Filing taxes can be a daunting task, but one crucial step in the process is completing Form W-4V, also known as the Voluntary Withholding Request. This form is used by individuals who receive certain government payments, such as Social Security benefits, to request voluntary withholding of federal income tax. In this article, we will guide you through the process of filling out Form W-4V online and provide you with valuable information to make the process easier.

What is Form W-4V?

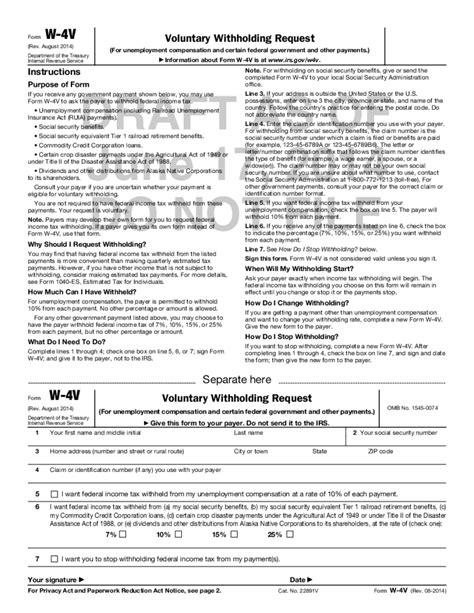

Form W-4V is a voluntary withholding request form used by recipients of certain government payments, including Social Security benefits, Supplemental Security Income (SSI) benefits, and unemployment compensation. By completing this form, individuals can request that the payer withhold federal income tax from their payments.

Who Needs to Fill Out Form W-4V?

If you receive any of the following government payments, you may need to fill out Form W-4V:

- Social Security benefits

- Supplemental Security Income (SSI) benefits

- Unemployment compensation

- Railroad Retirement benefits

- Tier 1 Railroad Retirement benefits

How to Fill Out Form W-4V Online

Filling out Form W-4V online is a straightforward process. Here's a step-by-step guide to help you complete the form:

- Determine if you need to fill out Form W-4V: If you receive any of the government payments mentioned earlier, you may need to fill out this form.

- Gather required information: You will need to provide your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Choose your withholding percentage: You can choose to have 7%, 10%, 12%, or 22% of your payments withheld for federal income tax.

- Complete the form: Fill out the form online, providing the required information and selecting your desired withholding percentage.

- Submit the form: Once you have completed the form, submit it online or print and mail it to the address listed on the form.

Benefits of Filling Out Form W-4V Online

Filling out Form W-4V online offers several benefits, including:

- Convenience: You can complete the form from the comfort of your own home, 24/7.

- Accuracy: Online forms reduce the risk of errors, ensuring that your information is accurate and complete.

- Speed: Online submissions are processed faster than paper forms, ensuring that your withholding request is processed quickly.

- Security: Online forms are secure, protecting your personal and financial information.

Common Mistakes to Avoid When Filling Out Form W-4V

When filling out Form W-4V, it's essential to avoid common mistakes that can delay processing or result in incorrect withholding. Here are some mistakes to avoid:

- Inaccurate or incomplete information: Ensure that you provide accurate and complete information, including your name, address, and Social Security number or ITIN.

- Incorrect withholding percentage: Choose the correct withholding percentage to avoid under or overpaying taxes.

- Failure to submit the form: Ensure that you submit the form online or by mail to the correct address.

FAQs About Form W-4V

Here are some frequently asked questions about Form W-4V:

Do I need to fill out Form W-4V if I'm already having taxes withheld from my Social Security benefits?

+No, if you're already having taxes withheld from your Social Security benefits, you don't need to fill out Form W-4V.

Can I change my withholding percentage at any time?

+Yes, you can change your withholding percentage at any time by completing a new Form W-4V and submitting it to the payer.

Do I need to fill out Form W-4V if I'm not a U.S. citizen?

+It depends on your individual circumstances. If you're a non-resident alien, you may need to fill out Form W-8BEN instead. Consult with a tax professional or the IRS to determine the correct form for your situation.

By following these steps and tips, you can easily fill out Form W-4V online and ensure that your government payments are withheld correctly for federal income tax. Remember to avoid common mistakes and consult with a tax professional if you have any questions or concerns.

Take the first step today and fill out Form W-4V online. Share your experiences and tips in the comments below, and don't forget to share this article with friends and family who may need to complete this form.