As a business owner in New Jersey, it's essential to understand the intricacies of workers' compensation laws, including exemptions. The New Jersey Workers' Compensation Exemption Form is a crucial document that can help you navigate the complexities of workers' compensation exemptions. In this comprehensive guide, we'll delve into the world of workers' compensation exemptions, exploring what they are, who is eligible, and how to file for an exemption.

Understanding Workers' Compensation Exemptions in New Jersey

In New Jersey, workers' compensation is a mandatory insurance program that provides benefits to employees who suffer work-related injuries or illnesses. However, some individuals may be exempt from workers' compensation coverage, including certain business owners, partners, and independent contractors. To qualify for an exemption, you'll need to file the New Jersey Workers' Compensation Exemption Form with the New Jersey Department of Labor and Workforce Development.

Who is Eligible for a Workers' Compensation Exemption in New Jersey?

To be eligible for a workers' compensation exemption in New Jersey, you must meet specific requirements. These include:

- Being a sole proprietor or a single-member limited liability company (LLC)

- Being a partner in a partnership

- Being an independent contractor

- Being a corporate officer who owns at least 25% of the corporation's stock

- Being a member of a limited liability company (LLC) that is not required to have workers' compensation coverage

The Benefits of Filing for a Workers' Compensation Exemption

Filing for a workers' compensation exemption can provide several benefits, including:

- Reduced insurance costs: By exempting yourself from workers' compensation coverage, you may be able to reduce your insurance premiums.

- Increased flexibility: As an exempt individual, you may have more flexibility in managing your business and making decisions about your work.

- Tax benefits: Depending on your business structure and tax situation, you may be able to claim tax deductions for your exemption.

How to File for a Workers' Compensation Exemption in New Jersey

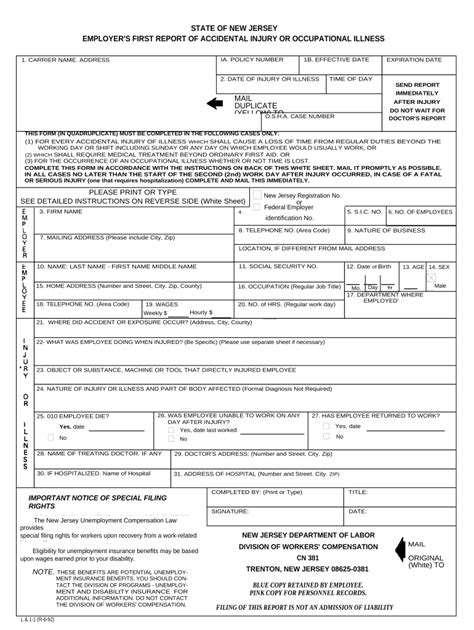

To file for a workers' compensation exemption in New Jersey, you'll need to complete the New Jersey Workers' Compensation Exemption Form and submit it to the New Jersey Department of Labor and Workforce Development. Here's a step-by-step guide to help you through the process:

- Download the exemption form: You can download the New Jersey Workers' Compensation Exemption Form from the New Jersey Department of Labor and Workforce Development website.

- Complete the form: Fill out the form accurately and thoroughly, providing all required information.

- Attach supporting documentation: You may need to attach supporting documentation, such as business registration documents or tax returns.

- Submit the form: Submit the completed form and supporting documentation to the New Jersey Department of Labor and Workforce Development.

Common Mistakes to Avoid When Filing for a Workers' Compensation Exemption

When filing for a workers' compensation exemption, it's essential to avoid common mistakes that can lead to delays or rejection. Here are some mistakes to watch out for:

- Incomplete or inaccurate information: Make sure to provide all required information and ensure that it's accurate.

- Failure to attach supporting documentation: Attach all required supporting documentation to avoid delays.

- Filing the wrong form: Ensure that you're filing the correct form for your business structure and exemption type.

Conclusion and Next Steps

Filing for a workers' compensation exemption in New Jersey can be a complex process, but with the right guidance, you can navigate the requirements and avoid common mistakes. By following this guide, you'll be well on your way to completing the New Jersey Workers' Compensation Exemption Form and submitting it to the New Jersey Department of Labor and Workforce Development.

We encourage you to share your experiences and ask questions in the comments section below. If you have any further questions or concerns, don't hesitate to reach out to a qualified professional for guidance.

What is the New Jersey Workers' Compensation Exemption Form?

+The New Jersey Workers' Compensation Exemption Form is a document that allows eligible individuals to exempt themselves from workers' compensation coverage in New Jersey.

Who is eligible for a workers' compensation exemption in New Jersey?

+Eligible individuals include sole proprietors, partners, independent contractors, corporate officers who own at least 25% of the corporation's stock, and members of limited liability companies (LLCs) that are not required to have workers' compensation coverage.

What are the benefits of filing for a workers' compensation exemption?

+The benefits of filing for a workers' compensation exemption include reduced insurance costs, increased flexibility, and tax benefits.