New York is one of the states with a complex tax system, and understanding the nuances of tax filing can be overwhelming for many residents. One crucial aspect of tax compliance in New York is the NY Withholding Form, also known as the IT-2104 form. This form is used by employers to report the amount of taxes withheld from employees' wages and salaries. In this article, we will delve into the world of NY Withholding Form, exploring its importance, filing requirements, and providing tips for accurate filing.

What is the NY Withholding Form?

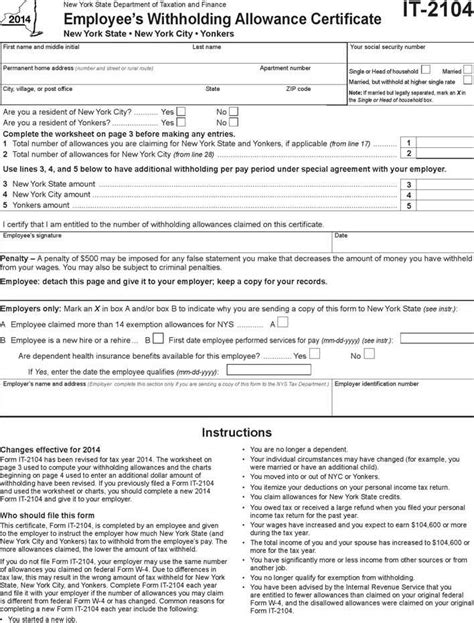

The NY Withholding Form, also known as the IT-2104 form, is a quarterly tax return that employers in New York State are required to file. The form is used to report the amount of taxes withheld from employees' wages and salaries, as well as other payments, such as bonuses, commissions, and tips. Employers are required to withhold taxes from employees' wages and salaries, and this form serves as a record of those withholdings.

Why is the NY Withholding Form Important?

The NY Withholding Form is crucial for both employers and employees. For employers, the form serves as proof of compliance with tax withholding regulations. Failure to file the form or pay the required taxes can result in penalties and fines. For employees, the form is essential for ensuring accurate tax withholding, which can impact their tax liability and refund.

Who is Required to File the NY Withholding Form?

All employers in New York State are required to file the NY Withholding Form if they:

- Withhold taxes from employees' wages and salaries

- Make payments subject to withholding, such as bonuses, commissions, and tips

- Have employees who are residents of New York State or have a place of business in the state

Filing Requirements for the NY Withholding Form

The NY Withholding Form must be filed on a quarterly basis, with the following due dates:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st for the fourth quarter (October 1 - December 31)

How to File the NY Withholding Form

Filing the NY Withholding Form can be done electronically or by mail. Employers can file the form online through the New York State Department of Taxation and Finance website or by submitting a paper copy to the department.

To file the form, employers will need to:

- Complete the IT-2104 form, including the employer's identification number, address, and contact information

- Report the total amount of taxes withheld from employees' wages and salaries for the quarter

- Report any adjustments or corrections to previous quarters

- Sign and date the form

Tips for Accurate Filing

To ensure accurate filing of the NY Withholding Form, employers should:

- Keep accurate records of tax withholdings and payments

- Use the correct form and instructions

- Report all required information, including adjustments and corrections

- Verify the accuracy of the form before filing

- Keep a copy of the filed form for their records

Common Mistakes to Avoid

When filing the NY Withholding Form, employers should avoid the following common mistakes:

- Failure to report all required information

- Incorrect calculation of tax withholdings

- Failure to file the form on time

- Incorrect or incomplete address or contact information

Penalties for Non-Compliance

Failure to file the NY Withholding Form or pay the required taxes can result in penalties and fines. The New York State Department of Taxation and Finance may impose the following penalties:

- 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%

- 1% of the unpaid tax for each month or part of a month, if the employer is willfully neglecting to file the form

Conclusion

The NY Withholding Form is a critical component of tax compliance in New York State. Employers must file the form accurately and on time to avoid penalties and fines. By understanding the filing requirements and tips for accurate filing, employers can ensure compliance with tax withholding regulations and avoid common mistakes.

Additional Resources

For more information on the NY Withholding Form and tax compliance in New York State, employers can visit the New York State Department of Taxation and Finance website or consult with a tax professional.

What is the purpose of the NY Withholding Form?

+The NY Withholding Form is used by employers to report the amount of taxes withheld from employees' wages and salaries, as well as other payments, such as bonuses, commissions, and tips.

Who is required to file the NY Withholding Form?

+All employers in New York State are required to file the NY Withholding Form if they withhold taxes from employees' wages and salaries, make payments subject to withholding, or have employees who are residents of New York State or have a place of business in the state.

What are the due dates for filing the NY Withholding Form?

+The NY Withholding Form must be filed on a quarterly basis, with the following due dates: April 30th for the first quarter, July 31st for the second quarter, October 31st for the third quarter, and January 31st for the fourth quarter.