As a homeowner, paying off your mortgage can be a significant milestone. Whether you're looking to eliminate debt, avoid future interest payments, or tap into your home's equity, requesting a payoff from your lender is a crucial step. Newrez, a leading mortgage lender, provides a payoff request form to help you initiate this process. In this article, we'll delve into the world of Newrez payoff request forms, exploring their importance, benefits, and a step-by-step guide to completing the form.

Understanding the Importance of a Payoff Request Form

A payoff request form is a document that provides your lender with the necessary information to process your mortgage payoff. It's essential to submit this form accurately and completely to avoid delays or complications. By requesting a payoff, you'll receive a statement outlining the outstanding balance on your mortgage, including any interest, fees, or other charges.

Benefits of Submitting a Payoff Request Form

- Receives an accurate and up-to-date payoff statement

- Ensures a smooth payoff process

- Helps avoid potential delays or complications

- Provides an opportunity to review and verify your mortgage details

Step-by-Step Guide to Completing the Newrez Payoff Request Form

To initiate the payoff process, follow these steps:

Step 1: Gather Required Information

- Your loan account number

- Property address

- Borrower's name (as it appears on the loan documents)

- Contact information (phone number and email address)

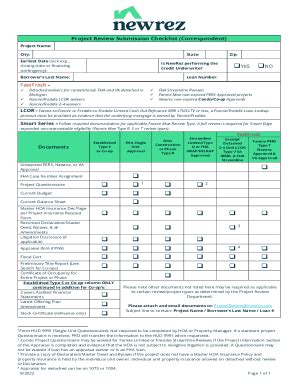

Step 2: Download and Review the Payoff Request Form

- Visit the Newrez website to download the payoff request form

- Review the form carefully, ensuring you understand the required information and instructions

Step 3: Complete the Payoff Request Form

- Fill out the form accurately and completely, providing all required information

- Ensure you sign and date the form

Step 4: Submit the Payoff Request Form

- Fax or mail the completed form to the address provided on the form

- Retain a copy of the form for your records

Step 5: Review and Verify Your Payoff Statement

- Receive and review your payoff statement carefully

- Verify the outstanding balance, interest, fees, and other charges

Common Questions and Concerns

- How long does it take to process a payoff request?

- Processing times may vary, but typically take 3-5 business days

- Can I submit a payoff request online?

- Currently, Newrez only accepts faxed or mailed payoff request forms

- What if I have multiple loans with Newrez?

- You'll need to submit a separate payoff request form for each loan

Conclusion: Taking Control of Your Mortgage Payoff

Requesting a payoff from Newrez is a straightforward process that requires attention to detail and accurate information. By following this step-by-step guide, you'll be well on your way to initiating the payoff process and taking control of your mortgage. If you have any further questions or concerns, don't hesitate to reach out to Newrez or consult with a mortgage professional.

What is the purpose of a payoff request form?

+A payoff request form provides the lender with the necessary information to process your mortgage payoff, ensuring an accurate and up-to-date payoff statement.

How do I submit a payoff request form to Newrez?

+You can fax or mail the completed form to the address provided on the form.

What information do I need to provide on the payoff request form?

+You'll need to provide your loan account number, property address, borrower's name, and contact information.