Understanding the QuickBooks ACH Form: A Comprehensive Guide

The QuickBooks ACH (Automated Clearing House) form is a crucial document for businesses that use QuickBooks for their accounting needs. It allows companies to authorize electronic funds transfers (EFTs) for payroll, vendor payments, and other transactions. Filling out the QuickBooks ACH form accurately is essential to avoid any delays or issues with your transactions. In this article, we will explore the five ways to fill out the QuickBooks ACH form, ensuring you have a seamless experience with your electronic payments.

What is the QuickBooks ACH Form?

The QuickBooks ACH form is a document that authorizes Intuit, the company behind QuickBooks, to initiate electronic funds transfers on your behalf. This form is typically required for businesses that want to use QuickBooks' payroll or payment features. The form includes essential information such as your company's name, address, bank account details, and the type of transactions you want to authorize.

Benefits of Using the QuickBooks ACH Form

Using the QuickBooks ACH form offers several benefits, including:

- Convenience: Electronic funds transfers are faster and more convenient than traditional paper checks.

- Cost-effective: ACH transactions often have lower fees compared to credit card transactions or wire transfers.

- Increased security: ACH transactions are considered more secure than paper checks, as they are less prone to tampering and theft.

- Improved accuracy: ACH transactions reduce the risk of human error, as the transaction details are automatically generated by QuickBooks.

5 Ways to Fill Out the QuickBooks ACH Form

Now that we have discussed the importance of the QuickBooks ACH form, let's explore the five ways to fill it out accurately:

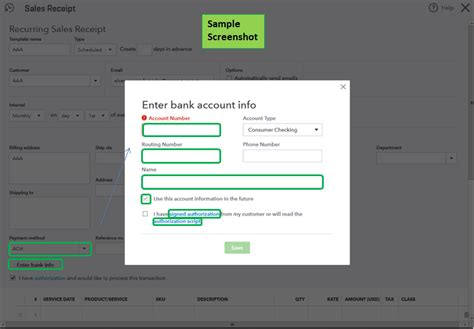

1. Manual Entry

You can fill out the QuickBooks ACH form manually by typing in the required information. This method is suitable for small businesses with simple payment needs. However, it may be more prone to human error, and you will need to ensure that you have the correct bank account details and authorization.

2. Importing Bank Account Information

QuickBooks allows you to import your bank account information directly from your financial institution. This method is more accurate and convenient, as it eliminates the need for manual entry. To import your bank account information, follow these steps:

- Go to the QuickBooks dashboard and click on the "Banking" tab.

- Select "Add Account" and choose your financial institution from the list.

- Follow the prompts to connect your bank account to QuickBooks.

3. Using a Template

QuickBooks provides a pre-built template for the ACH form that you can use to fill out the required information. This template is available in the QuickBooks dashboard, under the "Payroll" or "Payments" tab. Using a template can help ensure that you have all the necessary information and reduce the risk of errors.

4. Outsourcing to a Third-Party Service Provider

If you are not comfortable filling out the QuickBooks ACH form yourself, you can outsource the task to a third-party service provider. This method is suitable for large businesses or those with complex payment needs. Third-party service providers can help you fill out the form accurately and ensure compliance with regulatory requirements.

5. Using an Integrated Payment Solution

QuickBooks integrates with various payment solutions, such as payment gateways and merchant accounts. These solutions can help you fill out the ACH form accurately and streamline your payment process. Integrated payment solutions can also provide additional features, such as payment tracking and reconciliation.

Tips for Filling Out the QuickBooks ACH Form

To ensure that you fill out the QuickBooks ACH form accurately, follow these tips:

- Verify your bank account details: Double-check your bank account information to ensure it is accurate and up-to-date.

- Use the correct routing number: Make sure you use the correct routing number for your financial institution.

- Authorize the correct transactions: Ensure that you authorize the correct types of transactions, such as payroll or vendor payments.

- Keep a record: Keep a record of your completed ACH form for future reference and audit purposes.

Conclusion

Filling out the QuickBooks ACH form accurately is crucial for businesses that want to use electronic funds transfers. By following the five ways to fill out the form outlined in this article, you can ensure that your transactions are processed smoothly and efficiently. Remember to verify your bank account details, use the correct routing number, authorize the correct transactions, and keep a record of your completed form.

By implementing these tips and best practices, you can streamline your payment process and improve your overall accounting efficiency. If you have any further questions or concerns about filling out the QuickBooks ACH form, please don't hesitate to reach out to our support team.

We'd love to hear from you!

If you found this article helpful, please share your thoughts and feedback in the comments section below. Have you encountered any issues while filling out the QuickBooks ACH form? How did you resolve them? Your input will help us improve our content and provide better support to our readers.

Share this article:

If you think this article would be helpful to your colleagues or business associates, please share it with them. You can also share it on your social media platforms to help others benefit from this information.

What is the QuickBooks ACH form used for?

+The QuickBooks ACH form is used to authorize electronic funds transfers for payroll, vendor payments, and other transactions.

How do I fill out the QuickBooks ACH form manually?

+To fill out the QuickBooks ACH form manually, you will need to type in the required information, including your company's name, address, bank account details, and the type of transactions you want to authorize.

What are the benefits of using the QuickBooks ACH form?

+Using the QuickBooks ACH form offers several benefits, including convenience, cost-effectiveness, increased security, and improved accuracy.