Filing taxes can be a daunting task, especially for those who are new to the process or have complex tax situations. In Oklahoma, residents are required to file their state income tax returns using Form 511. In this article, we will provide a comprehensive guide to help you understand the Oklahoma Tax Form 511, including its components, filing requirements, and step-by-step instructions.

Understanding Oklahoma Tax Form 511

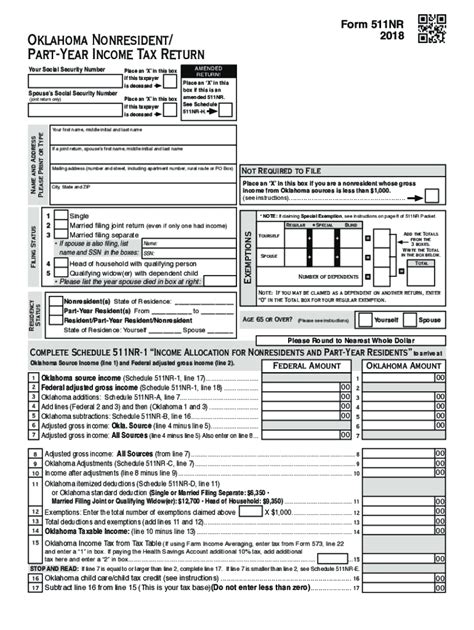

Oklahoma Tax Form 511 is the standard form used by the Oklahoma Tax Commission (OTC) to report an individual's state income tax liability. The form is used to calculate the amount of taxes owed to the state and to claim any eligible credits or deductions. The form consists of multiple sections, including income, deductions, credits, and tax liability.

Who Needs to File Form 511?

Not everyone is required to file Form 511. You must file an Oklahoma state income tax return if you meet one of the following conditions:

- You have Oklahoma state income tax withheld from your paycheck

- You have Oklahoma state income tax credits to claim

- You have Oklahoma state income tax deductions to claim

- You are required to make estimated tax payments

- You have Oklahoma state income tax liability to pay

Filing Requirements and Deadlines

To ensure timely filing, it's essential to understand the filing requirements and deadlines for Oklahoma Tax Form 511.

- Filing Status: You can file as single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Filing Deadline: The filing deadline for Oklahoma Tax Form 511 is April 15th of each year.

- Extension of Time to File: If you need more time to file, you can request an automatic six-month extension by filing Form 504 by the original deadline.

What You Need to File Form 511

Before you start filing Form 511, make sure you have the following documents and information:

- W-2 forms from all employers

- 1099 forms for freelance work, interest, dividends, and capital gains

- Last year's tax return (if applicable)

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Oklahoma driver's license or state ID

Step-by-Step Instructions for Filing Form 511

Now that you have all the necessary documents and information, it's time to start filing Form 511. Here's a step-by-step guide to help you navigate the process:

- Determine Your Filing Status: Choose your filing status based on your marital status and family situation.

- Report Your Income: Enter your income from all sources, including wages, tips, and self-employment income.

- Claim Deductions and Credits: Claim eligible deductions and credits, such as the standard deduction, itemized deductions, and tax credits.

- Calculate Your Tax Liability: Calculate your total tax liability based on your income, deductions, and credits.

- Pay Any Tax Due: Pay any tax due by the filing deadline to avoid penalties and interest.

Additional Forms and Schedules

Depending on your tax situation, you may need to file additional forms and schedules with your Form 511. Some common forms and schedules include:

- Schedule A: Itemized Deductions

- Schedule B: Interest and Dividend Income

- Schedule C: Business Income and Expenses

- Schedule D: Capital Gains and Losses

- Form 504: Extension of Time to File

Oklahoma Tax Form 511 Filing Options

You have several options to file your Oklahoma Tax Form 511:

- E-File: File electronically using the Oklahoma Tax Commission's online portal or a tax preparation software.

- Mail: Mail your completed form to the Oklahoma Tax Commission.

- In-Person: File in person at a local Oklahoma Tax Commission office.

Benefits of E-Filing

E-filing is a convenient and efficient way to file your Oklahoma Tax Form 511. Benefits of e-filing include:

- Faster processing and refund times

- Reduced errors and rejections

- Increased security and accuracy

- Ability to track the status of your return

Common Mistakes to Avoid

When filing your Oklahoma Tax Form 511, avoid common mistakes that can delay processing or result in penalties:

- Inaccurate or missing information: Double-check your social security number, address, and income information.

- Insufficient payment: Make sure to pay any tax due by the filing deadline.

- Incorrect filing status: Choose the correct filing status based on your marital status and family situation.

Amending Your Return

If you need to make changes to your original return, you can file an amended return using Form 511-X. You can amend your return to:

- Correct errors or omissions

- Claim additional deductions or credits

- Report changes in income or tax liability

Conclusion and Next Steps

Filing your Oklahoma Tax Form 511 requires attention to detail and accuracy. By following the step-by-step instructions and avoiding common mistakes, you can ensure a smooth and efficient filing process. If you have any questions or concerns, you can contact the Oklahoma Tax Commission or consult with a tax professional.

We hope this comprehensive guide has helped you understand the Oklahoma Tax Form 511 and its filing requirements. If you have any further questions or need assistance with your tax return, please don't hesitate to reach out.

What is the deadline for filing Oklahoma Tax Form 511?

+The filing deadline for Oklahoma Tax Form 511 is April 15th of each year.

Can I e-file my Oklahoma Tax Form 511?

+Yes, you can e-file your Oklahoma Tax Form 511 using the Oklahoma Tax Commission's online portal or a tax preparation software.

What if I need to make changes to my original return?

+If you need to make changes to your original return, you can file an amended return using Form 511-X.