As a business owner or accountant in Oregon, you're likely familiar with the Oregon WR form, also known as the Oregon Withholding Tax Form. This form is used to report and pay withholding taxes on wages paid to employees. Filling out the Oregon WR form correctly is crucial to avoid errors, penalties, and potential audits. In this article, we'll provide you with 5 tips to help you fill out the Oregon WR form accurately and efficiently.

Understanding the Oregon WR Form

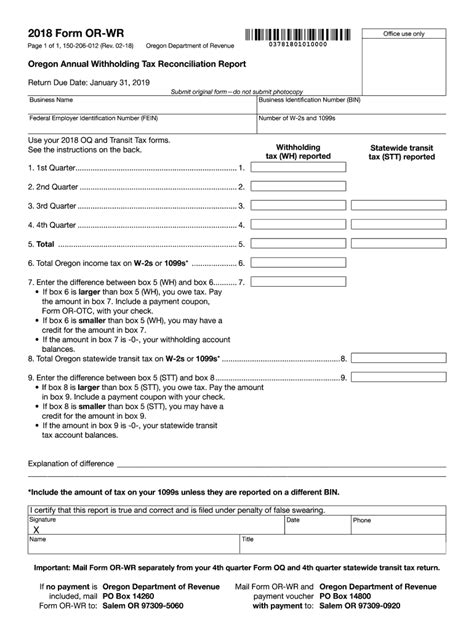

Before we dive into the tips, let's take a brief look at what the Oregon WR form is and what it's used for. The Oregon WR form is a quarterly tax return used to report and pay withholding taxes on wages paid to employees. It's typically filed by employers who have employees working in Oregon and are required to withhold Oregon state income taxes.

Tips for Filling Out the Oregon WR Form Correctly

1. Gather Required Information

To fill out the Oregon WR form correctly, you'll need to gather the required information. This includes:

- Your business's name and address

- Your business's Oregon withholding tax account number

- The quarter and year for which you're filing

- The total amount of Oregon withholding tax withheld from employee wages

- The total amount of Oregon withholding tax deposited with the state

Make sure you have all the necessary information before starting to fill out the form.

Breaking Down the Oregon WR Form

2. Fill Out the Form Accurately and Completely

Once you have all the required information, fill out the Oregon WR form accurately and completely. Make sure to:

- Use the correct form for the quarter and year you're filing

- Fill out all required fields, including your business's name and address, and the total amount of Oregon withholding tax withheld

- Report any corrections or adjustments to previous quarters

Double-check your work to ensure accuracy and completeness.

Common Mistakes to Avoid

3. Avoid Common Mistakes

Common mistakes to avoid when filling out the Oregon WR form include:

- Failing to report all withholding tax withheld from employee wages

- Reporting incorrect or incomplete information

- Failing to file the form on time

To avoid these mistakes, make sure to:

- Keep accurate records of employee wages and withholding tax withheld

- Review the form carefully before submitting it

- File the form on time to avoid penalties and interest

Oregon WR Form Deadlines and Penalties

4. Meet the Filing Deadline and Avoid Penalties

The Oregon WR form is typically due on the last day of the month following the end of the quarter. For example, the form for the first quarter (January 1 - March 31) is due on April 30th.

To avoid penalties and interest, make sure to file the form on time. If you're unable to file on time, you may be able to request an extension or waiver of penalty.

Requesting an Extension or Waiver of Penalty

5. Request an Extension or Waiver of Penalty if Necessary

If you're unable to file the Oregon WR form on time, you may be able to request an extension or waiver of penalty. To request an extension, you'll need to submit a written request to the Oregon Department of Revenue before the filing deadline.

To request a waiver of penalty, you'll need to submit a written request explaining why you were unable to file on time. The Oregon Department of Revenue will review your request and may waive the penalty if they determine that you had reasonable cause for not filing on time.

By following these 5 tips, you can ensure that you fill out the Oregon WR form correctly and avoid errors, penalties, and potential audits. Remember to gather required information, fill out the form accurately and completely, avoid common mistakes, meet the filing deadline, and request an extension or waiver of penalty if necessary.

What is the Oregon WR form used for?

+The Oregon WR form is used to report and pay withholding taxes on wages paid to employees.

What is the deadline for filing the Oregon WR form?

+The Oregon WR form is typically due on the last day of the month following the end of the quarter.

What happens if I fail to file the Oregon WR form on time?

+If you fail to file the Oregon WR form on time, you may be subject to penalties and interest. You may be able to request an extension or waiver of penalty, but you'll need to submit a written request to the Oregon Department of Revenue.