Filling out forms can be a daunting task, especially when it comes to financial institutions. Navy Federal Credit Union (NFCU) Form 98 is one such document that may leave you scratching your head. But don't worry, we're here to guide you through the process with ease. In this article, we'll break down the form into manageable sections and provide you with expert tips to ensure you fill it out correctly.

Understanding NFCU Form 98

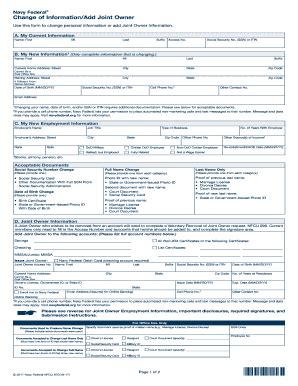

Before we dive into the nitty-gritty, let's take a moment to understand what NFCU Form 98 is all about. This form is typically used for loan applications, account openings, or other financial transactions within the Navy Federal Credit Union. It's essential to fill out the form accurately to avoid any delays or complications in the processing of your request.

Mistakes to Avoid When Filling Out NFCU Form 98

Before we explore the ways to fill out the form, let's highlight some common mistakes to avoid:

- Incomplete or missing information

- Incorrect or inconsistent data

- Failure to sign or date the form

- Not providing required supporting documents

By being aware of these potential pitfalls, you can ensure a smooth and hassle-free process.

1. Gather Required Information and Documents

To fill out NFCU Form 98 accurately, you'll need to gather the necessary information and documents. These may include:

- Identification documents (e.g., driver's license, passport)

- Proof of income and employment

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Address and contact information

- Loan or account details (if applicable)

Make sure you have all the required documents and information readily available before starting to fill out the form.

2. Fill Out the Form Section by Section

To avoid feeling overwhelmed, break down the form into manageable sections. Focus on one section at a time, ensuring you complete each part accurately before moving on to the next. This approach will help you stay organized and reduce errors.

Some of the key sections to focus on include:

- Personal and contact information

- Employment and income details

- Loan or account information (if applicable)

- Signatures and dates

3. Use the Correct Signatures and Dates

Signatures and dates are crucial components of NFCU Form 98. Ensure you sign the form in the designated areas and include the correct dates. This may include:

- Your signature as the applicant

- Co-signer signature (if applicable)

- Date of application

- Date of signature

Double-check that all signatures and dates are accurate and legible.

4. Review and Edit the Form Carefully

Once you've completed the form, take a moment to review it carefully. Check for any errors, omissions, or inconsistencies. This is your chance to catch any mistakes before submitting the form.

Pay particular attention to:

- Spelling and grammar

- Numerical accuracy

- Consistency in dates and signatures

Make any necessary edits before finalizing the form.

5. Submit the Form and Supporting Documents

With the form complete and reviewed, it's time to submit it along with any required supporting documents. Ensure you follow the Navy Federal Credit Union's submission guidelines, whether it's online, in-person, or by mail.

By following these steps, you'll be well on your way to filling out NFCU Form 98 with confidence.

What is NFCU Form 98 used for?

+NFCU Form 98 is typically used for loan applications, account openings, or other financial transactions within the Navy Federal Credit Union.

What documents do I need to fill out NFCU Form 98?

+You may need identification documents, proof of income and employment, Social Security number or ITIN, address and contact information, and loan or account details (if applicable).

How do I submit NFCU Form 98?

+Follow the Navy Federal Credit Union's submission guidelines, whether it's online, in-person, or by mail. Ensure you submit the form along with any required supporting documents.

By following these expert tips and guidelines, you'll be able to fill out NFCU Form 98 with ease and confidence.