Are you struggling to navigate the complexities of filing an S Corp tax extension form 2553? You're not alone. Many business owners and entrepreneurs find themselves overwhelmed by the intricacies of tax law and the paperwork that comes with it. However, with the right guidance, filing an S Corp tax extension form 2553 can be a straightforward process.

In this article, we'll break down the steps to file an S Corp tax extension form 2553 with ease. We'll cover the benefits of filing an S Corp, the eligibility requirements, and a step-by-step guide to completing the form. By the end of this article, you'll be equipped with the knowledge and confidence to file your S Corp tax extension form 2553 with ease.

Benefits of Filing an S Corp

Before we dive into the nitty-gritty of filing an S Corp tax extension form 2553, let's take a look at the benefits of filing an S Corp.

S Corporations, also known as Subchapter S corporations, offer several advantages over other types of business entities. Here are some of the key benefits:

- Pass-through taxation: S Corps are pass-through entities, meaning that the corporation itself is not subject to federal income tax. Instead, the corporation's income is passed through to the shareholders, who report it on their personal tax returns.

- Limited liability protection: S Corps provide limited liability protection for their shareholders, which means that their personal assets are protected in the event of business debts or lawsuits.

- Flexibility in ownership structure: S Corps can have up to 100 shareholders, and they can be individuals, trusts, or estates.

- Tax deductions: S Corps can deduct business expenses on their tax returns, which can help reduce their taxable income.

Eligibility Requirements for Filing an S Corp

To file an S Corp tax extension form 2553, your business must meet certain eligibility requirements. Here are some of the key requirements:

- Domestic corporation: Your business must be a domestic corporation, meaning that it must be formed in the United States.

- Not a publicly traded company: Your business cannot be a publicly traded company.

- Only allows certain types of shareholders: S Corps can only have certain types of shareholders, including individuals, trusts, and estates.

- Cannot have more than 100 shareholders: S Corps are limited to 100 shareholders.

Step-by-Step Guide to Filing an S Corp Tax Extension Form 2553

Now that we've covered the benefits and eligibility requirements of filing an S Corp, let's take a step-by-step look at how to file an S Corp tax extension form 2553.

Step 1: Gather Required Documents

Before you start filling out the form, you'll need to gather some required documents. These include:

- Articles of incorporation: You'll need to provide a copy of your business's articles of incorporation.

- Identification numbers: You'll need to provide your business's employer identification number (EIN) and the Social Security numbers or individual taxpayer identification numbers (ITINs) of your shareholders.

- Shareholder information: You'll need to provide information about your shareholders, including their names, addresses, and percentage of ownership.

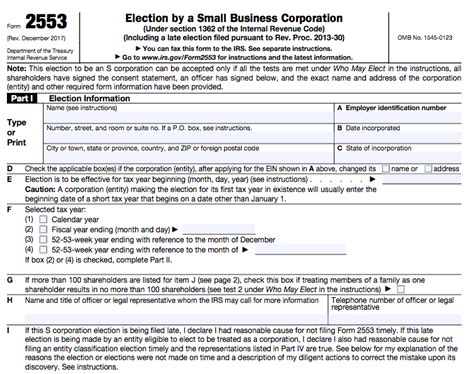

Step 2: Complete Form 2553

Once you have all the required documents, you can start filling out Form 2553. Here are some tips to keep in mind:

- Fill out the form completely and accurately: Make sure to fill out the form completely and accurately. Incomplete or inaccurate forms may be rejected.

- Use black ink: Use black ink to fill out the form. This will help ensure that your form is legible and can be scanned easily.

- Sign the form: Make sure to sign the form in the designated area.

Step 3: File the Form

Once you've completed the form, you can file it with the IRS. Here are some options:

- Mail the form: You can mail the form to the IRS address listed in the instructions.

- E-file the form: You can also e-file the form through the IRS's Electronic Federal Tax Payment System (EFTPS).

- Use a tax professional: If you're not comfortable filling out the form yourself, you can use a tax professional to help you with the process.

Common Mistakes to Avoid When Filing an S Corp Tax Extension Form 2553

When filing an S Corp tax extension form 2553, there are several common mistakes to avoid. Here are some of the most common mistakes:

- Filing the form late: Make sure to file the form on time. Late filings may result in penalties and interest.

- Incomplete or inaccurate information: Make sure to fill out the form completely and accurately. Incomplete or inaccurate forms may be rejected.

- Not signing the form: Make sure to sign the form in the designated area.

Tips for Filing an S Corp Tax Extension Form 2553

Here are some additional tips for filing an S Corp tax extension form 2553:

- Use tax software: Consider using tax software to help you with the filing process.

- Consult a tax professional: If you're not comfortable filling out the form yourself, consider consulting a tax professional.

- Keep accurate records: Keep accurate records of your business's income and expenses. This will help you complete the form accurately and ensure that you're taking advantage of all the tax deductions you're eligible for.

Conclusion

Filing an S Corp tax extension form 2553 can seem like a daunting task, but with the right guidance, it can be a straightforward process. By following the steps outlined in this article, you can ensure that your business is taking advantage of the benefits of filing an S Corp. Remember to gather all required documents, complete the form accurately, and file it on time. If you're not comfortable with the process, consider consulting a tax professional or using tax software to help you with the filing process.

What is the deadline for filing an S Corp tax extension form 2553?

+The deadline for filing an S Corp tax extension form 2553 is March 15th of each year.

Can I file an S Corp tax extension form 2553 electronically?

+Yes, you can file an S Corp tax extension form 2553 electronically through the IRS's Electronic Federal Tax Payment System (EFTPS).

What are the benefits of filing an S Corp?

+The benefits of filing an S Corp include pass-through taxation, limited liability protection, flexibility in ownership structure, and tax deductions.