If you're a business owner in California, you're likely familiar with the importance of filing your sales tax returns on time. The California Department of Tax and Fee Administration (CDTFA) requires businesses to file a sales tax return form on a regular basis, typically monthly or quarterly, depending on your business's specific filing requirements. In this article, we'll take a step-by-step look at the California sales tax return form and provide guidance on how to complete it accurately.

As a business owner, it's crucial to understand your sales tax obligations to avoid penalties, fines, and interest charges. The California sales tax return form is used to report and pay sales tax, use tax, and other taxes and fees to the CDTFA. Failure to file your sales tax return on time can result in costly consequences, including penalties, interest, and even loss of your business license.

Who Needs to File a California Sales Tax Return Form?

Before we dive into the step-by-step guide, it's essential to understand who needs to file a California sales tax return form. If your business is registered with the CDTFA and is required to collect and remit sales tax, you'll need to file a sales tax return form on a regular basis. This includes:

- Retailers and wholesalers who sell tangible personal property

- Businesses that provide taxable services, such as construction contractors and architects

- Online retailers who sell to California customers

- Businesses that import goods into California

Determining Your Filing Frequency

The frequency at which you need to file your California sales tax return form depends on your business's annual sales tax liability. The CDTFA requires businesses to file their sales tax returns on a monthly, quarterly, or annual basis.

- Monthly filing: If your business has an annual sales tax liability of $20,000 or more, you'll need to file your sales tax return on a monthly basis.

- Quarterly filing: If your business has an annual sales tax liability of $5,000 to $19,999, you'll need to file your sales tax return on a quarterly basis.

- Annual filing: If your business has an annual sales tax liability of less than $5,000, you may be eligible to file your sales tax return on an annual basis.

Step-by-Step Guide to Filing Your California Sales Tax Return Form

Now that we've covered who needs to file a California sales tax return form and the filing frequency, let's take a step-by-step look at how to complete the form.

Step 1: Gather Required Information

Before you begin filling out your California sales tax return form, you'll need to gather the following information:

- Your business's California seller's permit number

- Your business's federal employer identification number (FEIN)

- Your business's name and address

- The reporting period for which you're filing

- The total amount of sales tax collected during the reporting period

- The total amount of use tax owed during the reporting period

Step 2: Complete the Form

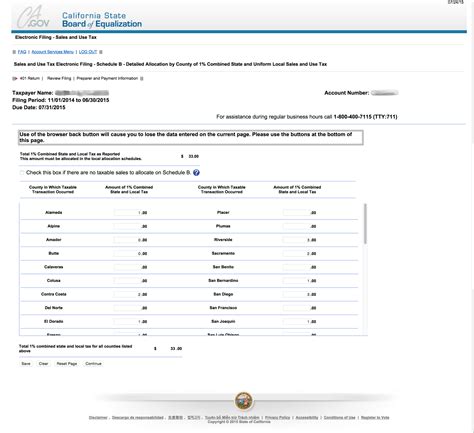

The California sales tax return form is typically filed online through the CDTFA's online portal. You can also file by mail or phone, but online filing is the most convenient and efficient method.

- Log in to your CDTFA online account and select the "File a Return" option.

- Enter your business's California seller's permit number and FEIN.

- Select the reporting period for which you're filing.

- Enter the total amount of sales tax collected during the reporting period.

- Enter the total amount of use tax owed during the reporting period.

- Calculate the total amount of tax due.

Calculating the Total Amount of Tax Due

To calculate the total amount of tax due, you'll need to multiply the total amount of sales tax collected during the reporting period by the applicable tax rate. You can use the CDTFA's tax rate chart to determine the applicable tax rate for your business.

- Sales tax rate: 7.25% (state rate) + 1.25% (local rate) = 8.5% (total tax rate)

- Total amount of sales tax collected: $10,000

- Total amount of tax due: $10,000 x 8.5% = $850

Step 3: Pay the Tax Due

Once you've calculated the total amount of tax due, you'll need to pay the tax due online or by mail. You can pay by check, money order, or credit card.

- Online payment: Select the "Pay Now" option and enter your payment information.

- Mail payment: Make a check or money order payable to the California Department of Tax and Fee Administration and mail it to the address listed on the CDTFA's website.

Common Errors to Avoid

When filing your California sales tax return form, it's essential to avoid common errors that can result in penalties, fines, and interest charges. Here are some common errors to avoid:

- Failing to file on time

- Failing to report all sales tax collected

- Failing to pay the correct amount of tax due

- Failing to maintain accurate records

Tips for Filing Your California Sales Tax Return Form

Here are some tips to help you file your California sales tax return form accurately and efficiently:

- Keep accurate records of all sales tax collected and use tax owed.

- Use the CDTFA's online portal to file your sales tax return.

- Pay the tax due online or by mail to avoid penalties and interest charges.

- Consult with a tax professional if you're unsure about any aspect of the filing process.

Conclusion

Filing your California sales tax return form is a critical aspect of running a business in California. By following the step-by-step guide outlined in this article, you can ensure that you're filing your sales tax return accurately and efficiently. Remember to gather all required information, complete the form accurately, and pay the tax due on time to avoid penalties, fines, and interest charges.

We hope this article has provided you with a comprehensive understanding of the California sales tax return form and the filing process. If you have any questions or concerns, please don't hesitate to comment below. We'd love to hear from you!

What is the California sales tax return form?

+The California sales tax return form is a document used to report and pay sales tax, use tax, and other taxes and fees to the California Department of Tax and Fee Administration (CDTFA).

Who needs to file a California sales tax return form?

+Businesses that are registered with the CDTFA and are required to collect and remit sales tax need to file a California sales tax return form.

How often do I need to file my California sales tax return form?

+The frequency at which you need to file your California sales tax return form depends on your business's annual sales tax liability. You may need to file monthly, quarterly, or annually.