As a business owner, managing finances and ensuring smooth transactions is crucial for the success of your company. One of the ways to achieve this is by using QuickBooks, a popular accounting software that helps you keep track of your financial records. However, when it comes to processing electronic checks, also known as eChecks, you may need to obtain authorization from your customers or clients. This is where the QuickBooks eCheck authorization form comes in.

In this article, we will provide a step-by-step guide on how to use the QuickBooks eCheck authorization form, including its importance, benefits, and how to fill it out. We will also discuss the requirements for obtaining eCheck authorization and how to maintain compliance with relevant regulations.

What is an eCheck Authorization Form?

An eCheck authorization form is a document that allows a business to debit a customer's checking account electronically. This form is used to obtain permission from the customer to process eCheck transactions, which are similar to traditional paper checks but are processed electronically. The eCheck authorization form typically includes the customer's name, address, bank account information, and authorization to debit the account.

Why is an eCheck Authorization Form Important?

The eCheck authorization form is important because it provides proof of authorization for eCheck transactions. Without this form, a business may not be able to process eCheck transactions, and may be liable for any disputes or chargebacks that arise.

Benefits of Using an eCheck Authorization Form

Using an eCheck authorization form provides several benefits, including:

- Reduced risk of disputes and chargebacks

- Increased security and compliance with regulations

- Simplified payment processing and reduced administrative burdens

- Improved customer relationships and trust

How to Fill Out an eCheck Authorization Form

To fill out an eCheck authorization form, you will need to provide the following information:

- Customer name and address

- Bank account information, including routing number and account number

- Type of account (checking or savings)

- Authorization to debit the account

- Signature and date

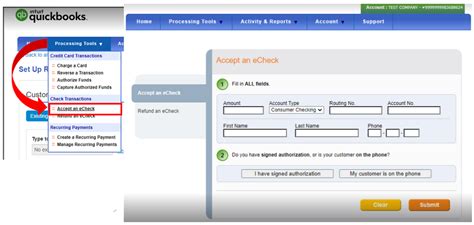

Here is a step-by-step guide to filling out an eCheck authorization form:

- Customer Information: Provide the customer's name and address.

- Bank Account Information: Provide the customer's bank account information, including routing number and account number.

- Type of Account: Specify the type of account (checking or savings).

- Authorization: Include a statement authorizing the business to debit the account.

- Signature and Date: Obtain the customer's signature and date.

Requirements for Obtaining eCheck Authorization

To obtain eCheck authorization, you will need to meet the following requirements:

- The customer must provide their bank account information and authorization to debit the account.

- The authorization must be in writing and signed by the customer.

- The authorization must include the customer's name, address, and bank account information.

- The authorization must specify the type of account (checking or savings).

- The authorization must include a statement authorizing the business to debit the account.

Compliance with Regulations

When obtaining eCheck authorization, it is essential to comply with relevant regulations, including:

- The Electronic Fund Transfer Act (EFTA)

- The Uniform Commercial Code (UCC)

- The Payment Card Industry Data Security Standard (PCI DSS)

These regulations require businesses to obtain explicit authorization from customers before processing eCheck transactions and to maintain secure and confidential records of customer information.

Best Practices for Maintaining eCheck Authorization

To maintain eCheck authorization, follow these best practices:

- Obtain explicit authorization from customers before processing eCheck transactions.

- Maintain secure and confidential records of customer information.

- Use secure payment processing systems and protocols.

- Monitor and reconcile eCheck transactions regularly.

- Provide clear and transparent information to customers about eCheck transactions.

By following these best practices, you can ensure that your business maintains compliance with relevant regulations and provides a secure and transparent payment processing experience for your customers.

Conclusion

In conclusion, the QuickBooks eCheck authorization form is an essential tool for businesses that process electronic checks. By understanding the importance and benefits of using an eCheck authorization form, and by following the steps outlined in this guide, you can ensure that your business maintains compliance with relevant regulations and provides a secure and transparent payment processing experience for your customers.

What is an eCheck authorization form?

+An eCheck authorization form is a document that allows a business to debit a customer's checking account electronically.

Why is an eCheck authorization form important?

+The eCheck authorization form is important because it provides proof of authorization for eCheck transactions and reduces the risk of disputes and chargebacks.

How do I fill out an eCheck authorization form?

+To fill out an eCheck authorization form, provide the customer's name and address, bank account information, type of account, authorization to debit the account, and signature and date.