Pennsylvania taxpayers who are unable to file their state tax returns on time may be eligible for an extension of time to file. The Pennsylvania Department of Revenue (DOR) provides a way for taxpayers to request an automatic six-month extension of time to file their tax returns using Form PA-40ES. In this article, we will delve into the details of Form PA-40ES, including its purpose, eligibility criteria, and the steps to complete and submit it.

What is Form PA-40ES?

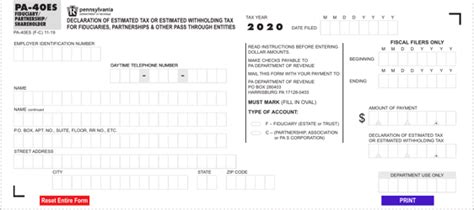

Form PA-40ES is the Pennsylvania Application for Extension of Time to File. It is used by taxpayers who need more time to file their Pennsylvania personal income tax return (Form PA-40). The form is used to request an automatic six-month extension of time to file, which extends the deadline to file the tax return from April 15th to October 15th.

Who is eligible for an extension of time to file?

Not all taxpayers are eligible for an extension of time to file. To qualify, taxpayers must meet certain conditions, including:

- They must be unable to file their tax return on time due to circumstances beyond their control.

- They must not have any outstanding tax liabilities or other tax obligations.

- They must not be under audit or investigation by the Pennsylvania DOR.

How to complete Form PA-40ES

To complete Form PA-40ES, taxpayers will need to provide the following information:

- Their name and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Their spouse's name and Social Security number or ITIN (if filing jointly).

- The tax year for which they are requesting an extension.

- The reason for requesting an extension.

Taxpayers can complete Form PA-40ES online through the Pennsylvania DOR's website or by mailing a paper copy to the address listed on the form.

Steps to submit Form PA-40ES

To submit Form PA-40ES, taxpayers can follow these steps:

- File online: Taxpayers can file Form PA-40ES online through the Pennsylvania DOR's website. They will need to create an account and log in to submit the form.

- Mail a paper copy: Taxpayers can also mail a paper copy of Form PA-40ES to the address listed on the form.

Important deadlines

Taxpayers should be aware of the following deadlines:

- April 15th: The original deadline to file Form PA-40.

- April 15th: The deadline to file Form PA-40ES and request an automatic six-month extension of time to file.

- October 15th: The extended deadline to file Form PA-40.

Consequences of not filing Form PA-40ES

If taxpayers fail to file Form PA-40ES and do not file their tax return on time, they may be subject to penalties and interest on any tax owed. The Pennsylvania DOR may also assess additional fees and charges for late filing and payment.

Additional information

Taxpayers who are granted an extension of time to file should be aware of the following:

- Interest: Interest will accrue on any tax owed from the original deadline to the date the tax is paid.

- Penalties: Penalties may be assessed for late filing and payment.

- Amended returns: If taxpayers need to make changes to their tax return, they can file an amended return (Form PA-40X) within three years of the original filing deadline.

Common mistakes to avoid

When completing and submitting Form PA-40ES, taxpayers should avoid the following common mistakes:

- Inaccurate information: Ensure that all information is accurate and complete.

- Missed deadlines: Ensure that the form is submitted on time to avoid penalties and interest.

- Insufficient payment: Ensure that sufficient payment is made to avoid penalties and interest.

Conclusion

Form PA-40ES is an important document for Pennsylvania taxpayers who need more time to file their state tax returns. By understanding the purpose, eligibility criteria, and steps to complete and submit the form, taxpayers can avoid penalties and interest on any tax owed. Remember to file Form PA-40ES on time and make sufficient payment to avoid any additional fees and charges.

FAQs

What is the deadline to file Form PA-40ES?

+The deadline to file Form PA-40ES is April 15th.

How long is the extension period?

+The extension period is six months, extending the deadline to file Form PA-40 to October 15th.

Can I file Form PA-40ES online?

+Yes, you can file Form PA-40ES online through the Pennsylvania DOR's website.