The complexities of tax season can be overwhelming, especially when it comes to understanding the nuances of estimated tax payments. For many individuals, particularly those who are self-employed or have variable income, navigating the world of estimated taxes can be a daunting task. One of the most common issues that arises is the underpayment of estimated taxes, which can result in penalties and fines. In this article, we will delve into the world of Form 2210, the form used to calculate and report underpayment of estimated tax penalties.

What is Form 2210?

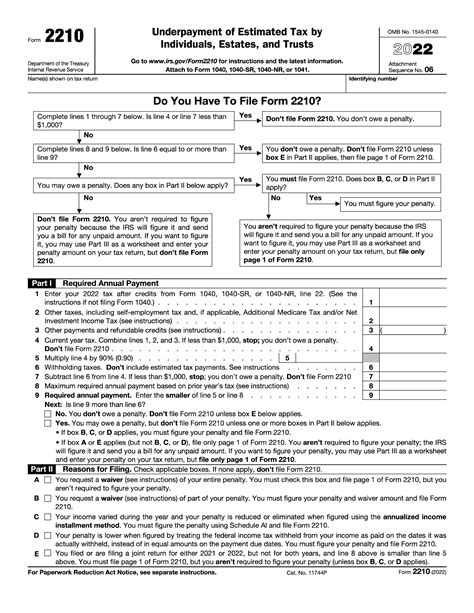

Form 2210, also known as the Underpayment of Estimated Tax by Individuals, Estates, and Trusts, is a form used by the Internal Revenue Service (IRS) to calculate and report underpayment of estimated tax penalties. This form is typically filed by individuals who are required to make estimated tax payments throughout the year, but fail to do so or underpay their estimated taxes.

Why is Form 2210 Important?

Form 2210 is an essential tool for individuals who are required to make estimated tax payments. Failure to file this form or pay the required penalties can result in additional fines and interest. By understanding how to complete Form 2210, individuals can avoid costly penalties and ensure they are in compliance with IRS regulations.

Who Needs to File Form 2210?

Not everyone is required to file Form 2210. However, individuals who meet certain criteria must file this form and pay the required penalties. These individuals include:

- Self-employed individuals who expect to owe more than $1,000 in taxes for the year

- Individuals who receive income that is not subject to withholding, such as rental income or investment income

- Individuals who are required to make estimated tax payments, but fail to do so or underpay their estimated taxes

How to Complete Form 2210

Completing Form 2210 can be a complex process, but it can be broken down into several steps. Here's a step-by-step guide to help you complete the form:

- Determine if you need to file Form 2210: Review the criteria listed above to determine if you are required to file Form 2210.

- Gather required documents: You will need to gather your tax returns, estimated tax payment vouchers, and any other relevant documents to complete the form.

- Calculate your estimated tax payments: Use Form 2210 to calculate your estimated tax payments for the year. You will need to calculate your total tax liability and subtract any withholding credits to determine your estimated tax payments.

- Determine if you owe a penalty: If you underpaid your estimated taxes or failed to make payments, you may owe a penalty. Use Form 2210 to calculate the penalty amount.

- Complete the form: Once you have calculated your estimated tax payments and penalty amount, complete Form 2210 and attach it to your tax return.

Penalty Relief

In some cases, the IRS may waive the penalty for underpayment of estimated taxes. To qualify for penalty relief, you must meet one of the following conditions:

- You did not owe any taxes in the prior tax year

- You are a first-time filer

- You experience a casualty, disaster, or other unusual circumstances that prevent you from making estimated tax payments

To request penalty relief, you will need to complete Form 2210 and attach a statement explaining why you are eligible for relief.

Practical Examples

To illustrate how Form 2210 works, let's consider a few practical examples:

- Example 1: John is a self-employed individual who expects to owe $10,000 in taxes for the year. He fails to make any estimated tax payments throughout the year and must file Form 2210 to calculate his penalty. Based on the form, John determines that he owes a penalty of $2,000.

- Example 2: Sarah is an individual who receives rental income that is not subject to withholding. She makes estimated tax payments throughout the year, but underpays her estimated taxes by $1,000. Sarah must file Form 2210 to calculate her penalty and pay the required amount.

Conclusion

In conclusion, Form 2210 is an essential tool for individuals who are required to make estimated tax payments. By understanding how to complete this form and calculate the required penalties, individuals can avoid costly fines and ensure they are in compliance with IRS regulations. Remember to review the criteria for filing Form 2210 and gather all required documents before completing the form.

Call to Action

If you are required to make estimated tax payments, don't wait until the last minute to file Form 2210. Take action today and ensure you are in compliance with IRS regulations. If you have any questions or concerns, consult with a tax professional or contact the IRS directly.

FAQ Section

What is the purpose of Form 2210?

+Form 2210 is used to calculate and report underpayment of estimated tax penalties.

Who is required to file Form 2210?

+Individuals who are self-employed, receive income that is not subject to withholding, or are required to make estimated tax payments must file Form 2210.

How do I calculate my estimated tax payments?

+Use Form 2210 to calculate your estimated tax payments. You will need to calculate your total tax liability and subtract any withholding credits to determine your estimated tax payments.