Oklahoma businesses and individuals are required to file various tax forms with the Oklahoma Tax Commission (OTC) to report their tax obligations. One of the key forms used for this purpose is the OTC Form 511, also known as the Oklahoma Individual Income Tax Return. In this article, we will provide a comprehensive guide to help you understand the OTC Form 511, its components, and the filing process.

Understanding the OTC Form 511

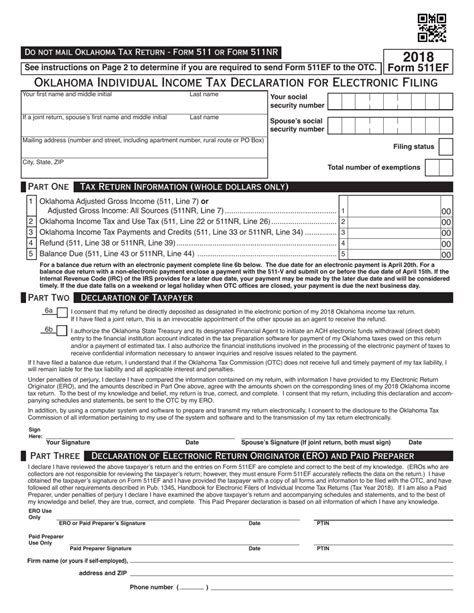

The OTC Form 511 is a tax return form used by Oklahoma residents to report their individual income tax. It is used to calculate the taxpayer's state income tax liability, as well as any tax credits or deductions they may be eligible for. The form is typically filed annually, with a deadline of April 15th for most taxpayers.

Components of the OTC Form 511

The OTC Form 511 consists of several sections, including:

- Personal Information: This section requires taxpayers to provide their name, address, social security number, and other identifying information.

- Income: This section requires taxpayers to report their income from various sources, including wages, salaries, tips, and self-employment income.

- Deductions: This section allows taxpayers to claim deductions for expenses such as charitable donations, mortgage interest, and medical expenses.

- Tax Credits: This section allows taxpayers to claim tax credits for items such as education expenses, child care expenses, and homebuyer credits.

- Tax Liability: This section calculates the taxpayer's total tax liability based on their income, deductions, and tax credits.

Filing the OTC Form 511

Taxpayers can file the OTC Form 511 electronically or by mail. Electronic filing is generally faster and more convenient, and can be done through the OTC's website or through a tax preparation software. Mailed forms should be sent to the OTC's address listed on the form.

Who Needs to File the OTC Form 511?

Most Oklahoma residents are required to file the OTC Form 511 if they have income from Oklahoma sources. This includes:

- Residents: Oklahoma residents who have income from any source, including wages, salaries, tips, and self-employment income.

- Non-Residents: Non-residents who have income from Oklahoma sources, such as rental income or income from a business located in Oklahoma.

- Part-Year Residents: Part-year residents who have income from Oklahoma sources during the time they were a resident.

Penalties for Not Filing the OTC Form 511

Taxpayers who fail to file the OTC Form 511 by the deadline may be subject to penalties and interest. The penalty for late filing is typically 5% of the unpaid tax per month, up to a maximum of 25%. Additionally, taxpayers may be subject to interest on the unpaid tax, which accrues at a rate of 5% per year.

Tips for Filing the OTC Form 511

Here are some tips to help you file the OTC Form 511 accurately and efficiently:

- Gather all necessary documents: Make sure you have all the necessary documents, including your W-2 forms, 1099 forms, and any other relevant tax documents.

- Use tax preparation software: Tax preparation software can help you navigate the filing process and ensure that you are taking advantage of all the tax credits and deductions you are eligible for.

- File electronically: Electronic filing is generally faster and more convenient than mailing a paper form.

- Seek help if needed: If you are unsure about any part of the filing process, consider seeking help from a tax professional or the OTC's customer service department.

OTC Form 511 Schedule and Due Dates

The OTC Form 511 is typically due on April 15th of each year. However, the OTC offers several payment options for taxpayers who are unable to pay their tax liability by the deadline. These options include:

- Installment Agreement: Taxpayers can enter into an installment agreement with the OTC to pay their tax liability in monthly installments.

- Extension: Taxpayers can file for an automatic six-month extension to file their tax return.

- Payment Plan: Taxpayers can set up a payment plan with the OTC to pay their tax liability over time.

Common Mistakes to Avoid When Filing the OTC Form 511

Here are some common mistakes to avoid when filing the OTC Form 511:

- Math errors: Double-check your math to ensure that you are accurately reporting your income, deductions, and tax credits.

- Missing information: Make sure you have all the necessary documents and information before filing your tax return.

- Incorrect filing status: Ensure that you are filing as the correct filing status, such as single, married filing jointly, or head of household.

OTC Form 511 and Tax Planning

The OTC Form 511 can be an important tool for tax planning. By accurately reporting your income, deductions, and tax credits, you can minimize your tax liability and ensure that you are taking advantage of all the tax savings available to you.

Conclusion

Filing the OTC Form 511 is an important part of Oklahoma's tax compliance process. By understanding the components of the form, the filing process, and common mistakes to avoid, you can ensure that you are accurately reporting your tax liability and taking advantage of all the tax savings available to you. If you have any questions or concerns about the OTC Form 511, consider seeking help from a tax professional or the OTC's customer service department.

What is the deadline for filing the OTC Form 511?

+The deadline for filing the OTC Form 511 is typically April 15th of each year.

Who is required to file the OTC Form 511?

+Most Oklahoma residents are required to file the OTC Form 511 if they have income from Oklahoma sources.

What are the penalties for not filing the OTC Form 511?

+Taxpayers who fail to file the OTC Form 511 by the deadline may be subject to penalties and interest.