Pit-1 forms, also known as Personal Income Tax Statements, play a crucial role in the tax filing process for individuals in many countries. While the specifics of the Pit-1 form can vary significantly depending on the jurisdiction, its importance in accurately reporting personal income and claiming applicable deductions and credits remains constant. Here are five key facts about Pit-1 forms that taxpayers should understand:

What is a Pit-1 Form?

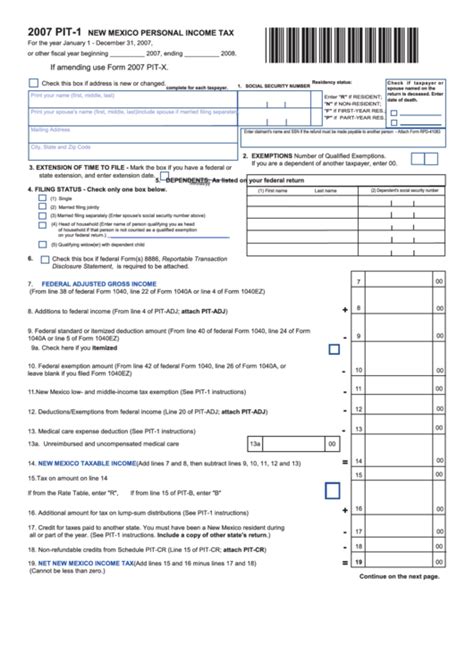

A Pit-1 form is a document that individuals use to report their income to the tax authorities. It typically includes sections for listing different types of income, such as employment income, self-employment income, interest, dividends, and capital gains, among others. The form also allows taxpayers to claim deductions and credits that can reduce their tax liability.

Benefits of Accurate Pit-1 Form Filing

Filing an accurate Pit-1 form is essential for several reasons. Firstly, it ensures that taxpayers comply with tax laws and regulations, thereby avoiding penalties and fines for non-compliance. Secondly, an accurate form helps taxpayers claim all eligible deductions and credits, which can significantly reduce their tax liability. Lastly, accurate reporting helps in maintaining a clean tax record, which is beneficial for future tax assessments and potential audits.

Steps to Fill Out a Pit-1 Form

Filling out a Pit-1 form requires careful attention to detail to ensure accuracy and completeness. Here are the general steps to follow:

- Gather necessary documents: Collect all relevant documents, including W-2 forms for employment income, 1099 forms for self-employment and other income, receipts for deductions, and records of charitable donations.

- Determine filing status: Choose the correct filing status, which affects the tax rates and deductions applicable.

- Report income: List all types of income earned during the tax year.

- Claim deductions and credits: Identify and claim all eligible deductions and credits to minimize tax liability.

- Review and sign: Carefully review the form for accuracy and completeness, then sign and date it.

Common Mistakes to Avoid

When filling out a Pit-1 form, there are several common mistakes that taxpayers should avoid:

- Incorrect reporting of income: Failing to report all income or incorrectly reporting income types can lead to penalties.

- Inaccurate deductions and credits: Claiming deductions or credits that are not eligible or incorrectly calculating their amounts can result in penalties and interest.

- Failure to sign and date: Signing and dating the form is crucial; unsigned forms are considered invalid.

Electronic Filing Options

Many tax authorities now offer electronic filing (e-filing) options for Pit-1 forms, which can make the filing process more convenient and efficient. E-filing typically involves using tax software or a tax professional's services to prepare and submit the form electronically. This method can reduce errors, speed up the refund process, and provide an immediate confirmation of receipt.

Conclusion: Empowering Tax Compliance

Understanding and accurately completing a Pit-1 form is a crucial aspect of tax compliance for individuals. By being aware of the form's requirements, benefits of accurate filing, steps to fill it out, common mistakes to avoid, and electronic filing options, taxpayers can ensure they meet their tax obligations efficiently and effectively. Empowering yourself with knowledge about Pit-1 forms can lead to better tax management and savings.

We hope this detailed guide to Pit-1 forms has provided valuable insights and practical advice for navigating the tax filing process. If you have any questions or would like to share your experiences with Pit-1 forms, please leave a comment below. Your feedback and engagement are appreciated and help in creating a community of informed taxpayers.

What is the deadline for filing a Pit-1 form?

+The deadline for filing a Pit-1 form varies by country and sometimes by region within a country. It's essential to check with the local tax authority for the specific deadline.

Can I file my Pit-1 form electronically?

+Yes, many tax authorities offer electronic filing options for Pit-1 forms. This can be done through tax software or by hiring a tax professional.

What are the penalties for late filing of a Pit-1 form?

+Penalties for late filing vary but often include fines and interest on the tax owed. It's crucial to file on time to avoid these additional costs.