As a business owner, you're no stranger to the complexities of taxation. With so many forms and deadlines to keep track of, it's easy to get overwhelmed. But what happens when you need a little extra time to file your S Corporation taxes? That's where the S Corporation tax extension form comes in. In this article, we'll break down five essential tips to help you navigate this process with ease.

Understanding the Importance of S Corporation Tax Extensions

Before we dive into the tips, let's quickly review why S Corporation tax extensions are so crucial. An S Corporation is a type of corporation that elects to pass corporate income, losses, deductions, and credits to its shareholders for federal tax purposes. This means that the corporation itself doesn't pay income taxes; instead, the shareholders report their share of income and expenses on their personal tax returns.

However, with the complexity of S Corporation taxation comes the need for flexibility. That's where the tax extension form comes in. By filing for an extension, you can buy yourself some extra time to gather all the necessary paperwork, consult with your accountant, and ensure that your tax return is accurate and complete.

Tip 1: Know Your Deadlines

One of the most critical things to remember when it comes to S Corporation tax extensions is the deadline. Typically, S Corporations must file their tax returns by March 15th of each year. However, if you need more time, you can file for an automatic six-month extension, which would give you a new deadline of September 15th.

It's essential to note that this deadline applies to both the initial tax return and any subsequent extensions. Missing this deadline can result in penalties and fines, so mark your calendar and plan accordingly.

The Benefits of Filing an S Corporation Tax Extension

So, why would you need to file an S Corporation tax extension? Here are just a few benefits:

- More Time to Gather Documents: Filing for an extension gives you extra time to collect all the necessary paperwork, including financial statements, receipts, and invoices.

- Reduced Penalties: By filing for an extension, you can avoid penalties and fines associated with late filing.

- Improved Accuracy: With more time to review and prepare your tax return, you're less likely to make errors or miss important deductions.

Tip 2: Understand the Extension Form

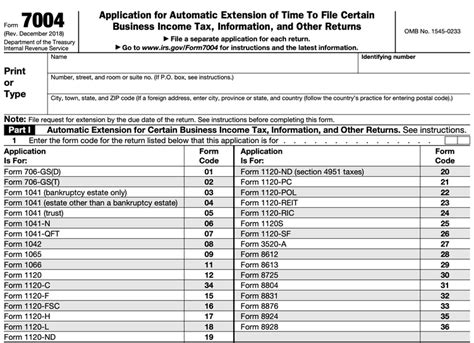

Now that we've covered the benefits of filing an S Corporation tax extension, let's talk about the actual form. The IRS requires S Corporations to file Form 7004, which is the Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns.

This form is relatively straightforward, but it's essential to ensure you're filling it out correctly. You'll need to provide your business's name, address, and Employer Identification Number (EIN), as well as the type of return you're requesting an extension for.

A Step-by-Step Guide to Filing Form 7004

Here's a step-by-step guide to help you file Form 7004:

- Download the Form: You can find Form 7004 on the IRS website or through your tax software provider.

- Fill Out the Form: Complete the form by providing the required information, including your business's name, address, and EIN.

- Choose the Correct Return Type: Select the type of return you're requesting an extension for, which in this case would be Form 1120S (U.S. Income Tax Return for an S Corporation).

- Calculate Your Estimated Tax: You'll need to estimate your corporation's tax liability and make a payment if necessary.

- Sign and Date the Form: Sign and date the form, making sure to keep a copy for your records.

Tip 3: Make Estimated Tax Payments

As mentioned earlier, when filing for an S Corporation tax extension, you may need to make estimated tax payments. This is especially true if you expect to owe taxes when you file your return.

The IRS requires corporations to make estimated tax payments if they expect to owe $500 or more in taxes for the year. You can use Form 1120-W to calculate your estimated tax liability and make payments online, by phone, or by mail.

Common Mistakes to Avoid When Filing an S Corporation Tax Extension

While filing an S Corporation tax extension can provide much-needed relief, it's essential to avoid common mistakes that can lead to penalties and fines. Here are a few things to watch out for:

- Missing the Deadline: Make sure to file Form 7004 by the original deadline (March 15th for S Corporations).

- Incorrect Information: Double-check your business's name, address, and EIN to ensure accuracy.

- Insufficient Payment: If you're required to make estimated tax payments, make sure to pay the correct amount to avoid penalties.

Tip 4: Consult with a Tax Professional

Filing an S Corporation tax extension can be complex, especially if you're new to the process. That's why it's essential to consult with a tax professional who can guide you through the process.

A tax professional can help you:

- Navigate the Form: Ensure you're filling out Form 7004 correctly and avoiding common mistakes.

- Estimate Tax Liability: Calculate your estimated tax liability and make payments if necessary.

- Avoid Penalties: Help you avoid penalties and fines associated with late filing or incorrect information.

The Importance of Record-Keeping

Finally, it's essential to maintain accurate and detailed records when filing an S Corporation tax extension. This includes:

- Financial Statements: Keep copies of your financial statements, including balance sheets and income statements.

- Receipts and Invoices: Maintain records of all receipts and invoices related to your business.

- Tax Returns: Keep copies of all tax returns, including Form 1120S and Form 7004.

By keeping accurate records, you can ensure a smooth tax filing process and avoid any potential issues with the IRS.

Tip 5: Stay Organized

Last but not least, it's essential to stay organized when filing an S Corporation tax extension. This includes:

- Marking Your Calendar: Make sure to mark your calendar with important deadlines, including the original deadline and any subsequent extension deadlines.

- Keeping Track of Documents: Keep track of all documents related to your tax return, including financial statements, receipts, and invoices.

- Following Up with the IRS: If you're unsure about the status of your tax return or extension, follow up with the IRS to ensure everything is in order.

By staying organized, you can avoid last-minute scrambles and ensure a smooth tax filing process.

What is the deadline for filing an S Corporation tax extension?

+The deadline for filing an S Corporation tax extension is typically March 15th of each year. However, if you need more time, you can file for an automatic six-month extension, which would give you a new deadline of September 15th.

What is the purpose of Form 7004?

+Form 7004 is the Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. It's used to request an extension of time to file an S Corporation tax return.

Do I need to make estimated tax payments when filing an S Corporation tax extension?

+Yes, you may need to make estimated tax payments when filing an S Corporation tax extension. The IRS requires corporations to make estimated tax payments if they expect to owe $500 or more in taxes for the year.