Filling out tax forms can be a daunting task, especially for those who are new to receiving retirement benefits. The RRB 1099-R form is a crucial document for recipients of railroad retirement benefits, as it reports the amount of benefits paid to them in a given tax year. In this article, we will guide you through the process of filling out the RRB 1099-R form correctly, ensuring you avoid any potential errors or delays in your tax filing.

Understanding the RRB 1099-R Form

The RRB 1099-R form is issued by the U.S. Railroad Retirement Board (RRB) to report the amount of railroad retirement benefits paid to recipients in a given tax year. The form is typically mailed to recipients by January 31st of each year and is used to report the following types of benefits:

- Railroad retirement annuities

- Supplemental annuities

- Disability annuities

- Survivor benefits

5 Ways to Fill Out the RRB 1099-R Form Correctly

- Gather Required Information

Before filling out the RRB 1099-R form, ensure you have the following information readily available:

- Your Social Security number or Railroad Retirement account number

- The amount of benefits paid to you in the tax year

- The amount of federal income tax withheld from your benefits

- The amount of state income tax withheld from your benefits (if applicable)

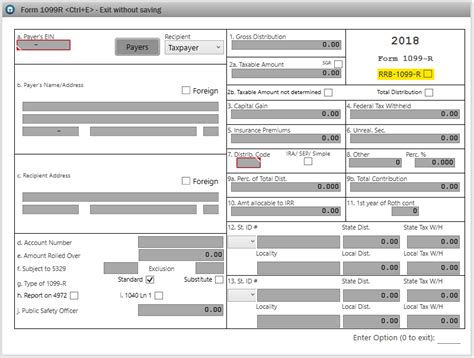

Filling Out the Form

- Fill Out the Recipient's Information

In Box 1, enter your name and address as it appears on the form. Ensure your name is spelled correctly, and your address is up-to-date.

In Box 2, enter your Social Security number or Railroad Retirement account number. This is crucial, as it helps identify you as the recipient of the benefits.

- Report Benefits Paid

In Box 4, report the total amount of benefits paid to you in the tax year. This amount is also reported in Box 1.

In Box 5, report the amount of federal income tax withheld from your benefits. This amount is also reported in Box 2.

Withholding Tax

If you have state income tax withheld from your benefits, report the amount in Box 6. Not all states tax railroad retirement benefits, so ensure you verify this information before reporting it.

- Calculate Taxable Amount

In Box 7, calculate the taxable amount of your benefits. This amount is typically the same as the amount reported in Box 4, minus any non-taxable amounts.

- Verify and Sign

Once you have completed the form, verify the information for accuracy. Sign and date the form, as required.

Common Errors to Avoid

- Inaccurate or incomplete recipient information

- Incorrect reporting of benefits paid or tax withheld

- Failure to sign and date the form

- Not reporting state income tax withheld (if applicable)

Tips for Filing Your Tax Return

- Use the RRB 1099-R form to report your railroad retirement benefits on your tax return (Form 1040).

- Ensure you report the correct amount of benefits paid and tax withheld.

- If you have any questions or concerns, consult with a tax professional or contact the RRB.

Conclusion and Next Steps

Filling out the RRB 1099-R form correctly is crucial for accurate tax reporting and to avoid any potential delays or errors. By following these 5 steps and avoiding common errors, you can ensure a smooth tax filing process. If you have any questions or concerns, don't hesitate to reach out to the RRB or a tax professional for guidance.

FAQs

What is the RRB 1099-R form used for?

+The RRB 1099-R form is used to report railroad retirement benefits paid to recipients in a given tax year.

What information do I need to fill out the RRB 1099-R form?

+You will need your Social Security number or Railroad Retirement account number, the amount of benefits paid to you in the tax year, and the amount of federal and state income tax withheld from your benefits (if applicable).

How do I report my railroad retirement benefits on my tax return?

+Use the RRB 1099-R form to report your railroad retirement benefits on your tax return (Form 1040). Ensure you report the correct amount of benefits paid and tax withheld.