Understanding the RD 108 Form in Michigan

In the state of Michigan, the RD 108 form is a crucial document used in real estate transactions. This form, also known as the "Real Estate Transfer Tax Valuation Affidavit," plays a significant role in the transfer of ownership of real property. In this article, we will delve into the details of the RD 108 form, its purpose, and the information required to complete it.

What is the RD 108 Form?

The RD 108 form is a standardized document required by the State of Michigan to facilitate the transfer of real property. The form is used to collect information about the property being transferred, including its value, location, and type of transfer. This information is essential for determining the amount of transfer tax due on the property.

Purpose of the RD 108 Form

The primary purpose of the RD 108 form is to provide the State of Michigan with the necessary information to calculate the transfer tax on real estate transactions. The form is used to:

- Determine the value of the property being transferred

- Calculate the transfer tax due on the property

- Verify the type of transfer (e.g., sale, gift, or inheritance)

- Ensure compliance with Michigan's real estate transfer tax laws

Who Needs to Complete the RD 108 Form?

The RD 108 form is typically completed by the buyer or seller of real property in Michigan. In most cases, the form is completed by the seller, but in some situations, the buyer may be required to complete the form. It is essential to note that the form must be completed and submitted to the local county register of deeds office within 30 days of the transfer.

Exemptions from Completing the RD 108 Form

There are certain situations where the RD 108 form is not required. These exemptions include:

- Transfers between spouses or former spouses

- Transfers to or from a trust

- Transfers of property with a value of $100 or less

- Transfers of property that are exempt from transfer tax under Michigan law

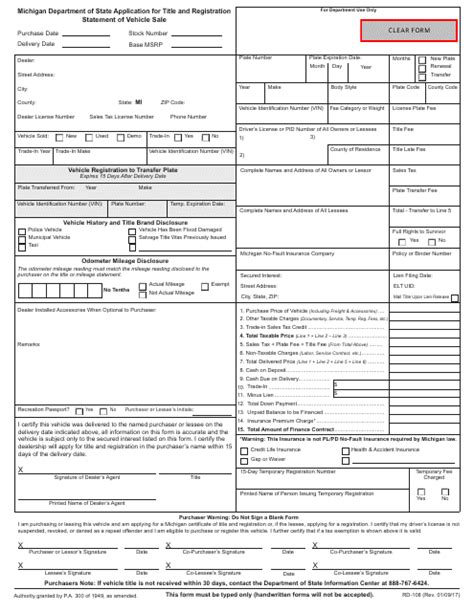

How to Complete the RD 108 Form

Completing the RD 108 form requires careful attention to detail and accuracy. The form consists of several sections, including:

- Section 1: Property Information

- Section 2: Transfer Information

- Section 3: Valuation Information

- Section 4: Exemption Information (if applicable)

It is essential to ensure that all required information is provided, and the form is signed and dated by the seller or buyer.

Tips for Completing the RD 108 Form

- Use black ink to complete the form

- Ensure all information is accurate and complete

- Attach any required supporting documentation (e.g., deed, title report)

- Sign and date the form

- Submit the form to the local county register of deeds office within 30 days of the transfer

Penalties for Non-Compliance

Failure to complete and submit the RD 108 form can result in penalties and fines. These penalties can include:

- Late filing fees

- Interest on unpaid transfer tax

- Civil penalties for non-compliance

It is essential to ensure that the form is completed accurately and submitted on time to avoid these penalties.

Conclusion

The RD 108 form is a critical document in Michigan real estate transactions. Understanding the purpose, requirements, and completion process of the form is essential for buyers and sellers. By following the guidelines outlined in this article, individuals can ensure compliance with Michigan's real estate transfer tax laws and avoid penalties for non-compliance.

What is the purpose of the RD 108 form?

+The RD 108 form is used to collect information about the property being transferred, including its value, location, and type of transfer, to determine the amount of transfer tax due on the property.

Who needs to complete the RD 108 form?

+The RD 108 form is typically completed by the buyer or seller of real property in Michigan. In most cases, the form is completed by the seller, but in some situations, the buyer may be required to complete the form.

What are the penalties for non-compliance with the RD 108 form?

+Failure to complete and submit the RD 108 form can result in penalties and fines, including late filing fees, interest on unpaid transfer tax, and civil penalties for non-compliance.