Renouncing executorship in New Jersey can be a complex and delicate process, especially when it involves navigating the intricacies of probate law. As an executor, you have been entrusted with the responsibility of managing the estate of a deceased loved one, ensuring that their wishes are respected, and their assets are distributed according to their will. However, circumstances may arise where you feel unable or unwilling to continue in this role. If you're contemplating renouncing your position as an executor in New Jersey, it's essential to understand the steps involved and the potential implications.

Step 1: Understand Your Role and Responsibilities

Before renouncing your position, it's crucial to have a clear understanding of your role and responsibilities as an executor. In New Jersey, an executor is responsible for managing the estate, paying debts, and distributing assets according to the will. This includes tasks such as:

- Filing the will with the Surrogate's Court

- Obtaining letters testamentary

- Identifying and valuing assets

- Paying debts and taxes

- Distributing assets to beneficiaries

Understanding the Consequences of Renunciation

Renouncing your position as an executor can have significant consequences, including:

- Delaying the administration of the estate

- Increasing costs and fees

- Potentially disrupting the distribution of assets

It's essential to consider these consequences carefully before making a decision.

Step 2: Review the Will and Estate Documents

Reviewing the will and estate documents is crucial in understanding the deceased's wishes and the potential implications of renouncing your position. This includes:

- Reviewing the will and any codicils

- Examining the estate's assets and liabilities

- Identifying potential beneficiaries and their interests

Identifying Alternative Executors

If you're considering renouncing your position, it's essential to identify potential alternative executors who can take over the administration of the estate. This may include:

- Co-executors named in the will

- Alternate executors named in the will

- Beneficiaries or other interested parties

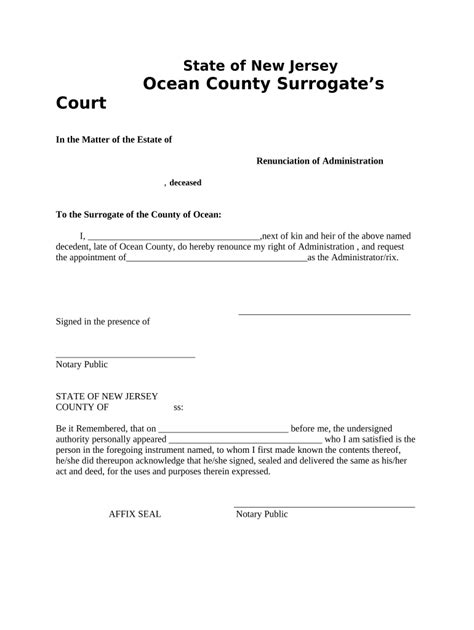

Step 3: Prepare a Renunciation Document

To renounce your position as an executor, you'll need to prepare a formal document stating your intention to resign. This document should include:

- Your name and address

- The name and address of the deceased

- The name and address of the Surrogate's Court

- A statement of your intention to renounce your position as executor

- The effective date of your renunciation

Filing the Renunciation Document

Once you've prepared the renunciation document, you'll need to file it with the Surrogate's Court. This typically involves:

- Filing the document with the court

- Serving notice on interested parties, such as beneficiaries and co-executors

- Paying any required filing fees

Step 4: Notify Interested Parties

After filing the renunciation document, you'll need to notify interested parties, including:

- Beneficiaries

- Co-executors

- Alternate executors

- Other parties with an interest in the estate

Providing Notice of Renunciation

Providing notice of your renunciation is essential to ensure that interested parties are aware of the change in executorship. This may involve:

- Serving notice personally or by mail

- Filing proof of service with the court

Step 5: Seek Court Approval

Finally, you'll need to seek court approval for your renunciation. This typically involves:

- Filing a petition with the Surrogate's Court

- Serving notice on interested parties

- Attending a hearing to confirm your renunciation

Finalizing the Renunciation Process

Once the court has approved your renunciation, you'll be formally released from your duties as executor. This may involve:

- Filing a final accounting with the court

- Distributing any remaining assets

- Closing the estate

Renouncing your position as an executor in New Jersey requires careful consideration and adherence to the steps outlined above. It's essential to seek the advice of an experienced attorney to ensure that the process is handled correctly and efficiently.

What do you think about the process of renouncing executorship in New Jersey? Share your thoughts and experiences in the comments below.

What is the role of an executor in New Jersey?

+An executor in New Jersey is responsible for managing the estate, paying debts, and distributing assets according to the will.

What are the consequences of renouncing executorship in New Jersey?

+Renouncing executorship in New Jersey can delay the administration of the estate, increase costs and fees, and potentially disrupt the distribution of assets.

How do I prepare a renunciation document in New Jersey?

+To prepare a renunciation document in New Jersey, you'll need to include your name and address, the name and address of the deceased, the name and address of the Surrogate's Court, a statement of your intention to renounce your position as executor, and the effective date of your renunciation.