Releasing earnest money can be a complex process, especially when dealing with the Texas Real Estate Commission (TREC) form. In Texas, earnest money is a deposit made by a buyer to demonstrate their commitment to purchasing a property. The TREC form is a standardized document used to facilitate the release of earnest money in various scenarios. In this article, we will explore five ways to release earnest money with the TREC form.

Understanding the TREC Form

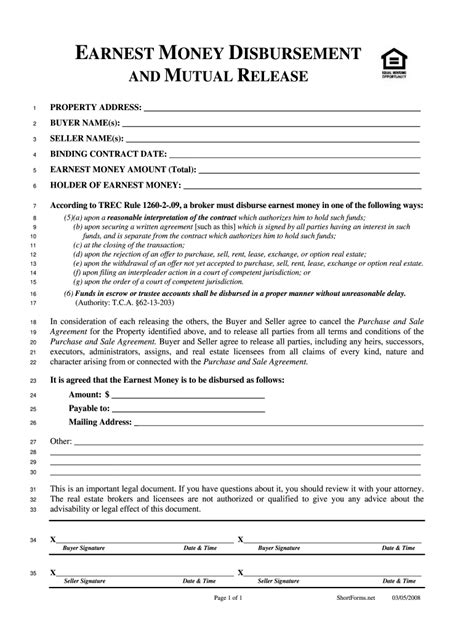

Before we dive into the five ways to release earnest money, it's essential to understand the TREC form. The TREC form is a contractual agreement between the buyer and seller that outlines the terms of the earnest money deposit. The form specifies the amount of earnest money, the parties involved, and the conditions under which the earnest money can be released.

Key Components of the TREC Form

The TREC form typically includes the following key components:

- Earnest money amount

- Buyer and seller information

- Property description

- Release conditions

- Signatures of the buyer and seller

1. Mutual Agreement

One way to release earnest money with the TREC form is through mutual agreement between the buyer and seller. This occurs when both parties agree to release the earnest money, usually due to a change in circumstances or a failure to meet contract conditions.

- Step 1: Negotiate the release terms

- Step 2: Complete the TREC form with the agreed-upon release terms

- Step 3: Obtain signatures from both the buyer and seller

2. Contract Termination

Another way to release earnest money is through contract termination. This occurs when the buyer or seller terminates the contract due to a failure to meet contract conditions or other unforeseen circumstances.

- Step 1: Review the contract terms

- Step 2: Identify the termination clause

- Step 3: Complete the TREC form with the termination details

- Step 4: Obtain signatures from both the buyer and seller

3. Inspection Objections

Earnest money can also be released due to inspection objections. This occurs when the buyer discovers issues with the property during the inspection period and decides to terminate the contract.

- Step 1: Conduct a property inspection

- Step 2: Identify inspection objections

- Step 3: Complete the TREC form with the inspection objections

- Step 4: Obtain signatures from both the buyer and seller

4. Financing Contingency

The financing contingency is another way to release earnest money. This occurs when the buyer fails to secure financing for the property.

- Step 1: Review the financing contingency clause

- Step 2: Determine the financing status

- Step 3: Complete the TREC form with the financing details

- Step 4: Obtain signatures from both the buyer and seller

5. Mediation and Arbitration

Finally, earnest money can be released through mediation and arbitration. This occurs when the buyer and seller disagree on the release terms and require a third-party mediator or arbitrator to resolve the dispute.

- Step 1: Review the mediation and arbitration clause

- Step 2: Engage a mediator or arbitrator

- Step 3: Complete the TREC form with the mediation and arbitration details

- Step 4: Obtain signatures from both the buyer and seller

Conclusion

Releasing earnest money with the TREC form requires careful consideration and attention to detail. By understanding the five ways to release earnest money, buyers and sellers can navigate the process with confidence. Remember to review the contract terms, complete the TREC form accurately, and obtain signatures from both parties to ensure a smooth release of earnest money.

What is the purpose of the TREC form?

+The TREC form is a contractual agreement between the buyer and seller that outlines the terms of the earnest money deposit.

Can earnest money be released without the TREC form?

+No, the TREC form is required to release earnest money in Texas.

What are the key components of the TREC form?

+The TREC form typically includes the earnest money amount, buyer and seller information, property description, release conditions, and signatures of the buyer and seller.