As a resident of New Jersey, it's essential to understand your state tax obligations to avoid any penalties or fines. One crucial document that plays a significant role in this process is the NJ Form 2210. In this article, we'll delve into the details of NJ Form 2210, its purpose, and what you need to do to fulfill your state tax obligations.

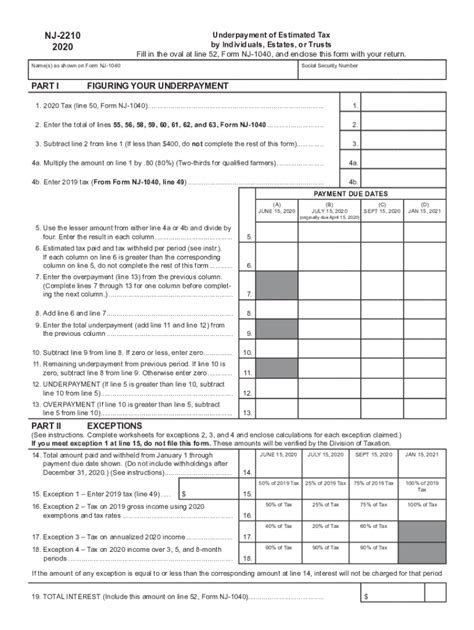

The NJ Form 2210 is a tax form used by the New Jersey Division of Taxation to calculate the amount of underpayment or overpayment of estimated taxes. As a taxpayer, you're required to make estimated tax payments throughout the year if you expect to owe a significant amount of taxes. This form helps you calculate the correct amount of estimated taxes and avoid any penalties.

Why is NJ Form 2210 Important?

The NJ Form 2210 is crucial for several reasons:

- Avoiding penalties: If you don't make sufficient estimated tax payments, you may be subject to penalties and fines. NJ Form 2210 helps you calculate the correct amount of estimated taxes, ensuring you avoid any penalties.

- Accurate tax calculation: The form provides a detailed calculation of your estimated taxes, taking into account your income, deductions, and credits.

- Record-keeping: NJ Form 2210 serves as a record of your estimated tax payments, making it easier to keep track of your tax obligations.

Who Needs to File NJ Form 2210?

You're required to file NJ Form 2210 if you're a New Jersey resident and expect to owe a significant amount of taxes. This includes:

- Individuals with self-employment income

- Renters or landlords with rental income

- Investors with dividend or interest income

- Retirees with pension or annuity income

How to Complete NJ Form 2210

Completing NJ Form 2210 involves several steps:

- Gather necessary documents: Collect your W-2 forms, 1099 forms, and any other relevant tax documents.

- Calculate your estimated taxes: Use the tax calculation worksheet provided with NJ Form 2210 to calculate your estimated taxes.

- Determine your payment schedule: Decide on a payment schedule that works for you, such as quarterly or annually.

- Complete the form: Fill out NJ Form 2210, ensuring you provide accurate information and calculations.

- Submit the form: Mail or e-file the completed form to the New Jersey Division of Taxation.

Common Mistakes to Avoid

When completing NJ Form 2210, avoid the following common mistakes:

- Inaccurate calculations: Double-check your calculations to ensure accuracy.

- Missing deadlines: Make timely payments to avoid penalties.

- Insufficient payments: Ensure you're making sufficient estimated tax payments to avoid underpayment penalties.

NJ Form 2210 Payment Options

You can make NJ Form 2210 payments using the following options:

- Electronic Funds Withdrawal (EFW): Pay online or by phone using EFW.

- Check or money order: Mail a check or money order with your payment voucher.

- Credit card: Pay by credit card online or by phone.

NJ Form 2210 FAQs

Here are some frequently asked questions about NJ Form 2210:

- What is the deadline for filing NJ Form 2210?: The deadline for filing NJ Form 2210 is April 15th of each year.

- Can I e-file NJ Form 2210?: Yes, you can e-file NJ Form 2210 through the New Jersey Division of Taxation website.

- What happens if I miss a payment?: If you miss a payment, you may be subject to penalties and fines.

Conclusion

NJ Form 2210 is a crucial document that helps you understand and fulfill your state tax obligations. By completing the form accurately and making timely payments, you can avoid penalties and fines. Remember to gather necessary documents, calculate your estimated taxes, and submit the form on time. If you have any questions or concerns, refer to the NJ Form 2210 FAQs or consult a tax professional.

What is the purpose of NJ Form 2210?

+NJ Form 2210 is used to calculate the amount of underpayment or overpayment of estimated taxes.

Who needs to file NJ Form 2210?

+Individuals with self-employment income, renters or landlords with rental income, investors with dividend or interest income, and retirees with pension or annuity income need to file NJ Form 2210.

What is the deadline for filing NJ Form 2210?

+The deadline for filing NJ Form 2210 is April 15th of each year.