As a resident of New Jersey or a non-resident who earned income in the state, filing the NJ 1040NR form is a crucial step in meeting your tax obligations. However, completing this form can be a daunting task, especially for those who are new to the process. In this article, we will guide you through the steps to fill out the NJ 1040NR form correctly, ensuring that you avoid common errors and potential penalties.

Understanding the NJ 1040NR Form

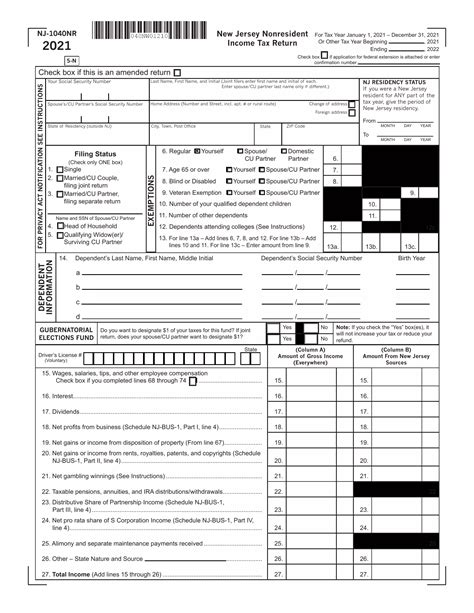

The NJ 1040NR form is the New Jersey non-resident income tax return, which is used by individuals who are not residents of New Jersey but have earned income in the state. This form is used to report income earned from New Jersey sources, such as employment, self-employment, and investments.

Gathering Required Documents

Before starting to fill out the NJ 1040NR form, it is essential to gather all the required documents. These include:

- W-2 forms from your employer(s)

- 1099 forms for freelance work, self-employment, or investment income

- Interest statements from banks and investments

- Dividend statements from investments

- Records of any deductions or credits you are claiming

Filling Out the NJ 1040NR Form

Now that you have gathered all the required documents, it is time to start filling out the NJ 1040NR form. Here are the steps to follow:

Section 1: Identification

In this section, you will provide your personal identification information, including your name, address, and Social Security number.

-

Section 2: Income

In this section, you will report all the income you earned from New Jersey sources. This includes wages, salaries, tips, and investment income.

-

Section 3: Deductions and Credits

In this section, you will claim any deductions and credits you are eligible for. This includes deductions for charitable donations, medical expenses, and mortgage interest.

-

Section 4: Tax Computation

In this section, you will calculate your tax liability based on your income and deductions.

-

Section 5: Payment and Refund

In this section, you will indicate whether you are making a payment or requesting a refund.

-

Tips for Filling Out the NJ 1040NR Form Correctly

To ensure that you fill out the NJ 1040NR form correctly, follow these tips:

- Use the correct form: Make sure you are using the correct form for the tax year you are filing for.

- Read the instructions: Take the time to read the instructions carefully before starting to fill out the form.

- Use the correct filing status: Make sure you are using the correct filing status, such as single, married filing jointly, or head of household.

- Report all income: Make sure you report all the income you earned from New Jersey sources.

- Claim all deductions and credits: Make sure you claim all the deductions and credits you are eligible for.

- Double-check your math: Double-check your math to ensure that you have calculated your tax liability correctly.

Common Errors to Avoid

When filling out the NJ 1040NR form, there are several common errors to avoid. These include:

- Forgetting to sign the form

- Forgetting to include required documentation

- Reporting incorrect income or deductions

- Claiming incorrect credits or deductions

- Failing to double-check math calculations

Conclusion

Filling out the NJ 1040NR form can be a complex process, but by following the steps outlined in this article, you can ensure that you complete the form correctly and avoid common errors. Remember to gather all the required documents, fill out the form carefully, and double-check your math calculations. If you are unsure about any aspect of the form, consider consulting a tax professional or seeking guidance from the New Jersey Division of Taxation.

FAQs

What is the NJ 1040NR form?

+The NJ 1040NR form is the New Jersey non-resident income tax return, which is used by individuals who are not residents of New Jersey but have earned income in the state.

What documents do I need to fill out the NJ 1040NR form?

+You will need to gather all the required documents, including W-2 forms, 1099 forms, interest statements, dividend statements, and records of any deductions or credits you are claiming.

How do I calculate my tax liability on the NJ 1040NR form?

+You will calculate your tax liability based on your income and deductions. You can use the tax tables or tax rate schedules to determine your tax liability.

-

-

-

-