The Pennsylvania Inheritance Tax Return, also known as the PA Form REV-276, is a crucial document that must be filed with the Pennsylvania Department of Revenue when a person passes away, leaving behind assets that are subject to inheritance tax. The form is used to report the transfer of property from the deceased person's estate to their beneficiaries, and it's essential to understand the process to avoid any delays or penalties.

The Pennsylvania Inheritance Tax Return is a complex form that requires careful attention to detail, and it's not uncommon for individuals to feel overwhelmed when dealing with the estate of a loved one. However, with the right guidance, you can navigate the process with ease and ensure that the deceased person's wishes are carried out as intended.

What is the Pennsylvania Inheritance Tax Return?

The Pennsylvania Inheritance Tax Return is a tax return that must be filed with the Pennsylvania Department of Revenue when a person passes away, leaving behind assets that are subject to inheritance tax. The form is used to report the transfer of property from the deceased person's estate to their beneficiaries, and it's essential to understand the process to avoid any delays or penalties.

Who Needs to File the Pennsylvania Inheritance Tax Return?

The Pennsylvania Inheritance Tax Return must be filed by the executor or administrator of the deceased person's estate. The executor or administrator is responsible for managing the estate and ensuring that all taxes, debts, and other obligations are paid.

If the deceased person had a will, the executor is usually named in the will. If there is no will, the court will appoint an administrator to manage the estate.

What Assets are Subject to Inheritance Tax?

In Pennsylvania, the following assets are subject to inheritance tax:

- Real estate, including the deceased person's primary residence

- Bank accounts, including checking and savings accounts

- Investments, including stocks, bonds, and mutual funds

- Retirement accounts, including 401(k) and IRA accounts

- Life insurance policies

- Business interests, including partnerships and corporations

However, some assets are exempt from inheritance tax, including:

- Assets that pass to the surviving spouse

- Assets that pass to a charity or qualified organization

- Assets that pass to a minor child or grandchildren

How to Calculate Inheritance Tax

The inheritance tax rate in Pennsylvania varies depending on the relationship between the deceased person and the beneficiary. The tax rates are as follows:

- 0% for assets that pass to the surviving spouse or to a charity or qualified organization

- 4.5% for assets that pass to a parent or child

- 12% for assets that pass to a sibling or other relatives

- 15% for assets that pass to non-relatives

To calculate the inheritance tax, you will need to determine the value of the assets that are subject to tax, and then multiply that value by the applicable tax rate.

How to File the Pennsylvania Inheritance Tax Return

To file the Pennsylvania Inheritance Tax Return, you will need to complete the following steps:

- Gather all necessary documents, including the deceased person's will, trust documents, and financial statements.

- Determine the value of the assets that are subject to inheritance tax.

- Calculate the inheritance tax using the applicable tax rate.

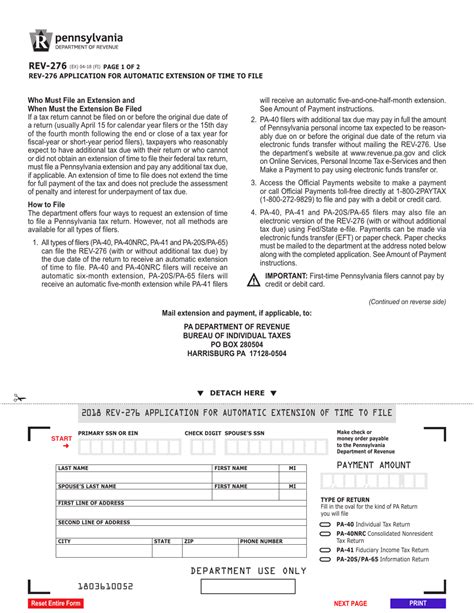

- Complete the Pennsylvania Inheritance Tax Return form (REV-276).

- Attach all necessary schedules and supporting documentation.

- File the return with the Pennsylvania Department of Revenue.

- Pay any inheritance tax due.

Deadlines for Filing the Pennsylvania Inheritance Tax Return

The deadline for filing the Pennsylvania Inheritance Tax Return is nine months from the date of the deceased person's death. However, if the estate is subject to federal estate tax, the deadline may be extended to 15 months.

Penalties for Late Filing or Non-Payment

If the Pennsylvania Inheritance Tax Return is filed late or if the inheritance tax is not paid, penalties and interest may be assessed. The penalties and interest can be substantial, so it's essential to file the return and pay the tax on time.

Conclusion

The Pennsylvania Inheritance Tax Return is a complex form that requires careful attention to detail. However, with the right guidance, you can navigate the process with ease and ensure that the deceased person's wishes are carried out as intended.

If you are the executor or administrator of an estate, it's essential to understand the inheritance tax laws in Pennsylvania and to seek professional advice if necessary. By following the steps outlined in this guide, you can ensure that the Pennsylvania Inheritance Tax Return is filed correctly and that any inheritance tax due is paid on time.

FAQ Section:

Who is responsible for filing the Pennsylvania Inheritance Tax Return?

+The executor or administrator of the deceased person's estate is responsible for filing the Pennsylvania Inheritance Tax Return.

What assets are subject to inheritance tax in Pennsylvania?

+In Pennsylvania, the following assets are subject to inheritance tax: real estate, bank accounts, investments, retirement accounts, life insurance policies, and business interests.

How do I calculate the inheritance tax in Pennsylvania?

+To calculate the inheritance tax, you will need to determine the value of the assets that are subject to tax, and then multiply that value by the applicable tax rate.