Filing taxes can be a daunting task, especially for those who are new to the process or have complex financial situations. In New Jersey, the tax return form filing process can be particularly challenging due to the state's unique tax laws and regulations. However, with the right guidance and resources, filing New Jersey tax return forms can be made easy.

For many New Jersey residents, tax season can be a source of stress and anxiety. The state's tax laws can be complex, and the process of gathering all necessary documents and filling out forms can be overwhelming. However, it's essential to remember that filing taxes is a critical part of being a responsible citizen, and it's crucial to get it right to avoid any potential penalties or fines.

In this article, we will provide a comprehensive guide on how to file New Jersey tax return forms with ease. We will cover the necessary steps, forms, and documents required, as well as provide tips and tricks to make the process smoother.

Understanding New Jersey Tax Laws

Before we dive into the tax return form filing process, it's essential to understand New Jersey's tax laws. The state has a progressive income tax system, with rates ranging from 5.525% to 10.75%. New Jersey also has a number of tax credits and deductions available, including the Earned Income Tax Credit (EITC) and the New Jersey Property Tax Relief Program.

New Jersey Tax Forms

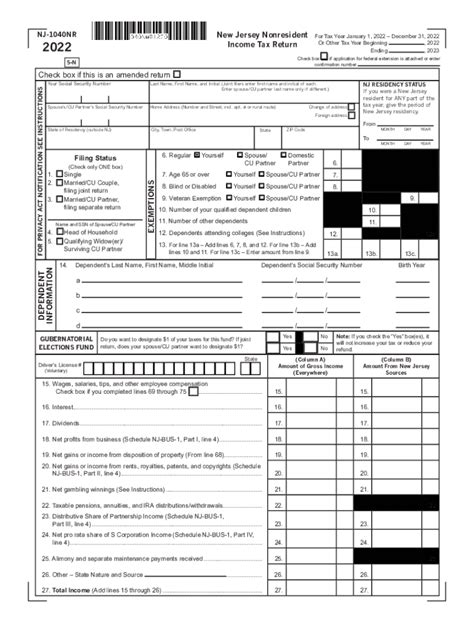

New Jersey offers several tax forms, each with its own specific requirements and deadlines. The most common tax forms include:

- Form NJ-1040: This is the standard form for New Jersey residents, used to report income, deductions, and credits.

- Form NJ-1040-H: This form is used by homeowners to claim the New Jersey Homestead Rebate.

- Form NJ-1040-ES: This form is used by self-employed individuals and businesses to make estimated tax payments.

Gathering Necessary Documents

To file New Jersey tax return forms, you'll need to gather several necessary documents. These include:

- W-2 forms from your employer(s)

- 1099 forms for freelance or contract work

- Interest statements from banks and investments

- Dividend statements from investments

- Charitable donation receipts

- Medical expense receipts

Additional Documents for Homeowners

If you're a homeowner, you'll need to gather additional documents, including:

- Mortgage interest statements

- Property tax bills

- Home improvement receipts

Filing New Jersey Tax Return Forms

Once you have all necessary documents, you can begin filing your New Jersey tax return forms. Here are the steps to follow:

- Choose a filing status: You can file as single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Complete Form NJ-1040: Enter your personal and income information, including your Social Security number, address, and employment information.

- Claim deductions and credits: Claim any deductions and credits you're eligible for, including the EITC and New Jersey Property Tax Relief Program.

- Calculate your tax liability: Use the tax tables or tax calculator to determine your tax liability.

- Make a payment: If you owe taxes, you can make a payment online or by mail.

E-Filing vs. Paper Filing

New Jersey offers both e-filing and paper filing options. E-filing is faster and more convenient, but paper filing may be necessary for certain situations, such as if you need to attach additional documentation.

Additional Resources

If you need additional help or guidance, there are several resources available:

- New Jersey Division of Taxation: The official website for New Jersey tax information, including forms, instructions, and FAQs.

- IRS: The official website for federal tax information, including forms, instructions, and FAQs.

- Tax professionals: Consider hiring a tax professional to help with the filing process.

Tips and Tricks

Here are some additional tips and tricks to make the tax return form filing process easier:

- Start early: Give yourself plenty of time to gather documents and file your taxes.

- Use tax software: Consider using tax software, such as TurboTax or H&R Block, to make the filing process easier.

- Double-check your work: Make sure to review your return carefully to avoid errors or omissions.

We hope this comprehensive guide has made the New Jersey tax return form filing process easier for you. Remember to stay organized, gather all necessary documents, and seek help if needed. Happy filing!

What is the deadline for filing New Jersey tax return forms?

+The deadline for filing New Jersey tax return forms is typically April 15th, but it may vary depending on the specific form and situation.

Can I file New Jersey tax return forms electronically?

+Yes, New Jersey offers e-filing options for many tax forms, including Form NJ-1040.

What is the New Jersey Earned Income Tax Credit (EITC)?

+The New Jersey EITC is a tax credit available to low-income working individuals and families.