Are you a resident of Hawaii or a business owner operating in the Aloha State? If so, you're likely familiar with the Hawaii Tax Form G-49, also known as the General Excise Tax Return. Filing this form can be a daunting task, but with the right guidance, you can navigate the process with ease. In this article, we'll break down the Hawaii Tax Form G-49 into 5 easy steps, making it simple for you to fill out and submit your return accurately.

Understanding the Hawaii Tax Form G-49

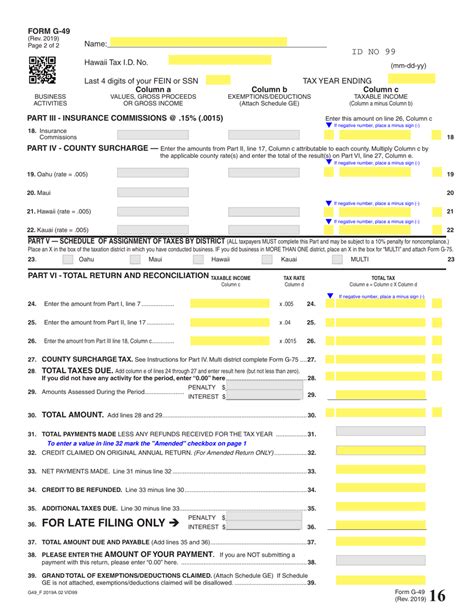

The Hawaii Tax Form G-49 is a quarterly return that must be filed by businesses and individuals who are subject to the general excise tax. This tax is imposed on the gross income of businesses operating in Hawaii, including sales, services, and rentals. The form is used to report the taxpayer's gross income, deductions, and tax liability for the quarter.

Step 1: Gather Required Information and Documents

Before starting the form, make sure you have all the necessary information and documents. You'll need:

- Your business's name, address, and tax ID number

- Gross income from sales, services, and rentals for the quarter

- Deductions, such as cost of goods sold, operating expenses, and charitable contributions

- Any other relevant documentation, such as invoices and receipts

Step 2: Complete the Header Section

The header section of the form requires basic information about your business, including:

- Business name and address

- Tax ID number

- Quarter and year being reported

- Contact information, including phone number and email address

Make sure to fill out this section accurately, as it will help the Hawaii Department of Taxation identify your business and process your return correctly.

Completing the Gross Income Section

The gross income section is where you'll report your business's total income from sales, services, and rentals for the quarter.

Line 1: Gross Income from Sales

Report your total sales income for the quarter, including sales of goods and services. Make sure to include all sales, regardless of whether they were made in cash or on credit.

Line 2: Gross Income from Services

Report your total income from services, including consulting fees, commission income, and other service-related income.

Line 3: Gross Income from Rentals

Report your total income from rentals, including rent from real estate, equipment, and other property.

Step 3: Calculate Deductions and Tax Liability

Once you've reported your gross income, you'll need to calculate your deductions and tax liability.

Line 4: Cost of Goods Sold

Report the cost of goods sold, including the cost of materials, labor, and overhead.

Line 5: Operating Expenses

Report your operating expenses, including rent, utilities, and other business expenses.

Line 6: Charitable Contributions

Report your charitable contributions, including donations to qualified organizations.

Line 7: Total Deductions

Calculate your total deductions by adding up the amounts on lines 4, 5, and 6.

Line 8: Tax Liability

Calculate your tax liability by multiplying your taxable income (gross income minus total deductions) by the applicable tax rate.

Step 4: Complete the Payment and Signature Section

If you owe taxes, you'll need to complete the payment section and submit your payment with the return. You can pay online, by mail, or in person.

Make sure to sign and date the return, as it will be invalid without your signature.

Step 5: Submit the Return

Once you've completed the form, review it carefully for accuracy and completeness. You can submit the return online, by mail, or in person.

Make sure to keep a copy of the return for your records, as you may need to refer to it later.

Filing the Hawaii Tax Form G-49 doesn't have to be a daunting task. By following these 5 easy steps, you can ensure that your return is accurate and complete. Remember to gather all required information and documents, complete the header section, report your gross income, calculate deductions and tax liability, complete the payment and signature section, and submit the return. If you have any questions or concerns, don't hesitate to contact the Hawaii Department of Taxation for assistance.

We hope this article has been helpful in guiding you through the process of filling out the Hawaii Tax Form G-49. If you have any questions or comments, please feel free to share them below.

What is the due date for filing the Hawaii Tax Form G-49?

+The due date for filing the Hawaii Tax Form G-49 is the 20th day of the month following the end of the quarter.

Can I file the Hawaii Tax Form G-49 online?

+Yes, you can file the Hawaii Tax Form G-49 online through the Hawaii Department of Taxation's website.

What is the penalty for late filing of the Hawaii Tax Form G-49?

+The penalty for late filing of the Hawaii Tax Form G-49 is 5% of the tax due per month, up to a maximum of 25%.