Filing taxes can be a daunting task, especially when it comes to complex forms like the OGE Form 450. The Office of Government Ethics (OGE) requires this form to be submitted by certain government employees and officials to disclose their financial interests and assets. With the deadline looming, it's essential to understand the intricacies of the OGE Form 450 and how to navigate its complexities. In this article, we'll provide you with 5 essential filing tips to help you unlock the OGE Form 450 and ensure a smooth submission process.

Understanding the OGE Form 450

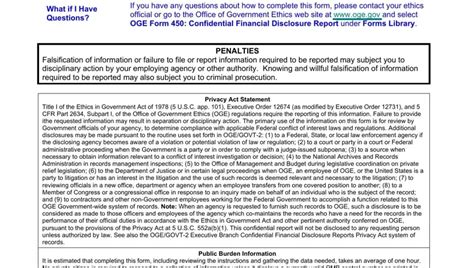

The OGE Form 450 is a critical document that requires filers to disclose their financial interests, assets, and liabilities. The form is designed to promote transparency and prevent conflicts of interest among government officials. It's essential to understand the form's purpose and the types of information required to ensure accurate and complete filing.

Tip 1: Determine Your Filing Status

Before starting the filing process, it's crucial to determine your filing status. The OGE Form 450 is required for certain government employees and officials, including:

- Senate-confirmed officials

- Presidential appointees

- Senior Executive Service (SES) members

- Other high-ranking government officials

If you're unsure about your filing status, consult with your agency's ethics office or the OGE website for guidance.

Breaking Down the OGE Form 450 Sections

The OGE Form 450 is divided into several sections, each requiring specific information. Understanding the sections and the types of information required is critical to accurate filing.

Section I: Identification and Contact Information

This section requires basic identification and contact information, including:

- Name and title

- Agency and office

- Address and phone number

Section II: Financial Interests and Assets

This section requires disclosure of financial interests and assets, including:

- Stocks and bonds

- Real estate holdings

- Retirement accounts

- Other financial interests

Section III: Liabilities and Gifts

This section requires disclosure of liabilities and gifts, including:

- Debts and loans

- Gifts received from outside sources

Tip 2: Gather Required Documents and Information

To ensure accurate filing, gather all required documents and information before starting the filing process. This includes:

- Financial statements and account records

- Tax returns and W-2 forms

- Real estate deeds and property records

- Gift receipts and documentation

Tip 3: Understand the Filing Deadline and Extensions

The OGE Form 450 filing deadline is typically May 15th of each year. However, extensions may be granted in certain circumstances. It's essential to understand the filing deadline and extension rules to avoid penalties and fines.

Tip 4: Seek Guidance and Support

Filing the OGE Form 450 can be complex and overwhelming. Don't hesitate to seek guidance and support from your agency's ethics office or the OGE website. Additionally, consider consulting with a financial advisor or tax professional to ensure accurate and complete filing.

Tip 5: Review and Verify Your Submission

Before submitting your OGE Form 450, review and verify your submission to ensure accuracy and completeness. This includes:

- Reviewing all sections and attachments

- Verifying financial information and calculations

- Ensuring all required signatures and dates are included

By following these 5 essential filing tips, you'll be well on your way to unlocking the OGE Form 450 and ensuring a smooth submission process. Remember to stay informed, seek guidance, and review your submission carefully to avoid penalties and fines.

Conclusion

Filing the OGE Form 450 is a critical requirement for certain government employees and officials. By understanding the form's purpose, sections, and filing requirements, you'll be able to navigate its complexities and ensure accurate and complete filing. Remember to seek guidance, review your submission carefully, and stay informed to avoid penalties and fines.

FAQ Section

Who is required to file the OGE Form 450?

+The OGE Form 450 is required for certain government employees and officials, including Senate-confirmed officials, Presidential appointees, Senior Executive Service (SES) members, and other high-ranking government officials.

What is the filing deadline for the OGE Form 450?

+The OGE Form 450 filing deadline is typically May 15th of each year. However, extensions may be granted in certain circumstances.

Where can I find guidance and support for filing the OGE Form 450?

+You can find guidance and support on the OGE website or by consulting with your agency's ethics office. Additionally, consider consulting with a financial advisor or tax professional to ensure accurate and complete filing.