NJ ST-3 Form: A Comprehensive Guide to State Tax Filing

As a New Jersey resident, understanding the NJ ST-3 form is crucial for accurate and timely state tax filing. The NJ ST-3 form, also known as the New Jersey Employer's Quarterly Report, is a vital document that employers must submit to the state government. In this comprehensive guide, we will delve into the details of the NJ ST-3 form, its importance, and provide step-by-step instructions on how to complete it.

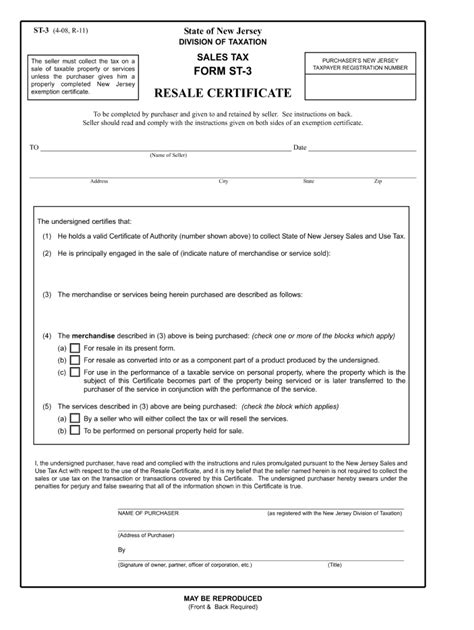

What is the NJ ST-3 Form?

The NJ ST-3 form is a quarterly report that employers in New Jersey must file with the state government to report their employees' wages, taxes withheld, and other relevant information. The form is used to calculate the employer's tax liability and to ensure compliance with the state's tax laws. The NJ ST-3 form is typically filed on a quarterly basis, with deadlines on April 30th, July 31st, October 31st, and January 31st of the following year.

Why is the NJ ST-3 Form Important?

The NJ ST-3 form is essential for several reasons:

- It helps the state government to track and collect taxes owed by employers.

- It ensures that employers are in compliance with the state's tax laws and regulations.

- It provides valuable information for the state to calculate and distribute tax refunds to employees.

- It helps employers to maintain accurate records of their employees' wages and taxes withheld.

Who Needs to File the NJ ST-3 Form?

All employers in New Jersey who have employees are required to file the NJ ST-3 form. This includes:

- Private sector employers

- Public sector employers

- Non-profit organizations

- Government agencies

How to Complete the NJ ST-3 Form

Completing the NJ ST-3 form can be a daunting task, but with the right guidance, it can be done accurately and efficiently. Here's a step-by-step guide to help you complete the form:

- Gather necessary information: Before starting to complete the form, gather all necessary information, including:

- Employee wages and taxes withheld

- Employer identification number (EIN)

- Business name and address

- Quarter ending date

- Download and print the form: Download the NJ ST-3 form from the New Jersey Department of Treasury's website or print it from the NJ Treasury's online portal.

- Complete the form: Fill out the form accurately and completely, making sure to include all required information.

- Calculate tax liability: Calculate the employer's tax liability using the information provided on the form.

- Sign and date the form: Sign and date the form, making sure to include the employer's name and title.

- Submit the form: Submit the completed form to the New Jersey Department of Treasury by the quarterly deadline.

Tips for Completing the NJ ST-3 Form

- Use the correct form: Make sure to use the correct form for the quarter being reported.

- Include all required information: Include all required information, including employee wages and taxes withheld.

- Calculate tax liability accurately: Calculate the employer's tax liability accurately to avoid penalties and fines.

- Submit the form on time: Submit the completed form by the quarterly deadline to avoid penalties and fines.

NJ ST-3 Form Deadlines and Penalties

The NJ ST-3 form has quarterly deadlines, which are as follows:

- April 30th for the quarter ending March 31st

- July 31st for the quarter ending June 30th

- October 31st for the quarter ending September 30th

- January 31st of the following year for the quarter ending December 31st

Failure to submit the form by the deadline may result in penalties and fines. The penalty for late filing is 5% of the tax due for each month or part of a month, up to a maximum of 25%.

NJ ST-3 Form Amendments and Corrections

If an employer needs to make amendments or corrections to a previously filed NJ ST-3 form, they can do so by filing an amended return. The amended return must be filed within three years of the original filing date. Employers can also file a correction to a previously filed return if they discover an error or omission.

NJ ST-3 Form and the New Jersey Unemployment Compensation Law

The NJ ST-3 form is also used to report information related to the New Jersey Unemployment Compensation Law. Employers must report the following information on the form:

- Employee wages and taxes withheld

- Unemployment compensation contributions

- Employee benefits

Benefits of Filing the NJ ST-3 Form Accurately

Filing the NJ ST-3 form accurately and on time has several benefits, including:

- Avoiding penalties and fines

- Ensuring compliance with the state's tax laws and regulations

- Providing valuable information for the state to calculate and distribute tax refunds to employees

- Helping employers to maintain accurate records of their employees' wages and taxes withheld

Conclusion

The NJ ST-3 form is a critical document that employers in New Jersey must file with the state government to report their employees' wages, taxes withheld, and other relevant information. By understanding the importance of the form, who needs to file it, and how to complete it, employers can ensure accurate and timely state tax filing. By following the tips and guidelines provided in this comprehensive guide, employers can avoid penalties and fines and ensure compliance with the state's tax laws and regulations.

What is the NJ ST-3 form?

+The NJ ST-3 form is a quarterly report that employers in New Jersey must file with the state government to report their employees' wages, taxes withheld, and other relevant information.

Who needs to file the NJ ST-3 form?

+All employers in New Jersey who have employees are required to file the NJ ST-3 form.

What is the deadline for filing the NJ ST-3 form?

+The NJ ST-3 form has quarterly deadlines, which are April 30th, July 31st, October 31st, and January 31st of the following year.