Filling out an RTGS (Real-Time Gross Settlement) form for ICICI Bank can seem like a daunting task, but with the right guidance, it can be a straightforward process. In this article, we will break down the steps to fill out the RTGS ICICI Bank form, ensuring that you have a seamless experience.

What is RTGS and Why is it Important?

Before we dive into the steps, let's quickly understand what RTGS is and why it's essential. RTGS is a payment system that allows for the transfer of funds from one bank to another on a real-time basis. It's a safe and efficient way to transfer large amounts of money, making it a popular choice for businesses and individuals alike.

Step 1: Gather Required Information

To fill out the RTGS ICICI Bank form, you'll need to gather some essential information. This includes:

- The beneficiary's name and account number

- The beneficiary's bank name and branch

- The IFSC (Indian Financial System Code) of the beneficiary's bank

- The amount you want to transfer

- Your own account details, including your account number and branch

Why is IFSC Code Important?

The IFSC code is a unique code assigned to each bank branch in India. It's used to identify the beneficiary's bank and facilitate the transfer of funds. Without the correct IFSC code, the transaction may not be processed.

Step 2: Fill Out the RTGS Form

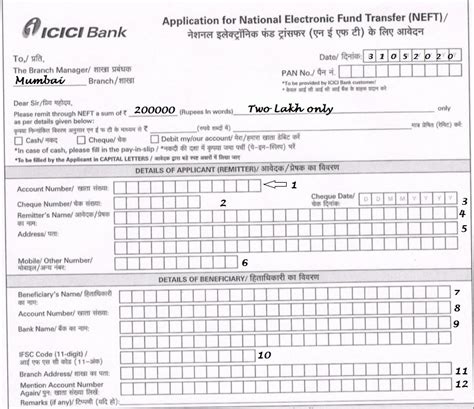

Now that you have all the required information, you can start filling out the RTGS form. The form will typically ask for the following details:

- Remitter's details (your name, account number, and branch)

- Beneficiary's details (name, account number, bank name, and branch)

- Transfer amount

- IFSC code of the beneficiary's bank

Make sure to fill out the form accurately and carefully, as any mistakes may lead to delays or rejection of the transaction.

Step 3: Verify the Details

Before submitting the form, it's essential to verify the details you've filled out. Double-check the beneficiary's account number, IFSC code, and other details to ensure they are accurate.

What Happens if the Details are Incorrect?

If the details are incorrect, the transaction may not be processed, or it may be delayed. In some cases, the funds may be transferred to the wrong account. To avoid such situations, it's crucial to verify the details carefully.

Step 4: Submit the Form

Once you've verified the details, you can submit the form to the bank. You can do this in person at the bank branch or through online banking, if available.

Step 5: Track the Transaction

After submitting the form, you can track the transaction to ensure it's processed successfully. You can do this through online banking or by contacting the bank's customer care.

How Long Does it Take for the Transaction to be Processed?

The transaction is typically processed in real-time, meaning the funds are transferred immediately. However, in some cases, it may take a few hours or a day for the transaction to be processed.

By following these 5 steps, you can fill out the RTGS ICICI Bank form accurately and efficiently. Remember to gather all the required information, fill out the form carefully, verify the details, submit the form, and track the transaction.

We hope this article has been helpful in guiding you through the process of filling out the RTGS ICICI Bank form. If you have any questions or need further clarification, please feel free to comment below.

What is the minimum amount that can be transferred through RTGS?

+The minimum amount that can be transferred through RTGS is ₹2 lakh.

What is the maximum amount that can be transferred through RTGS?

+There is no maximum limit for RTGS transactions.

Can I cancel an RTGS transaction?

+No, RTGS transactions cannot be cancelled once they are processed.