If you're a resident of Ohio, you're likely familiar with the RITA Form 37, also known as the Municipal Income Tax Return. Filing your taxes can be a daunting task, but with the right guidance, it can be a breeze. In this article, we'll break down the RITA Form 37 filing instructions into easy-to-follow steps, ensuring you're well on your way to completing your tax return with confidence.

The importance of accurate tax filing cannot be overstated. Not only does it help you avoid penalties and fines, but it also ensures you're taking advantage of the tax credits and deductions you're eligible for. As a resident of Ohio, it's essential to understand the specific requirements for filing your municipal income tax return. So, let's dive in and explore the RITA Form 37 filing instructions in detail.

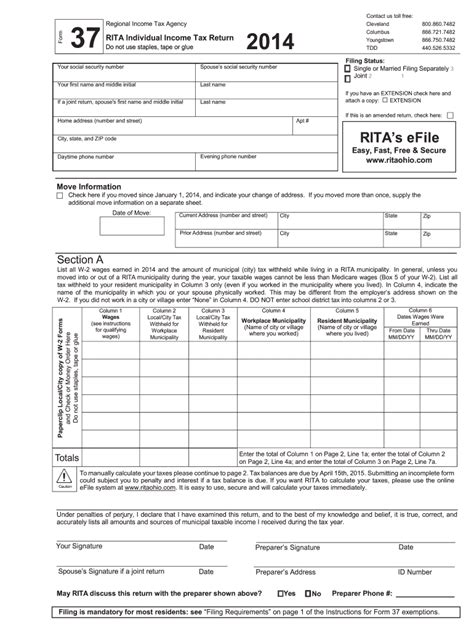

Understanding the RITA Form 37

The RITA Form 37 is a tax return form used by residents of Ohio to report their municipal income tax. The form is used to calculate the amount of tax owed to the municipality where you live and work. It's essential to understand the different sections of the form and what information is required to complete it accurately.

Gathering Required Documents

Before you start filling out the RITA Form 37, make sure you have all the necessary documents. These may include:

- Your W-2 forms from your employer(s)

- Your 1099 forms for any freelance or contract work

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's social security number or ITIN (if applicable)

- Your dependents' social security numbers or ITINs (if applicable)

- Any tax deductions or credits you're eligible for

Filing Status and Exemptions

When filling out the RITA Form 37, you'll need to select your filing status and claim any exemptions you're eligible for. Your filing status will determine the tax rates and credits you're eligible for. You can choose from the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

You may also be eligible for exemptions, such as the dependent exemption or the blind exemption. Make sure to review the eligibility criteria carefully to ensure you're taking advantage of all the exemptions you're eligible for.

Reporting Income

One of the most critical sections of the RITA Form 37 is the income section. You'll need to report all your income from various sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains

- Rents and royalties

Make sure to report all your income accurately, as underreporting your income can result in penalties and fines.

Claiming Deductions and Credits

The RITA Form 37 allows you to claim various deductions and credits to reduce your tax liability. Some common deductions and credits include:

- Standard deduction

- Itemized deductions

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

Make sure to review the eligibility criteria for each deduction and credit carefully to ensure you're taking advantage of all the tax savings available to you.

Filing and Payment Options

Once you've completed the RITA Form 37, you can file it electronically or by mail. The filing deadline is typically April 15th, but it's essential to check the RITA website for any changes to the filing deadline.

You can pay your tax bill online, by phone, or by mail. Make sure to keep a record of your payment, as you may need to refer to it later.

Amended Returns

If you need to make changes to your original return, you can file an amended return using the RITA Form 37X. This form is used to correct errors or report changes to your income, deductions, or credits.

Conclusion

Filing your RITA Form 37 doesn't have to be a daunting task. By following the steps outlined in this article, you'll be well on your way to completing your tax return with confidence. Remember to gather all the necessary documents, select the correct filing status and exemptions, report your income accurately, claim deductions and credits, and file your return on time.

We hope this article has provided you with a comprehensive guide to filing your RITA Form 37. If you have any further questions or concerns, please don't hesitate to reach out to the RITA customer support team.

What's Next?

Now that you've completed your RITA Form 37, it's essential to stay organized and keep track of your tax documents. Consider using a tax preparation software or consulting with a tax professional to ensure you're taking advantage of all the tax savings available to you.

FAQs

What is the deadline for filing the RITA Form 37?

+The filing deadline for the RITA Form 37 is typically April 15th, but it's essential to check the RITA website for any changes to the filing deadline.

Can I file my RITA Form 37 electronically?

+What is the penalty for late filing of the RITA Form 37?

+The penalty for late filing of the RITA Form 37 is typically 10% of the unpaid tax, plus interest and penalties.