The North Carolina CD-419 form is a crucial document for businesses operating in the state, particularly those involved in the sale of tangible personal property. As a business owner, understanding the purpose, requirements, and implications of this form is essential to ensure compliance with North Carolina's tax laws. In this article, we will delve into the details of the CD-419 form, providing a comprehensive guide for businesses to navigate the process with ease.

Why is the CD-419 form important?

The CD-419 form, also known as the Certificate of Compliance for Sales Tax, is a document that verifies a business's compliance with North Carolina's sales tax laws. It is typically required when a business purchases or sells tangible personal property, such as inventory, equipment, or supplies. The form serves as proof that the business has paid the required sales tax on the transaction or is exempt from paying sales tax.

Who needs to complete the CD-419 form?

Businesses operating in North Carolina that engage in the sale of tangible personal property are required to complete the CD-419 form. This includes:

- Retailers

- Wholesalers

- Distributors

- Manufacturers

- Construction contractors

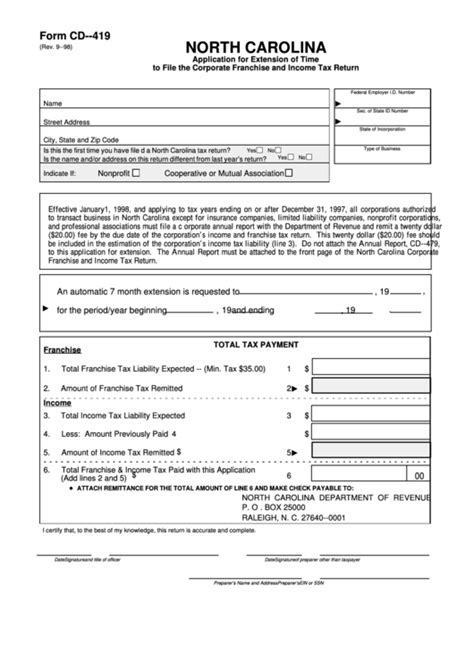

What information is required on the CD-419 form?

The CD-419 form requires the following information:

- Business name and address

- Federal Employer Identification Number (FEIN)

- North Carolina Sales Tax Account Number

- Type of business (retail, wholesale, etc.)

- Description of the property being sold or purchased

- Date of sale or purchase

- Sales price or purchase price

- Sales tax amount (if applicable)

How to complete the CD-419 form

Completing the CD-419 form requires attention to detail and accuracy. Businesses can follow these steps to ensure they complete the form correctly:

- Obtain the correct form: Download the CD-419 form from the North Carolina Department of Revenue website or contact the department directly.

- Fill out the form: Complete the form in its entirety, providing all required information.

- Sign and date the form: The business owner or authorized representative must sign and date the form.

- Attach supporting documentation: If required, attach supporting documentation, such as invoices or receipts.

When is the CD-419 form due?

The CD-419 form is typically due at the time of sale or purchase. However, in some cases, the form may be due at a later date, such as:

- When a business applies for a sales tax exemption

- When a business files an amended return

- When a business is audited by the North Carolina Department of Revenue

Penalties for non-compliance

Failure to complete the CD-419 form or provide false information can result in penalties and fines. The North Carolina Department of Revenue may impose:

- A penalty of $50 or 5% of the tax due, whichever is greater

- Interest on the unpaid tax

- Fines for willful neglect or fraud

Exemptions and exceptions

Some businesses may be exempt from completing the CD-419 form or paying sales tax. These include:

- Businesses selling exempt property, such as food or prescription medication

- Businesses with a valid resale certificate

- Businesses with a valid sales tax exemption certificate

Conclusion

In conclusion, the North Carolina CD-419 form is a critical document for businesses operating in the state. By understanding the purpose, requirements, and implications of this form, businesses can ensure compliance with North Carolina's tax laws and avoid penalties and fines. If you have any questions or concerns about the CD-419 form, consult with a tax professional or contact the North Carolina Department of Revenue.

What is the purpose of the CD-419 form?

+The CD-419 form verifies a business's compliance with North Carolina's sales tax laws and serves as proof that the business has paid the required sales tax on a transaction or is exempt from paying sales tax.

Who needs to complete the CD-419 form?

+Businesses operating in North Carolina that engage in the sale of tangible personal property, such as retailers, wholesalers, distributors, manufacturers, and construction contractors.

What are the penalties for non-compliance with the CD-419 form?

+Failure to complete the CD-419 form or provide false information can result in penalties and fines, including a penalty of $50 or 5% of the tax due, interest on the unpaid tax, and fines for willful neglect or fraud.