As a business owner or accountant, you understand the importance of maintaining accurate financial records, including petty cash reconciliation. Petty cash reconciliation is the process of verifying that the petty cash balance matches the actual amount of cash on hand. However, this process can be time-consuming and prone to errors, especially when done manually. Fortunately, using Excel can simplify petty cash reconciliation and make it more efficient. In this article, we will explore five ways to simplify petty cash reconciliation with Excel.

What is Petty Cash Reconciliation?

Petty cash reconciliation is the process of verifying that the petty cash balance matches the actual amount of cash on hand. This process involves comparing the petty cash balance in the company's accounting records with the actual amount of cash in the petty cash fund. The goal of petty cash reconciliation is to ensure that the company's financial records are accurate and up-to-date.

Why is Petty Cash Reconciliation Important?

Petty cash reconciliation is important for several reasons:

- Accurate financial records: Petty cash reconciliation ensures that the company's financial records are accurate and up-to-date.

- Prevention of errors: Petty cash reconciliation helps to prevent errors and discrepancies in the company's financial records.

- Detection of theft: Petty cash reconciliation can help to detect theft or misappropriation of petty cash funds.

- Compliance with accounting standards: Petty cash reconciliation is required by accounting standards and regulatory bodies.

5 Ways to Simplify Petty Cash Reconciliation with Excel

Here are five ways to simplify petty cash reconciliation with Excel:

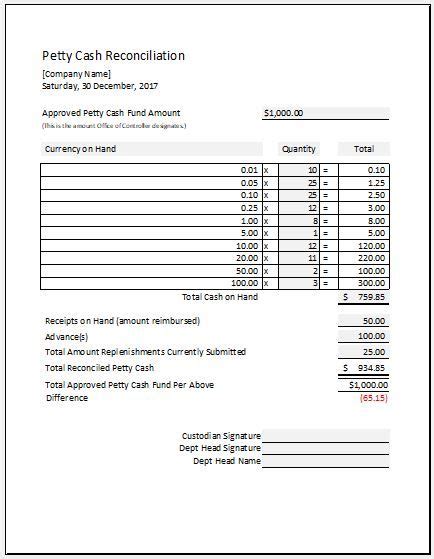

1. Use a Petty Cash Reconciliation Template

Using a petty cash reconciliation template in Excel can simplify the process and reduce errors. The template can be customized to meet the company's specific needs and can include columns for date, description, debit, credit, and balance.

- Create a template: Create a petty cash reconciliation template in Excel that includes columns for date, description, debit, credit, and balance.

- Customize the template: Customize the template to meet the company's specific needs.

- Use formulas: Use formulas to calculate the balance and to highlight any discrepancies.

2. Automate Petty Cash Entries

Automating petty cash entries can simplify the process and reduce errors. Excel can be used to automate petty cash entries by creating a drop-down list of common expenses and using formulas to calculate the amount.

- Create a drop-down list: Create a drop-down list of common expenses in Excel.

- Use formulas: Use formulas to calculate the amount and to update the balance.

- Automate entries: Automate petty cash entries by using Excel's AutoFill feature.

3. Use Conditional Formatting

Using conditional formatting in Excel can help to highlight any discrepancies or errors in the petty cash reconciliation. Conditional formatting can be used to highlight cells that contain errors or discrepancies.

- Use conditional formatting: Use conditional formatting to highlight cells that contain errors or discrepancies.

- Create rules: Create rules to highlight cells that contain errors or discrepancies.

- Use colors: Use colors to highlight cells that contain errors or discrepancies.

4. Use PivotTables

Using PivotTables in Excel can help to simplify petty cash reconciliation by summarizing data and highlighting trends. PivotTables can be used to summarize data by date, description, or amount.

- Create a PivotTable: Create a PivotTable in Excel to summarize data.

- Summarize data: Summarize data by date, description, or amount.

- Highlight trends: Highlight trends and patterns in the data.

5. Use Excel's Auditing Tools

Using Excel's auditing tools can help to simplify petty cash reconciliation by highlighting errors and discrepancies. Excel's auditing tools can be used to track changes, identify errors, and highlight discrepancies.

- Use Excel's auditing tools: Use Excel's auditing tools to track changes, identify errors, and highlight discrepancies.

- Track changes: Track changes to the petty cash reconciliation spreadsheet.

- Identify errors: Identify errors and discrepancies in the petty cash reconciliation.

By implementing these five ways to simplify petty cash reconciliation with Excel, businesses can streamline their financial processes, reduce errors, and improve accuracy.

What is petty cash reconciliation?

+Petty cash reconciliation is the process of verifying that the petty cash balance matches the actual amount of cash on hand.

Why is petty cash reconciliation important?

+Petty cash reconciliation is important for several reasons, including accurate financial records, prevention of errors, detection of theft, and compliance with accounting standards.

How can I simplify petty cash reconciliation with Excel?

+You can simplify petty cash reconciliation with Excel by using a petty cash reconciliation template, automating petty cash entries, using conditional formatting, using PivotTables, and using Excel's auditing tools.

We hope this article has provided you with a comprehensive guide on how to simplify petty cash reconciliation with Excel. By implementing these five ways, you can streamline your financial processes, reduce errors, and improve accuracy. Do you have any questions or comments about petty cash reconciliation or Excel? Please leave a comment below.