A 1035 exchange is a tax-deferred exchange of a life insurance policy or an annuity contract for a new life insurance policy or annuity contract. Northwestern Mutual offers this option to its policyholders, allowing them to upgrade their coverage or adjust their policy to better suit their changing needs. The Northwestern Mutual 1035 exchange form is a crucial document that facilitates this process. In this article, we will delve into the intricacies of the 1035 exchange process and provide a step-by-step guide on how to navigate the Northwestern Mutual 1035 exchange form.

What is a 1035 Exchange?

A 1035 exchange is a provision under Section 1035 of the Internal Revenue Code that allows policyholders to exchange an existing life insurance policy or annuity contract for a new one without incurring tax liabilities. This exchange can be made for various reasons, such as upgrading coverage, adjusting policy terms, or switching to a more suitable policy. The 1035 exchange process involves transferring the cash value of the existing policy to the new policy, thereby deferring taxes on any gains.

Benefits of a 1035 Exchange

A 1035 exchange offers several benefits to policyholders, including:

- Tax-deferred growth: The exchange allows policyholders to transfer the cash value of their existing policy to a new policy without incurring taxes on any gains.

- Increased coverage: Policyholders can upgrade their coverage to better suit their changing needs.

- Improved policy terms: The exchange enables policyholders to adjust policy terms, such as premium payments or death benefits.

- Reduced premiums: In some cases, policyholders may be able to reduce their premiums by exchanging their existing policy for a new one.

Northwestern Mutual 1035 Exchange Form: A Step-By-Step Guide

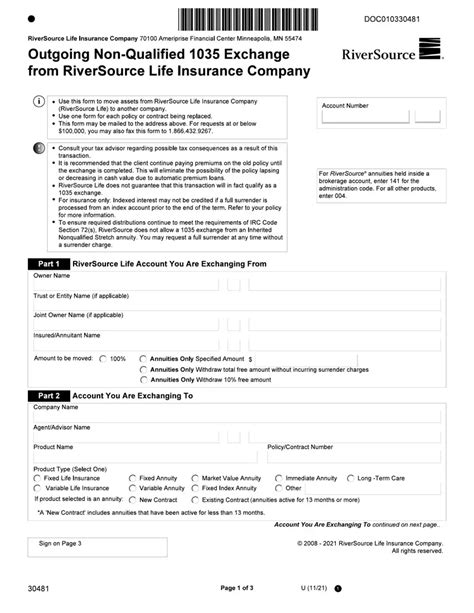

The Northwestern Mutual 1035 exchange form is a document that policyholders must complete to initiate the exchange process. Here's a step-by-step guide to help you navigate the form:

**Step 1: Review Your Policy Options**

Before initiating the 1035 exchange process, review your policy options to determine the best course of action. Consider factors such as coverage, premium payments, and policy terms.

Step 2: Gather Required Documents

To complete the Northwestern Mutual 1035 exchange form, you'll need to gather the following documents:

- Existing policy contract: You'll need to provide details about your existing policy, including the policy number and coverage amount.

- Identification documents: You may need to provide identification documents, such as a driver's license or passport.

- Proof of address: You may need to provide proof of address, such as a utility bill or bank statement.

**Step 3: Complete the 1035 Exchange Form**

The Northwestern Mutual 1035 exchange form is a multi-page document that requires you to provide detailed information about your existing policy and the new policy you're interested in purchasing. The form will ask for the following information:

- Policyholder information: You'll need to provide your name, address, and contact information.

- Existing policy information: You'll need to provide details about your existing policy, including the policy number and coverage amount.

- New policy information: You'll need to provide details about the new policy you're interested in purchasing, including the policy number and coverage amount.

Step 4: Review and Sign the Form

Once you've completed the form, review it carefully to ensure accuracy. Sign and date the form, and make a copy for your records.

Step 5: Submit the Form

Submit the completed form to Northwestern Mutual, along with any required documents. You can submit the form online, by mail, or through your agent.

**After Submitting the Form**

After submitting the form, Northwestern Mutual will review your application and initiate the 1035 exchange process. This may take several weeks, depending on the complexity of your application.

Tips and Reminders

- Review your policy options carefully: Before initiating the 1035 exchange process, review your policy options to determine the best course of action.

- Gather required documents: Make sure you have all required documents before submitting the form.

- Review and sign the form carefully: Review the form carefully before signing and submitting it.

Common Mistakes to Avoid

- Incomplete or inaccurate information: Make sure you provide complete and accurate information on the form.

- Failure to gather required documents: Make sure you have all required documents before submitting the form.

- Not reviewing the form carefully: Review the form carefully before signing and submitting it.

Conclusion

The Northwestern Mutual 1035 exchange form is a document that policyholders must complete to initiate the exchange process. By following the step-by-step guide outlined above, you can navigate the form with ease and ensure a smooth exchange process.

Call to Action

If you're considering a 1035 exchange, contact Northwestern Mutual today to learn more about the process and to determine if it's right for you.

FAQs

Q: What is a 1035 exchange?

A: A 1035 exchange is a provision under Section 1035 of the Internal Revenue Code that allows policyholders to exchange an existing life insurance policy or annuity contract for a new one without incurring tax liabilities.

Q: What are the benefits of a 1035 exchange?

A: The benefits of a 1035 exchange include tax-deferred growth, increased coverage, improved policy terms, and reduced premiums.

Q: How do I initiate the 1035 exchange process?

A: To initiate the 1035 exchange process, you'll need to complete the Northwestern Mutual 1035 exchange form and submit it to Northwestern Mutual, along with any required documents.

Q: How long does the 1035 exchange process take?

A: The 1035 exchange process may take several weeks, depending on the complexity of your application.

Q: Can I cancel my 1035 exchange?

A: Yes, you can cancel your 1035 exchange, but you may be subject to certain penalties or fees.