PNC Bank, one of the largest banks in the United States, offers a range of deposit services to its customers. The PNC Deposit Form is an essential tool for individuals and businesses to facilitate secure and efficient deposit processing. In this article, we will delve into the world of PNC deposit forms, exploring their benefits, types, and how to use them effectively.

The Importance of Deposit Forms in Banking

Deposit forms are a crucial part of the banking process, enabling customers to deposit funds into their accounts securely and efficiently. These forms provide a paper trail of transactions, ensuring that all deposits are accurately recorded and verified. In the digital age, deposit forms may seem old-fashioned, but they remain an essential tool for businesses and individuals who prefer to manage their finances offline.

Benefits of Using PNC Deposit Forms

Using PNC deposit forms offers several benefits, including:

- Security: Deposit forms provide a secure way to deposit funds, reducing the risk of errors or misappropriation of funds.

- Accuracy: Deposit forms ensure that all transactions are accurately recorded, reducing the likelihood of errors or discrepancies.

- Convenience: Deposit forms can be completed at the customer's convenience, eliminating the need to visit a bank branch during business hours.

Types of PNC Deposit Forms

PNC Bank offers various deposit forms to cater to different customer needs. Some of the most common types of deposit forms include:

- Personal Deposit Form: This form is designed for individual customers who want to deposit funds into their personal checking or savings accounts.

- Business Deposit Form: This form is designed for businesses that want to deposit funds into their business checking or savings accounts.

- Mobile Deposit Form: This form is designed for customers who want to deposit funds using their mobile devices.

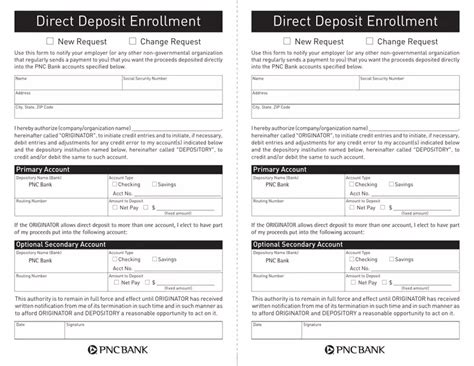

How to Fill Out a PNC Deposit Form

Filling out a PNC deposit form is a straightforward process that requires some basic information. Here's a step-by-step guide to help you complete the form:

- Account Information: Enter your PNC Bank account number and account type (checking or savings).

- Deposit Amount: Enter the amount you want to deposit, making sure to include the correct decimal point.

- Deposit Type: Indicate the type of deposit you are making (cash, check, or direct deposit).

- Check Information: If you are depositing a check, enter the check number, date, and amount.

Best Practices for Using PNC Deposit Forms

To ensure secure and efficient deposit processing, follow these best practices when using PNC deposit forms:

- Verify Account Information: Double-check your account number and account type to avoid errors.

- Use a Secure Method: Use a secure method to transmit the deposit form, such as mail or fax.

- Keep Records: Keep a record of your deposit form, including the date and amount deposited.

Common Errors to Avoid When Using PNC Deposit Forms

When using PNC deposit forms, it's essential to avoid common errors that can delay or prevent deposit processing. Here are some common errors to avoid:

- Incorrect Account Information: Entering incorrect account information can result in delayed or rejected deposits.

- Insufficient Deposit Amount: Depositing an amount that is less than the minimum required can result in rejected deposits.

Conclusion

PNC deposit forms are an essential tool for individuals and businesses to facilitate secure and efficient deposit processing. By understanding the benefits, types, and best practices for using PNC deposit forms, customers can ensure accurate and timely deposit processing.

We encourage you to share your experiences with PNC deposit forms in the comments section below. Your feedback will help others understand the benefits and challenges of using these forms.

What is the minimum deposit amount required for PNC deposit forms?

+The minimum deposit amount required for PNC deposit forms varies depending on the type of account and deposit method. It's best to check with PNC Bank for specific requirements.

Can I use a PNC deposit form to deposit funds into a joint account?

+Yes, you can use a PNC deposit form to deposit funds into a joint account. However, you will need to ensure that both account holders sign the form.

How long does it take for PNC Bank to process a deposit form?

+PNC Bank typically processes deposit forms within 1-2 business days. However, processing times may vary depending on the deposit method and account type.