Filing taxes can be a daunting task, especially for individuals with complex financial situations. In New York State, residents are required to file a variety of tax forms, including the IT-203-B. But what exactly is the IT-203-B, and how does it affect your tax obligations?

In this article, we'll delve into the world of New York State taxation and explore five essential facts about the NY Form IT-203-B. Whether you're a seasoned taxpayer or just starting out, this guide will help you navigate the complexities of the IT-203-B and ensure you're in compliance with state tax regulations.

What is the NY Form IT-203-B?

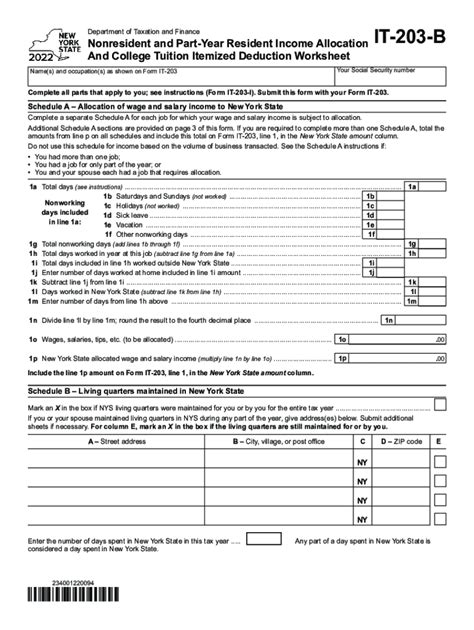

The NY Form IT-203-B is a supplemental tax form used by the New York State Department of Taxation and Finance to report income from various sources, including interest, dividends, and capital gains. This form is typically filed in conjunction with the standard New York State income tax return, Form IT-203.

Who Needs to File the IT-203-B?

Not all New York State residents need to file the IT-203-B. Generally, this form is required for individuals who have income from sources that are not reported on the standard IT-203 form. Some common examples of income that may require the IT-203-B include:

- Interest from savings accounts, certificates of deposit (CDs), or bonds

- Dividends from stocks or mutual funds

- Capital gains from the sale of investments or assets

- Income from trusts, estates, or partnerships

Benefits of Filing the IT-203-B

Filing the IT-203-B can provide several benefits, including:

- Accurate reporting of income: By reporting all income sources on the IT-203-B, you can ensure that your tax return is accurate and complete.

- Reduced audit risk: Filing the IT-203-B can help reduce the risk of an audit, as it demonstrates your compliance with state tax regulations.

- Potential tax savings: In some cases, reporting income on the IT-203-B may result in a lower tax liability, as certain types of income may be eligible for deductions or credits.

How to File the IT-203-B

Filing the IT-203-B is a relatively straightforward process. Here are the general steps to follow:

- Gather required documentation: Collect all necessary documentation, including interest statements, dividend reports, and capital gains statements.

- Complete the form: Fill out the IT-203-B form, making sure to report all required income sources.

- Attach supporting documentation: Attach copies of supporting documentation, such as interest statements and dividend reports.

- File the form: Submit the completed IT-203-B form to the New York State Department of Taxation and Finance, either electronically or by mail.

Deadlines and Penalties

The deadline for filing the IT-203-B is typically the same as the deadline for filing the standard IT-203 form. Failure to file the IT-203-B by the deadline may result in penalties and interest on any unpaid tax liability.

Common Mistakes to Avoid

When filing the IT-203-B, it's essential to avoid common mistakes that can result in errors, delays, or even penalties. Some common mistakes to avoid include:

- Failing to report all income sources

- Incorrectly calculating tax liability

- Failing to attach supporting documentation

- Missing the filing deadline

By understanding the ins and outs of the NY Form IT-203-B, you can ensure that your tax return is accurate, complete, and compliant with state regulations. Remember to gather all required documentation, complete the form accurately, and file by the deadline to avoid any potential penalties or errors.

We hope this article has provided valuable insights into the world of New York State taxation and the NY Form IT-203-B. If you have any further questions or concerns, please don't hesitate to reach out.

What is the NY Form IT-203-B used for?

+The NY Form IT-203-B is used to report income from various sources, including interest, dividends, and capital gains.

Who needs to file the IT-203-B?

+Individuals with income from sources not reported on the standard IT-203 form, such as interest, dividends, and capital gains, may need to file the IT-203-B.

What is the deadline for filing the IT-203-B?

+The deadline for filing the IT-203-B is typically the same as the deadline for filing the standard IT-203 form.