In today's fast-paced business world, managing tax compliance can be a daunting task. As a responsible taxpayer, it's essential to stay on top of your obligations to avoid penalties and ensure smooth operations. One crucial aspect of tax compliance is filling out the necessary forms, such as the Fillable Rita Form 17.

What is Rita Form 17?

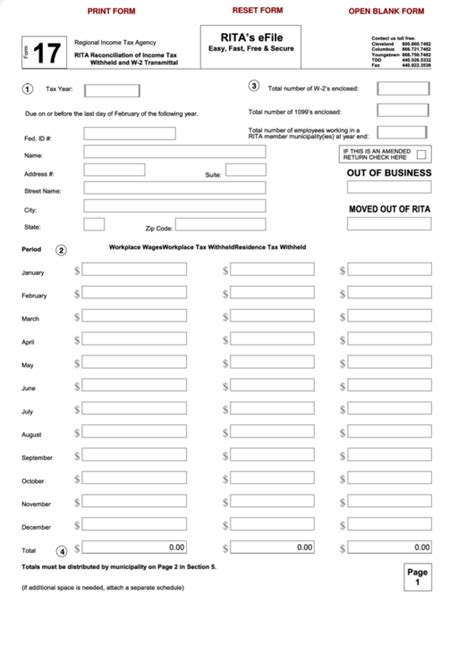

Rita Form 17 is a tax form used by the Regional Income Tax Agency (RITA) to report income tax withholding and payments made by employers on behalf of their employees. The form is used to reconcile the amounts withheld and paid throughout the year, ensuring accuracy and compliance with tax regulations.

Importance of Filling Out Rita Form 17

Filling out Rita Form 17 accurately and on time is crucial for several reasons:

- Avoid penalties: Failure to file or inaccuracies in the form can lead to penalties and fines, which can be costly and time-consuming to resolve.

- Ensure compliance: Completing the form demonstrates your commitment to tax compliance, reducing the risk of audits and other tax-related issues.

- Streamline tax processing: By providing accurate information, you can ensure that your tax obligations are processed efficiently, minimizing delays and errors.

Easy Download and Instructions

To make the process easier, we've provided a fillable version of Rita Form 17 that you can download and complete at your convenience.

Downloading the Form

You can download the fillable Rita Form 17 from our website by following these steps:

- Click on the "Download" button below.

- Save the form to your computer or mobile device.

- Open the form using a compatible software or app, such as Adobe Acrobat.

Filling Out the Form

To ensure accuracy and completeness, follow these steps to fill out the form:

- Section 1: Employer Information: Provide your employer identification number, name, and address.

- Section 2: Employee Information: List the names, addresses, and Social Security numbers of all employees who had income tax withheld.

- Section 3: Withholding and Payments: Report the total amount of income tax withheld and paid for each employee.

- Section 4: Reconciliation: Reconcile the total amount of income tax withheld and paid with the amount reported in Section 3.

Tips and Reminders

- Use black ink: When completing the form by hand, use black ink to ensure legibility.

- Keep records: Maintain accurate records of all withholding and payments, including cancelled checks and payment receipts.

- Submit on time: File the form by the deadline to avoid penalties and fines.

Common Mistakes to Avoid

When filling out Rita Form 17, it's essential to avoid common mistakes that can lead to delays, penalties, or even audits. Here are some mistakes to watch out for:

- Inaccurate or incomplete information: Ensure that all information is accurate and complete, including employee names, addresses, and Social Security numbers.

- Math errors: Double-check calculations to avoid errors in reporting withholding and payments.

- Late filing: Submit the form by the deadline to avoid penalties and fines.

Conclusion

Filling out Rita Form 17 is a crucial aspect of tax compliance, and accuracy is essential to avoid penalties and ensure smooth operations. By downloading the fillable form and following the instructions, you can ensure that your tax obligations are processed efficiently and minimize the risk of errors or audits.

If you have any questions or concerns about filling out Rita Form 17, don't hesitate to reach out to our team of tax experts. We're here to help you navigate the process and ensure compliance with tax regulations.

Share Your Experience

Have you filled out Rita Form 17 before? Share your experience and tips in the comments below. Your feedback can help others navigate the process and ensure compliance with tax regulations.

What is Rita Form 17 used for?

+Rita Form 17 is used to report income tax withholding and payments made by employers on behalf of their employees.

How do I download the fillable Rita Form 17?

+You can download the fillable Rita Form 17 from our website by clicking on the "Download" button and saving the form to your computer or mobile device.

What are the common mistakes to avoid when filling out Rita Form 17?

+Common mistakes to avoid include inaccurate or incomplete information, math errors, and late filing.