The Illinois Rut-50 tax form - a crucial document for anyone who wants to claim a refund on their Illinois use tax or prepare for their annual tax filing. However, navigating the complexities of this form can be daunting, especially for those who are new to the world of tax filing. In this article, we will break down the essentials of the Illinois Rut-50 tax form, providing you with 5 essential tips to help you understand and complete it with ease.

What is the Illinois Rut-50 tax form?

The Illinois Rut-50 tax form is a document used by the Illinois Department of Revenue to process refunds for Illinois use tax. It is typically used by individuals and businesses who have paid use tax on purchases made outside of Illinois, but are eligible for a refund. The form is also used to claim a refund on overpaid use tax or to report and pay use tax owed.

Tip #1: Determine Your Eligibility

Before you start filling out the Illinois Rut-50 tax form, it's essential to determine if you're eligible for a refund. To qualify, you must have paid use tax on a purchase made outside of Illinois, and the purchase must be eligible for a refund. Some common examples of eligible purchases include:

- Purchases made online from out-of-state retailers

- Purchases made from out-of-state vendors

- Purchases made at garage sales or flea markets

If you're unsure about your eligibility, it's best to consult with a tax professional or contact the Illinois Department of Revenue directly.

Tip #2: Gather Required Documents

To complete the Illinois Rut-50 tax form, you'll need to gather several required documents, including:

- A copy of your receipt or invoice showing the amount of use tax paid

- A copy of your Illinois driver's license or state ID

- A copy of your social security number or Individual Taxpayer Identification Number (ITIN)

Make sure you have all the necessary documents before starting the form, as this will save you time and frustration in the long run.

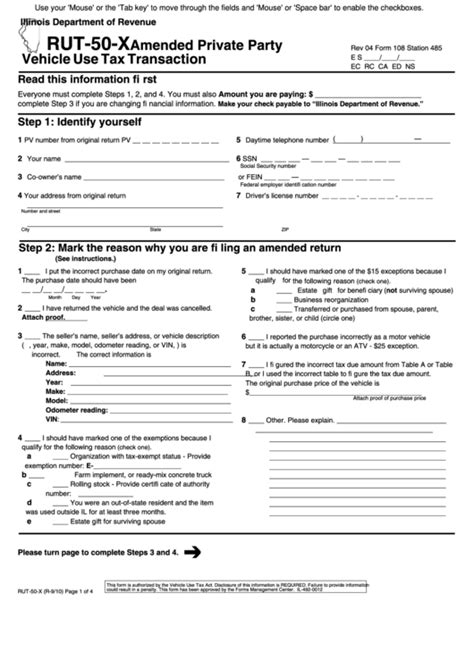

Tip #3: Understand the Different Sections of the Form

The Illinois Rut-50 tax form is divided into several sections, each with its own specific requirements. Here's a brief overview of what you can expect:

- Section 1: Claimant Information - This section requires your personal and contact information.

- Section 2: Purchase Information - This section requires details about the purchase, including the date, amount, and type of purchase.

- Section 3: Use Tax Information - This section requires information about the use tax paid, including the amount and date paid.

Take your time to carefully read and complete each section, as inaccuracies can delay your refund.

**Calculating Your Refund**

Calculating your refund can be a complex process, but it's essential to get it right. Here are some tips to help you calculate your refund:

- Use the Illinois use tax rate of 5% to calculate the amount of use tax paid

- Subtract any credits or deductions you're eligible for

- Calculate the total amount of refund due

Tip #4: Avoid Common Mistakes

When completing the Illinois Rut-50 tax form, it's easy to make mistakes that can delay your refund. Here are some common mistakes to avoid:

- Inaccurate or incomplete information

- Failure to sign and date the form

- Failure to include required documentation

Take your time to carefully review the form before submitting it, and consider consulting with a tax professional if you're unsure.

Tip #5: Submit Your Form Correctly

Once you've completed the Illinois Rut-50 tax form, it's essential to submit it correctly. Here are some tips to help you get it right:

- Mail the form to the correct address: Illinois Department of Revenue, PO Box 7035, Springfield, IL 62791-7035

- Include all required documentation

- Keep a copy of the form for your records

By following these tips, you can ensure that your form is processed quickly and efficiently.

**Additional Resources**

If you're still unsure about the Illinois Rut-50 tax form, there are several additional resources available to help you. Here are a few:

- Illinois Department of Revenue website:

- Illinois Department of Revenue phone number: (217) 782-3336

- Local tax professionals or accountants

By following these 5 essential tips, you can navigate the complexities of the Illinois Rut-50 tax form with ease. Remember to take your time, gather all required documents, and avoid common mistakes. If you're still unsure, don't hesitate to reach out to additional resources for help.

Now that you've read this article, we invite you to share your thoughts and experiences with the Illinois Rut-50 tax form in the comments below. Have you had any challenges or successes with this form? What tips do you have to share with others? Let's start a conversation!

What is the Illinois Rut-50 tax form used for?

+The Illinois Rut-50 tax form is used to claim a refund on Illinois use tax or to report and pay use tax owed.

Who is eligible for a refund on the Illinois Rut-50 tax form?

+Individuals and businesses who have paid use tax on purchases made outside of Illinois and are eligible for a refund.

What documents are required to complete the Illinois Rut-50 tax form?

+A copy of your receipt or invoice showing the amount of use tax paid, a copy of your Illinois driver's license or state ID, and a copy of your social security number or Individual Taxpayer Identification Number (ITIN).