In today's fast-paced business world, loans and financial agreements are an integral part of many transactions. Whether you're a business owner, investor, or individual, having a clear and legally binding agreement is essential to protect your interests. This is where a promissory note comes in - a written promise to repay a debt, usually with interest. To help you navigate this process, we'll explore the concept of promissory notes and provide you with 5 free printable promissory note templates.

What is a Promissory Note?

A promissory note is a type of financial instrument that outlines the terms of a loan or debt agreement. It's a binding contract between the borrower (the person or entity receiving the loan) and the lender (the person or entity providing the loan). The note specifies the amount borrowed, interest rate, repayment terms, and any other conditions or obligations.

Key Components of a Promissory Note

A typical promissory note includes the following essential elements:

- Amount borrowed: The total amount of money lent to the borrower.

- Interest rate: The percentage rate at which interest is charged on the loan.

- Repayment terms: The schedule for repaying the loan, including the number of payments, payment frequency, and due dates.

- Collateral: Any assets or property used to secure the loan.

- Default provisions: The consequences of failing to meet the repayment terms, such as late fees or penalties.

Benefits of Using a Promissory Note

Using a promissory note offers several advantages:

- Clear understanding: A promissory note ensures that both parties have a clear understanding of the loan terms, reducing the risk of miscommunication or disputes.

- Legally binding: A signed promissory note is a legally binding contract, providing a level of security for the lender and protecting the borrower's rights.

- Flexibility: Promissory notes can be customized to suit specific business or personal needs, allowing for flexibility in loan terms and conditions.

5 Free Printable Promissory Note Templates

To help you create a professional and effective promissory note, we've compiled 5 free printable templates:

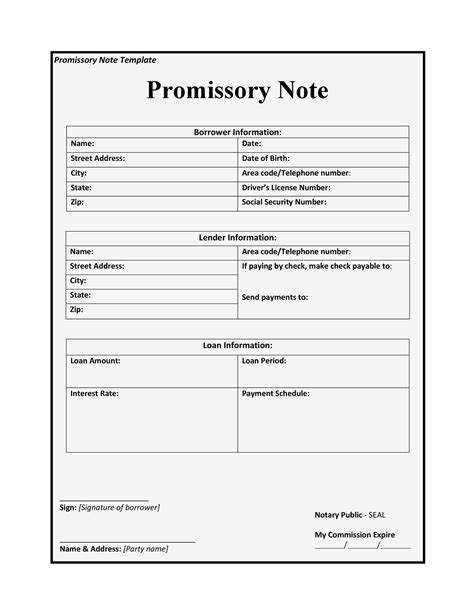

Template 1: Simple Promissory Note

This basic template includes the essential elements of a promissory note, making it perfect for simple loan agreements.

- Download:

Template 2: Secured Promissory Note

This template is designed for loans that involve collateral or security, providing added protection for the lender.

- Download:

Template 3: Unsecured Promissory Note

This template is suitable for loans without collateral, relying on the borrower's creditworthiness and reputation.

- Download:

Template 4: Installment Promissory Note

This template is designed for loans with fixed installment payments, making it ideal for business or personal loans with regular repayments.

- Download:

Template 5: Balloon Promissory Note

This template is suitable for loans with a larger final payment (balloon payment), often used for commercial or real estate loans.

- Download:

Conclusion

Using a promissory note is an effective way to establish a clear and legally binding agreement between lenders and borrowers. By downloading and customizing one of our 5 free printable promissory note templates, you'll be able to create a professional and effective document that protects your interests and facilitates smooth transactions.

What is the purpose of a promissory note?

+A promissory note is a written promise to repay a debt, outlining the terms of a loan or debt agreement between the borrower and lender.

What are the key components of a promissory note?

+A typical promissory note includes the amount borrowed, interest rate, repayment terms, collateral, and default provisions.

What are the benefits of using a promissory note?

+Using a promissory note provides a clear understanding of the loan terms, is legally binding, and offers flexibility in loan terms and conditions.