As a business owner in New York State, it's essential to understand the process of completing the NYS Sales Tax Form ST-100. This form is used to report and pay sales tax on taxable sales and purchases made by your business. In this article, we'll guide you through the 6 steps to complete the NYS Sales Tax Form ST-100 accurately and efficiently.

Understanding the NYS Sales Tax Form ST-100

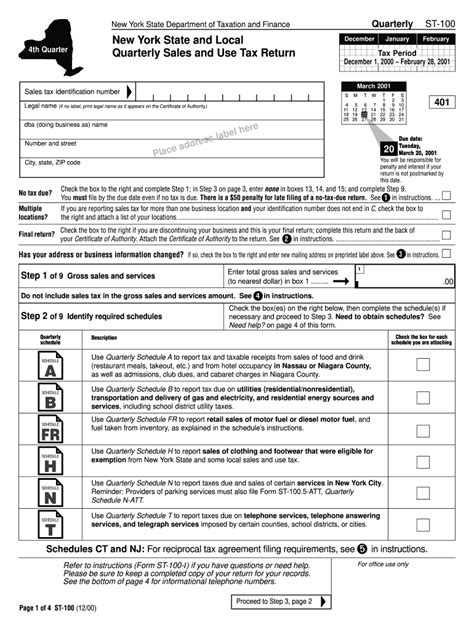

The NYS Sales Tax Form ST-100 is a quarterly return that must be filed by businesses that collect sales tax in New York State. The form is used to report sales tax collected on taxable sales and purchases, as well as to claim any allowable credits or deductions.

Step 1: Gather Required Information and Documents

Before starting to complete the NYS Sales Tax Form ST-100, gather all the necessary information and documents. These may include:

- Your business's Federal Employer Identification Number (FEIN)

- Your New York State Taxpayer Identification Number (TIN)

- Sales tax collected on taxable sales and purchases

- Allowable credits or deductions

- Records of sales tax exemptions or exclusions

- Records of any sales tax payments made during the quarter

Important Documents to Keep Handy

- Sales tax invoices and receipts

- Purchase orders and receipts

- Exemption certificates

- Records of sales tax payments made during the quarter

Step 2: Determine Your Filing Frequency and Due Date

The NYS Sales Tax Form ST-100 is typically filed on a quarterly basis. However, the filing frequency and due date may vary depending on your business's sales tax obligations.

- Quarterly filers: The due date for quarterly filers is the 20th day of the month following the end of the quarter.

- Annual filers: The due date for annual filers is February 20th of the following year.

Quarterly Filing Periods

- January 1 - March 31: April 20th

- April 1 - June 30: July 20th

- July 1 - September 30: October 20th

- October 1 - December 31: January 20th

Step 3: Complete the Form ST-100

Now that you have gathered all the necessary information and documents, it's time to complete the NYS Sales Tax Form ST-100.

- Part 1: Report sales tax collected on taxable sales and purchases

- Part 2: Claim any allowable credits or deductions

- Part 3: Report any sales tax exemptions or exclusions

- Part 4: Calculate the total sales tax due or overpayment

Important Fields to Complete

- Line 1: Total sales tax collected

- Line 2: Total sales tax due

- Line 3: Allowable credits or deductions

- Line 4: Sales tax exemptions or exclusions

Step 4: Calculate the Total Sales Tax Due or Overpayment

To calculate the total sales tax due or overpayment, follow these steps:

- Subtract the total sales tax collected from the total sales tax due

- Add any allowable credits or deductions

- Subtract any sales tax exemptions or exclusions

Example Calculation

- Total sales tax collected: $1,000

- Total sales tax due: $1,200

- Allowable credits or deductions: $100

- Sales tax exemptions or exclusions: $50

Total sales tax due or overpayment: $1,200 - $1,000 + $100 - $50 = $250

Step 5: Submit the Form ST-100 and Make Payment

Once you have completed the NYS Sales Tax Form ST-100, submit it to the New York State Department of Taxation and Finance.

- Online: File and pay online through the New York State Tax Department's website

- Mail: Mail the completed form and payment to the address listed on the form

- In-person: Submit the form and payment in person at a designated Tax Department office

Payment Options

- Electronic funds transfer (EFT)

- Check or money order

- Credit card (online only)

Step 6: Keep Accurate Records

Finally, keep accurate records of your sales tax transactions, including:

- Sales tax invoices and receipts

- Purchase orders and receipts

- Exemption certificates

- Records of sales tax payments made during the quarter

Importance of Accurate Records

- Ensures compliance with sales tax laws and regulations

- Helps prevent errors and penalties

- Provides a clear audit trail

We hope this article has provided you with a comprehensive guide on how to complete the NYS Sales Tax Form ST-100. By following these 6 steps, you can ensure that your business is in compliance with New York State sales tax laws and regulations.

We encourage you to share your thoughts and experiences on completing the NYS Sales Tax Form ST-100. Do you have any tips or best practices to share? Leave a comment below!

What is the due date for quarterly filers?

+The due date for quarterly filers is the 20th day of the month following the end of the quarter.

What is the penalty for late filing?

+The penalty for late filing is 5% of the tax due, plus 0.5% of the tax due for each month or fraction of a month that the return is late.

Can I file the Form ST-100 online?

+Yes, you can file the Form ST-100 online through the New York State Tax Department's website.