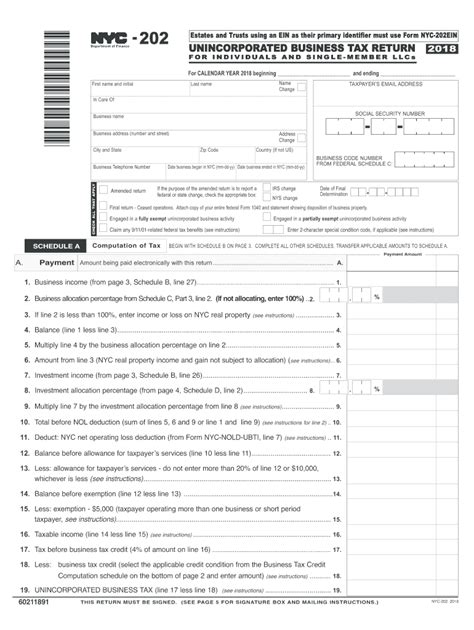

Form NYC-202 is a tax form required by the New York City Department of Finance, which must be filed annually by all businesses that operate within the five boroughs of New York City (Manhattan, Brooklyn, Queens, the Bronx, and Staten Island). The form is used to report the amount of taxes owed by the business, including the General Corporation Tax (GCT), the Unincorporated Business Tax (UBT), and the Commercial Rent Tax (CRT).

Why is Form NYC-202 Important?

Filing Form NYC-202 is crucial for several reasons:

- Tax Compliance: Filing the form ensures that your business is compliant with New York City tax laws, avoiding any penalties or fines that may arise from non-compliance.

- Tax Payment: The form is used to calculate and pay the taxes owed by your business, which is essential for maintaining a good standing with the city.

- Record-Keeping: The form helps your business keep accurate records of its tax payments and financial transactions, which can be useful for future reference or audit purposes.

Who Needs to File Form NYC-202?

The following businesses need to file Form NYC-202:

- Limited Liability Companies (LLCs): LLCs that operate within the five boroughs of New York City must file the form.

- Corporations: Corporations that operate within the five boroughs of New York City must file the form, unless they are exempt under the New York City Tax Law.

- Partnerships: Partnerships that operate within the five boroughs of New York City must file the form.

- Sole Proprietorships: Sole proprietorships that operate within the five boroughs of New York City must file the form, unless they are exempt under the New York City Tax Law.

How to File Form NYC-202

Filing Form NYC-202 can be a complex process, but with the right guidance, it can be done efficiently. Here are the step-by-step instructions:

Filing Instructions

Step 1: Gather Required Information

Before filing the form, gather all the necessary information, including:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Tax year and accounting period

- Business income and expenses

- Tax credits and deductions

Step 2: Determine Tax Liability

Calculate your business's tax liability using the tax rates and brackets provided by the New York City Department of Finance.

Step 3: Complete Form NYC-202

Complete Form NYC-202, making sure to include all the required information and calculations. You can download the form from the New York City Department of Finance website or file electronically through the NYC Tax Portal.

Step 4: Attach Required Schedules and Supporting Documents

Attach all required schedules and supporting documents, including:

- Schedule A: Business Income and Expenses

- Schedule B: Tax Credits and Deductions

- Schedule C: Commercial Rent Tax

- Supporting documents, such as financial statements and receipts

Step 5: File the Form and Pay Taxes

File the form and pay the taxes owed by the deadline, which is typically March 15th of each year. You can file electronically or by mail.

Filing Form NYC-202 Electronically

Filing Form NYC-202 electronically is a convenient and efficient way to submit your tax return. Here are the steps:

Electronic Filing Instructions

Step 1: Create an Account

Create an account on the NYC Tax Portal, which can be accessed through the New York City Department of Finance website.

Step 2: Gather Required Information

Gather all the necessary information, including business name and address, FEIN, tax year, and accounting period.

Step 3: Complete Form NYC-202

Complete Form NYC-202, making sure to include all the required information and calculations.

Step 4: Attach Required Schedules and Supporting Documents

Attach all required schedules and supporting documents, including Schedule A, Schedule B, and supporting documents.

Step 5: Submit the Form and Pay Taxes

Submit the form and pay the taxes owed by the deadline.

Common Mistakes to Avoid

When filing Form NYC-202, avoid the following common mistakes:

- Late Filing: Filing the form late can result in penalties and fines.

- Inaccurate Information: Providing inaccurate information can result in delays or even an audit.

- Missing Schedules and Supporting Documents: Failing to attach required schedules and supporting documents can result in delays or even an audit.

Conclusion

Filing Form NYC-202 is a crucial step for businesses operating within the five boroughs of New York City. By following the instructions outlined in this guide, businesses can ensure that they are compliant with New York City tax laws and avoid any penalties or fines. Remember to gather all the necessary information, determine your tax liability, complete the form, attach required schedules and supporting documents, and file the form on time.

FAQs

What is Form NYC-202?

+Form NYC-202 is a tax form required by the New York City Department of Finance, which must be filed annually by all businesses that operate within the five boroughs of New York City.

Who needs to file Form NYC-202?

+Limited Liability Companies (LLCs), corporations, partnerships, and sole proprietorships that operate within the five boroughs of New York City must file Form NYC-202.

What is the deadline for filing Form NYC-202?

+The deadline for filing Form NYC-202 is typically March 15th of each year.