Saving for retirement is a crucial step in securing your financial future. One of the most popular retirement savings options is a 401(k) plan, which allows you to contribute a portion of your income to a tax-deferred retirement account. One America is a leading provider of 401(k) plans, offering a range of investment options and tools to help you manage your retirement savings. If you're a One America 401(k) plan participant, you may need to withdraw funds from your account at some point. In this comprehensive guide, we'll walk you through the One America 401k withdrawal process, including the forms you'll need to complete and the rules you need to follow.

Understanding 401(k) Withdrawal Rules

Before we dive into the withdrawal process, it's essential to understand the rules surrounding 401(k) withdrawals. The IRS sets rules for 401(k) withdrawals, including age restrictions, penalty rules, and tax implications. Here are some key things to keep in mind:

- Age 59 1/2 Rule: You can withdraw funds from your 401(k) account without penalty if you're 59 1/2 or older.

- Penalty for Early Withdrawal: If you withdraw funds before age 59 1/2, you may be subject to a 10% penalty, in addition to income tax on the withdrawal.

- Required Minimum Distributions (RMDs): Starting at age 72, you'll need to take RMDs from your 401(k) account each year, which will be subject to income tax.

One America 401k Withdrawal Form

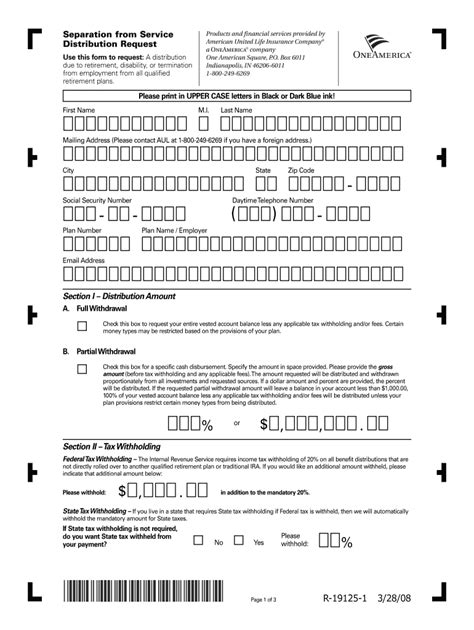

To initiate a withdrawal from your One America 401(k) account, you'll need to complete a withdrawal form. The form will ask for your personal and account information, as well as the withdrawal details. Here's what you can expect:

- Withdrawal Form: You can obtain a withdrawal form from your plan administrator or download it from the One America website.

- Required Information: You'll need to provide your name, Social Security number, and account information, as well as the withdrawal amount and frequency.

- Withdrawal Options: You can choose from various withdrawal options, including lump-sum, installment, or annuity payments.

Step-by-Step Guide to Completing the One America 401k Withdrawal Form

Completing the One America 401k withdrawal form can seem daunting, but it's a straightforward process. Here's a step-by-step guide to help you get started:

- Gather Required Documents: Before you begin, make sure you have all the necessary documents, including your Social Security number, account information, and identification.

- Download or Obtain the Form: Download the withdrawal form from the One America website or obtain it from your plan administrator.

- Fill Out the Form: Complete the form with your personal and account information, as well as the withdrawal details.

- Choose Your Withdrawal Option: Select your withdrawal option, including lump-sum, installment, or annuity payments.

- Sign and Date the Form: Sign and date the form, and make sure to keep a copy for your records.

- Submit the Form: Submit the completed form to your plan administrator or mail it to the address listed on the form.

Tips and Considerations

Before you initiate a withdrawal from your One America 401(k) account, consider the following tips and considerations:

- Taxes and Penalties: Withdrawals from your 401(k) account will be subject to income tax and potential penalties.

- Investment Options: Consider your investment options and how they may be impacted by a withdrawal.

- Retirement Goals: Consider how a withdrawal may impact your retirement goals and adjust your plan accordingly.

One America 401k Withdrawal Rules and Regulations

In addition to the IRS rules, One America has its own set of rules and regulations governing 401(k) withdrawals. Here are some key things to keep in mind:

- Plan Rules: Your plan document outlines the rules and regulations governing your 401(k) account, including withdrawal rules.

- Administrative Fees: One America may charge administrative fees for withdrawals, which will be deducted from your account balance.

- Investment Restrictions: Some investments may have restrictions or penalties for withdrawals, so be sure to review your investment options carefully.

Frequently Asked Questions

Here are some frequently asked questions about the One America 401k withdrawal process:

Q: Can I withdraw funds from my 401(k) account at any time?

A: Yes, you can withdraw funds from your 401(k) account at any time, but you may be subject to penalties and taxes.Q: Do I need to complete a withdrawal form to initiate a withdrawal?

A: Yes, you'll need to complete a withdrawal form to initiate a withdrawal from your One America 401(k) account.Q: Can I withdraw funds from my 401(k) account online?

A: Yes, you can withdraw funds from your 401(k) account online through the One America website.Conclusion

Withdrawing funds from your One America 401(k) account can be a complex process, but with the right guidance, you can navigate the rules and regulations with ease. Remember to carefully review your plan document, consider your investment options, and seek professional advice if needed. By following the steps outlined in this guide, you can ensure a smooth and successful withdrawal process.

What is the minimum age for 401(k) withdrawals?

+The minimum age for 401(k) withdrawals is 59 1/2.

Can I withdraw funds from my 401(k) account online?

+Yes, you can withdraw funds from your 401(k) account online through the One America website.

Are there any penalties for early 401(k) withdrawals?

+Yes, there may be penalties for early 401(k) withdrawals, including a 10% penalty for withdrawals before age 59 1/2.