The convenience of direct deposit has revolutionized the way we receive our paychecks. No more waiting for a physical check to arrive in the mail or dealing with the hassle of depositing it at the bank. With Paychex direct deposit, you can have your paycheck automatically deposited into your bank account, making it easily accessible and saving you time. To take advantage of this convenient service, you'll need to complete a Paychex direct deposit form. In this article, we'll guide you through the 5 simple steps to complete the form and start enjoying the benefits of direct deposit.

Step 1: Gather Required Information

Before you start filling out the Paychex direct deposit form, make sure you have all the necessary information at hand. This includes:

- Your name and address

- Your Social Security number or Employee Identification Number (EIN)

- Your bank account information, including:

- Bank name

- Bank routing number (also known as the ABA number)

- Bank account number

- Bank account type (checking or savings)

Why is Bank Routing Number Important?

The bank routing number is a crucial piece of information that ensures your direct deposit is processed correctly. It's a 9-digit number that identifies the bank and location where your account is held. You can find the routing number on the bottom left corner of your checks or on the bank's website.

Step 2: Choose Your Deposit Options

Paychex offers several deposit options to suit your needs. You can choose to deposit your entire paycheck into one account or split it between multiple accounts. You can also opt for a partial deposit, where a portion of your paycheck is deposited into one account and the remaining amount is deposited into another account.

- Whole deposit: Deposit your entire paycheck into one account.

- Partial deposit: Split your paycheck between two or more accounts.

- Multiple accounts: Deposit your paycheck into multiple accounts.

Benefits of Multiple Accounts

Depositing your paycheck into multiple accounts can help you manage your finances more effectively. For example, you can deposit a portion of your paycheck into a savings account for emergency funds or long-term goals, while depositing the remaining amount into a checking account for everyday expenses.

Step 3: Fill Out the Form

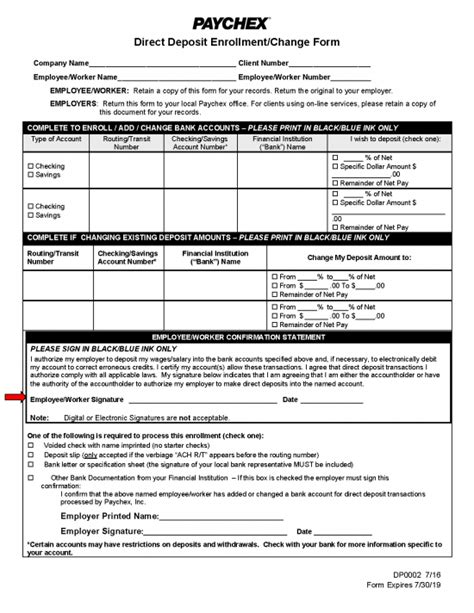

Now that you have all the necessary information and have chosen your deposit options, it's time to fill out the Paychex direct deposit form. The form will typically ask for the following information:

- Your name and address

- Your Social Security number or EIN

- Your bank account information

- Your deposit options (whole, partial, or multiple accounts)

Make sure to fill out the form accurately and completely, as errors may delay the processing of your direct deposit.

Tips for Filling Out the Form

- Use a black or blue pen to fill out the form.

- Make sure to sign and date the form.

- Keep a copy of the completed form for your records.

Step 4: Submit the Form

Once you've completed the Paychex direct deposit form, submit it to your payroll administrator or HR representative. They will review the form and ensure that it's processed correctly.

What Happens After Submitting the Form?

After submitting the form, your payroll administrator will verify the information and set up your direct deposit. This may take a few days to a week, depending on the payroll processing schedule. Once your direct deposit is set up, your paycheck will be automatically deposited into your bank account on the designated payday.

Step 5: Confirm Your Direct Deposit

After your direct deposit is set up, confirm that the funds are being deposited into your bank account correctly. You can do this by checking your bank statement or online banking portal.

Benefits of Direct Deposit

Direct deposit offers several benefits, including:

- Convenience: No more waiting for a physical check to arrive in the mail.

- Time-saving: No more dealing with depositing a check at the bank.

- Security: Reduced risk of lost or stolen checks.

By following these 5 simple steps, you can complete the Paychex direct deposit form and start enjoying the benefits of direct deposit.

If you have any questions or concerns about the Paychex direct deposit form, don't hesitate to ask. We're here to help.

What is the Paychex direct deposit form?

+The Paychex direct deposit form is a document that allows you to set up direct deposit for your paycheck. It requires you to provide your bank account information and choose your deposit options.

How long does it take to set up direct deposit?

+It may take a few days to a week to set up direct deposit, depending on the payroll processing schedule.

Can I split my paycheck between multiple accounts?

+Yes, you can split your paycheck between multiple accounts using the Paychex direct deposit form.