As a US citizen or resident alien, you may be aware of the importance of filing Form 8840, also known as the "Initial and Annual Statement of Foreign Financial Assets" or "Statement of Specified Foreign Financial Assets." This form is used to report certain foreign financial assets to the Internal Revenue Service (IRS). In this article, we will explore five ways to complete Form 8840, as well as provide guidance on the benefits, working mechanisms, and steps involved in the process.

Understanding Form 8840

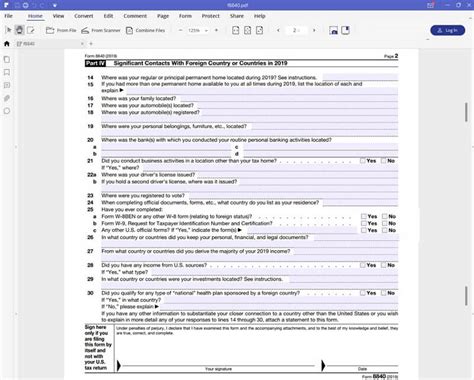

Form 8840 is a critical document that helps the IRS track foreign financial assets held by US citizens and resident aliens. The form is used to report various types of foreign financial assets, including:

- Foreign bank accounts

- Foreign securities

- Foreign real estate

- Foreign business interests

- Other foreign financial assets

The form is typically filed with the IRS by the deadline for filing Form 1040, which is usually April 15th of each year.

Benefits of Filing Form 8840

Filing Form 8840 provides several benefits, including:

- Avoiding penalties and fines for failing to report foreign financial assets

- Demonstrating compliance with US tax laws and regulations

- Reducing the risk of audit and examination by the IRS

- Providing transparency and disclosure of foreign financial assets

Method 1: Filing Form 8840 Electronically

One way to complete Form 8840 is by filing it electronically through the IRS website. This method is convenient and efficient, as it allows you to submit the form quickly and easily.

To file Form 8840 electronically, you will need to:

- Create an account on the IRS website

- Fill out the form online

- Submit the form electronically

- Receive confirmation of receipt from the IRS

Method 1 Benefits

Filing Form 8840 electronically provides several benefits, including:

- Faster processing and receipt of confirmation

- Reduced risk of errors and mistakes

- Increased security and confidentiality

- Environmentally friendly and paperless

Method 2: Filing Form 8840 by Mail

Another way to complete Form 8840 is by filing it by mail. This method is suitable for those who prefer to submit the form in paper format or do not have access to electronic filing.

To file Form 8840 by mail, you will need to:

- Download and print the form from the IRS website

- Fill out the form manually

- Sign and date the form

- Mail the form to the IRS address listed on the form

Method 2 Benefits

Filing Form 8840 by mail provides several benefits, including:

- Ability to review and verify the form before submission

- Ability to keep a paper copy of the form for records

- Suitable for those without access to electronic filing

Method 3: Filing Form 8840 through a Tax Professional

A third way to complete Form 8840 is by filing it through a tax professional. This method is suitable for those who require assistance with the form or have complex foreign financial assets.

To file Form 8840 through a tax professional, you will need to:

- Consult with a tax professional who is familiar with Form 8840

- Provide the necessary documentation and information

- Allow the tax professional to prepare and submit the form

Method 3 Benefits

Filing Form 8840 through a tax professional provides several benefits, including:

- Expertise and guidance on complex foreign financial assets

- Reduced risk of errors and mistakes

- Increased accuracy and completeness of the form

Method 4: Filing Form 8840 through Tax Software

A fourth way to complete Form 8840 is by filing it through tax software. This method is suitable for those who prefer to prepare and submit the form using software.

To file Form 8840 through tax software, you will need to:

- Choose a tax software that supports Form 8840

- Follow the software's instructions and prompts

- Fill out the form electronically

- Submit the form through the software

Method 4 Benefits

Filing Form 8840 through tax software provides several benefits, including:

- Convenient and efficient preparation and submission

- Reduced risk of errors and mistakes

- Increased accuracy and completeness of the form

Method 5: Filing Form 8840 through the IRS Free File Program

A fifth way to complete Form 8840 is by filing it through the IRS Free File program. This method is suitable for those who meet the eligibility criteria and prefer to file the form for free.

To file Form 8840 through the IRS Free File program, you will need to:

- Check the eligibility criteria on the IRS website

- Choose a participating tax software provider

- Fill out the form electronically

- Submit the form through the software

Method 5 Benefits

Filing Form 8840 through the IRS Free File program provides several benefits, including:

- Free filing and submission of the form

- Convenient and efficient preparation and submission

- Reduced risk of errors and mistakes

Conclusion

In conclusion, there are five ways to complete Form 8840, each with its own benefits and advantages. Whether you choose to file electronically, by mail, through a tax professional, through tax software, or through the IRS Free File program, it is essential to ensure accuracy and completeness of the form. By following the steps and guidelines outlined in this article, you can ensure that you are in compliance with US tax laws and regulations.

We invite you to share your thoughts and experiences with Form 8840 in the comments section below. If you have any questions or concerns, please do not hesitate to reach out. Remember to stay informed and up-to-date on the latest tax laws and regulations.

What is Form 8840?

+Form 8840 is a document used to report certain foreign financial assets to the Internal Revenue Service (IRS).

Who needs to file Form 8840?

+US citizens and resident aliens who have certain foreign financial assets need to file Form 8840.

What are the benefits of filing Form 8840?

+The benefits of filing Form 8840 include avoiding penalties and fines, demonstrating compliance with US tax laws and regulations, and reducing the risk of audit and examination by the IRS.