Petty cash reconciliation is an essential process for any business that uses a petty cash fund to manage small expenses. It helps to ensure that the cash held in the fund is accurately accounted for and that any discrepancies are identified and rectified. However, the process can be time-consuming and prone to errors if not managed properly. In this article, we will discuss five ways to simplify petty cash reconciliation using a printable form.

The Importance of Petty Cash Reconciliation

Petty cash reconciliation is crucial for maintaining the accuracy and integrity of a company's financial records. It helps to prevent errors, misappropriation of funds, and potential losses. By regularly reconciling the petty cash fund, businesses can ensure that their financial statements are accurate and up-to-date.

What is Petty Cash Reconciliation?

Petty cash reconciliation is the process of comparing the actual cash held in the petty cash fund with the amount recorded in the company's financial records. This process involves verifying the cash held in the fund, identifying any discrepancies, and making adjustments as necessary.

5 Ways to Simplify Petty Cash Reconciliation with a Printable Form

- Create a Standardized Petty Cash Form

A standardized petty cash form can help to simplify the reconciliation process by providing a clear and consistent format for recording transactions. The form should include columns for the date, description, amount, and running balance. This will help to ensure that all transactions are accurately recorded and easily reconciled.

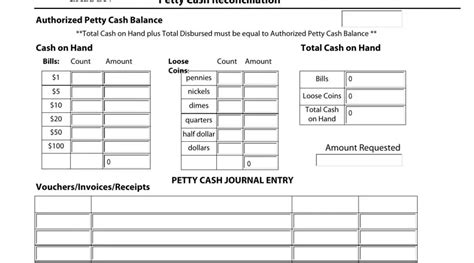

- Use a Petty Cash Reconciliation Template

A petty cash reconciliation template can help to streamline the reconciliation process by providing a pre-formatted template that can be completed quickly and easily. The template should include space for the date, cash balance, and any discrepancies or adjustments.

- Implement a Regular Reconciliation Schedule

Regular reconciliation of the petty cash fund can help to identify any discrepancies or errors early on. This can be done on a daily, weekly, or monthly basis, depending on the size of the fund and the frequency of transactions.

Benefits of Regular Reconciliation

Regular reconciliation of the petty cash fund can help to:

- Identify errors or discrepancies early on

- Prevent misappropriation of funds

- Ensure accurate financial records

- Reduce the risk of financial losses

- Use a Petty Cash Tracker

A petty cash tracker can help to simplify the reconciliation process by providing a clear and concise record of all transactions. The tracker should include columns for the date, description, amount, and running balance.

- ** Automate Petty Cash Reconciliation**

Automating petty cash reconciliation can help to simplify the process by reducing the need for manual calculations and record-keeping. This can be done using accounting software or a spreadsheet program.

Benefits of Automation

Automating petty cash reconciliation can help to:

- Reduce errors and discrepancies

- Save time and increase efficiency

- Improve accuracy and reliability

- Enhance financial reporting and analysis

Conclusion

Petty cash reconciliation is an essential process for any business that uses a petty cash fund. By simplifying the process using a printable form, businesses can reduce errors, increase efficiency, and improve financial reporting and analysis. By implementing a standardized petty cash form, using a petty cash reconciliation template, implementing a regular reconciliation schedule, using a petty cash tracker, and automating petty cash reconciliation, businesses can ensure that their financial records are accurate and up-to-date.

Take Action

Start simplifying your petty cash reconciliation process today by downloading a printable petty cash form or template. Implement a regular reconciliation schedule and consider automating the process using accounting software or a spreadsheet program.

FAQs

What is petty cash reconciliation?

+Petty cash reconciliation is the process of comparing the actual cash held in the petty cash fund with the amount recorded in the company's financial records.

Why is petty cash reconciliation important?

+Petty cash reconciliation is important because it helps to prevent errors, misappropriation of funds, and potential losses. It also ensures that the company's financial records are accurate and up-to-date.

How often should petty cash reconciliation be performed?

+Petty cash reconciliation should be performed regularly, depending on the size of the fund and the frequency of transactions. This can be done on a daily, weekly, or monthly basis.