Withdrawing from a 401(k) plan can be a daunting task, especially when navigating the complexities of retirement accounts. For Paychex 401(k) plan participants, understanding the withdrawal process is crucial to ensure a smooth and stress-free experience. In this article, we will delve into the world of Paychex 401(k) withdrawal forms, providing a step-by-step guide to help you through the process.

The importance of understanding 401(k) withdrawal rules cannot be overstated. Failing to comply with the rules can result in penalties, taxes, and even loss of retirement savings. Moreover, the rules governing 401(k) withdrawals can be complex, making it essential to seek guidance from a financial expert or plan administrator. As a Paychex 401(k) plan participant, it is vital to be aware of the withdrawal options available to you, including the Paychex 401(k) withdrawal form.

Understanding Paychex 401(k) Withdrawal Rules

Before diving into the Paychex 401(k) withdrawal form, it is essential to understand the rules governing withdrawals. The IRS sets specific rules for 401(k) withdrawals, including:

- Age 59 1/2: Participants can withdraw funds without incurring a 10% penalty.

- Separation from service: Participants can withdraw funds after leaving their job or retiring.

- Disability: Participants can withdraw funds if they become disabled.

- Substantially equal payments: Participants can withdraw funds in substantially equal payments over their life expectancy.

Types of Paychex 401(k) Withdrawals

Paychex 401(k) plan participants have several withdrawal options available to them. These include:

- Lump-sum withdrawals: Participants can withdraw a portion or all of their account balance.

- Installment withdrawals: Participants can withdraw funds in regular installments over a set period.

- Annuity withdrawals: Participants can purchase an annuity with their account balance, providing a guaranteed income stream.

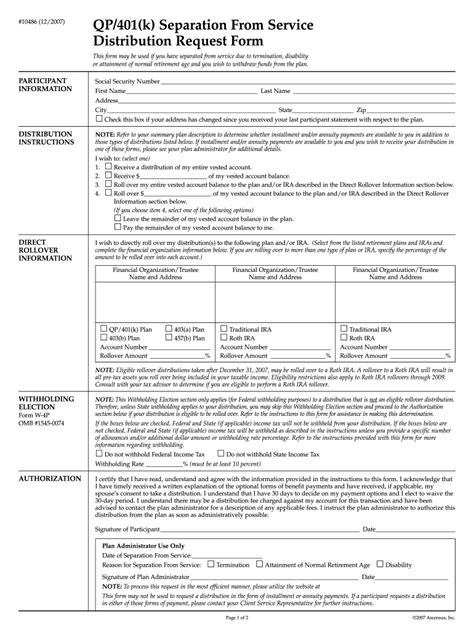

Completing the Paychex 401(k) Withdrawal Form

To initiate a withdrawal from your Paychex 401(k) plan, you will need to complete the Paychex 401(k) withdrawal form. Here's a step-by-step guide to help you through the process:

- Gather required documents: Before starting the withdrawal process, ensure you have all required documents, including your plan participant ID, Social Security number, and a copy of your plan document.

- Determine your withdrawal type: Decide which type of withdrawal you want to make, considering factors such as taxes, penalties, and your financial goals.

- Complete the withdrawal form: Fill out the Paychex 401(k) withdrawal form, providing all required information, including your account balance, withdrawal amount, and payment instructions.

- Submit the form: Submit the completed form to Paychex, either online or by mail, depending on your plan's requirements.

- Verify your withdrawal: Once your withdrawal is processed, verify the transaction to ensure it was completed correctly.

Paychex 401(k) Withdrawal Form Requirements

When completing the Paychex 401(k) withdrawal form, ensure you provide all required information, including:

- Your plan participant ID

- Your Social Security number

- Your account balance

- The withdrawal amount

- Payment instructions

- Your signature

Paychex 401(k) Withdrawal Tax Implications

Withdrawing from a 401(k) plan can have significant tax implications. Understanding these implications is crucial to avoid unexpected tax liabilities. Here are some key tax considerations:

- Income tax: Withdrawals are subject to income tax, which can range from 10% to 37%, depending on your tax bracket.

- Penalties: Withdrawals made before age 59 1/2 may incur a 10% penalty, unless you qualify for an exception.

- Withholding: Paychex may withhold taxes on your withdrawal, which can range from 10% to 30%.

Paychex 401(k) Withdrawal FAQs

Still have questions about the Paychex 401(k) withdrawal form or process? Here are some frequently asked questions:

- Q: How do I initiate a withdrawal from my Paychex 401(k) plan? A: You can initiate a withdrawal by completing the Paychex 401(k) withdrawal form and submitting it to Paychex.

- Q: What are the tax implications of withdrawing from my Paychex 401(k) plan? A: Withdrawals are subject to income tax, and may incur penalties if made before age 59 1/2.

- Q: Can I withdraw funds from my Paychex 401(k) plan if I'm still employed? A: Yes, but you may be subject to penalties and taxes.

What is the minimum age requirement for withdrawing from a Paychex 401(k) plan?

+The minimum age requirement for withdrawing from a Paychex 401(k) plan is 59 1/2, unless you qualify for an exception.

Can I withdraw funds from my Paychex 401(k) plan if I'm disabled?

+Yes, you can withdraw funds from your Paychex 401(k) plan if you're disabled, but you may be subject to taxes and penalties.

How do I avoid penalties when withdrawing from my Paychex 401(k) plan?

+To avoid penalties, ensure you meet the age requirement, qualify for an exception, or take substantially equal payments over your life expectancy.

In conclusion, withdrawing from a Paychex 401(k) plan requires careful consideration and understanding of the rules and tax implications. By following this step-by-step guide and completing the Paychex 401(k) withdrawal form accurately, you can ensure a smooth and stress-free experience. Remember to consult with a financial expert or plan administrator to ensure you're making the best decision for your retirement goals.